A wide disparity exists between the homeownership rates of White, African American and Hispanic households, according to analysis from the Urban Institute. As of 2013, homeownership rates nationwide are:

- 69.4% for White households;

- 45.4% for Hispanic households; and

- 42.8% for African American households.*

How do homeownership rates fare across multi-racial and multi-faceted California?

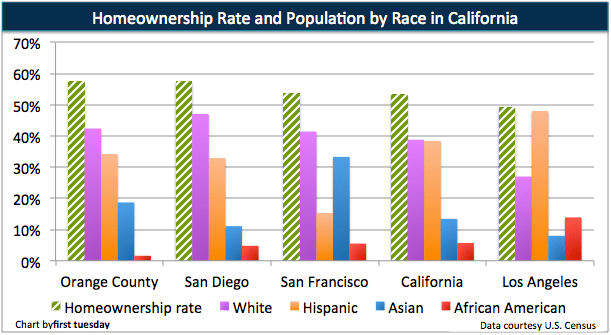

That’s more difficult to nail down, due to insufficient data in recent years. However, let’s take a look at the homeownership rate in California’s largest regions alongside each area’s racial makeup as of 2013, the most recent Census year.

You’ll notice places with high homeownership rates (Orange County, San Diego and San Francisco) all have a higher than average White population. Los Angeles has a below average homeownership rate, along with a much smaller White population and larger Hispanic and African American population.

*Editor’s note — The Urban Institute’s study does not report on homeownership rates for other minority groups, like Asian or Pacific Islanders. However, given that this group makes up a large share of California’s population, we have included this population in the graph, above. Population labels follow the Census terminology of White only, Hispanic, Asian and African American.

Why is it so much harder for African American and Hispanic households to become homeowners?

A lot of factors converge to put these groups at a financial disadvantage, which in most cases hinders their ability to attain homeownership.

The Urban Institute identifies several intertwined factors:

- The average lifetime earnings of a White individual born in 1943-1951 is $2 million. The average African American individual born in the same period earns $1.5 million. The corresponding Hispanic individual earns even less, at $1 million.

- White families are five times more likely to receive large inheritances (of at least $10,000) than African Americans (no study has been completed on other minority groups).

- Savings are disrupted by unequal access to retirement plans, as the average White family has $130,500 in retirement accounts. The average African American family has $19,000 saved for retirement and the average Hispanic family has $12,300 saved in retirement funds.

- The student debt load of an average White family — not just those who take out student loans, but all White families — is just over $8,000. The average African American family shoulders $10,300. The average Hispanic family holds $3,400 in student debt. (Of note: when you limit the average student debt load to just those who have taken out student loans rather than the entire population, the average amount is three to four times higher across racial groups).

- The average graduation rate at private not-for-profit four-year colleges is 67% for White students, 45% for African American students and 60% for Hispanic Students. (Asian students have the highest graduation rate at 75%.) This is according to the College Board, and identified by Vox.

These combined disadvantages make saving for a down payment and qualifying for a mortgage disproportionately difficult (or impossible) for many African American and Hispanic families. This corrupt cycle is most apparent in the inheritance statistic. In this case, “keeping it in the family” means the continuation of wealth concentrated within White families. There’s nothing wrong with leaving or receiving inheritance gifts, it’s just an example of the continuing income disparity between races and the resulting homeownership gap.

There are some options for low-income families of any race wishing to become homebuyers. The Department of Housing and Urban Development (HUD) has a list of homebuyer programs for underserved communities. However, most federal programs aim to subsidize those who are already homeowners, rather than converting tenants into first-time homebuyers.

For example, the mortgage interest tax deduction (MID) hugely benefits the top 20% of income earners. Of the $69 billion distributed in tax subsidies in 2013, $50 billion went to this top-income class, according to the Urban Institute.

A better use of government energy would be to assist current tenants so they have more ability to save for down payments. This would help end the cycle of overspending on rent and under saving for other endeavors, like a college education, retirement or a home purchase. Personal savings remain low, averaging 4.8% in 2014. Meanwhile, residential rents have risen quickly in recent years, further denting the homeownership hopes for current renters.

Concord Mike,

Please see the editor’s note, which states that the Urban Institute’s report on wealth equality does not cover Asian Americans. However, this group is included in first tuesday’s population graph.

Regards,

Editorial Staff

Why don’t we see data for Asian Americans in this list?

Could it be that this data would show Asians doing better than whites, which would disprove the race baiting argument made in this article?