Use an ownership expenditure analysis to show prospective homebuyers how ownership will create savings over renting, and create more deals.

Show them the money!

Market got you down? Don’t just passively wait for referrals or walk-ins— find clients by FARMing qualified tenants and converting them into homebuyers.

Many of these tenants have never considered buying since they assume homeownership is financially unfeasible. Preparing an ownership expense analysis for review with potential homebuyers gives a realistic picture of the actual monthly cost of homeownership. Comparing today’s home prices, interest rates and utilities with the rent and utilities they now pay as tenants, will likely encourage them to reconsider homeownership.

Agents have not usually gone to great lengths for most homebuyers – after all, all buyers’ agents have historically been known (in multiple listing service (MLS) jargon) as “selling agents,” despite the fact they are doing the job of a buying agent. Their job is to help buy, not sell.

Outdated agency verbiage and the notions connected to it do not fly in the direction of today’s topsy-turvy property market, the developing real estate paradigm we at first tuesday describe as the starfish puzzle.

“Standard practice,” the holy writ of excuse

Up until 1972, the back of an agent’s business cards commonly had a dollar comparison between the monthly rent and monthly ownership expenditures for a typical first time homebuyer’s low-tier home.

The math demonstrated the savings to be had by buying comparable or better replacement housing instead of continuing to rent. These cards essentially told the recipient, if they were renting instead of owning, they were mathematically challenged.

Today’s standard practice does not include this tactic. Agents typically do not provide tenants who are potential homebuyers with this simple buy-vs-rent analysis or the more useful, yet slightly more extensive, ownership expense analysis. Their claim: it is not standard practice, the holy writ for an excuse to do nothing. But in today’s sluggish housing market,agents have the time and need to go the extra mile to locate and counsel tenants who are qualified to become homeowners.

Related articles:

Rise and fall of real estate brokers

Damage control: restoring public trust in real estate professionals

Agents may not realize it, but by hiding behind the crumbling wall of standard practice, they lumber along with the crowd, presenting little to differentiate them from other low-performing agents.

Seller’s agents are to know the facts about their listing and investigate the property’s conditions of title, improvements, location and operations before it is even placed on the market. Otherwise, they do not know what it is they are asking homebuyers to purchase. And when placed on the market, the information is to be communicated to potential homebuyers ASAP — before their offer is accepted. [Holmes v. Summer (2010) 188 CA4th 1510]

Related article:

Otherwise, seller’s agents are liable for misrepresentation due to their failure to advise the homebuyer on the property’s many known and knowable conditions affecting value prior to the homebuyer going under contract. [Jue v.Smiser (1994) 23 CA 4th 312]

Thus, buyer’s agents who make a home expense comparison part of their higher standard will reap the benefits of happier, better-informed clients, translating into future referrals.

Oh, the savings to be had

First-time homebuyers make a direct comparison between mortgage payments and rent payments, while accounting for additional utilities, homeowners insurance, property taxes and maintenance required of homeownership.

To inform potential homebuyers, sellers and their agents can prepare first tuesday Form 306, Property Expense Report, to quickly review the monthly costs of ownership for the listed property with prospective homebuyers.

Related article:

Transparency of a home’s operating costs sets the listed home apart, and homebuyers who receive real operating information feel more confident about making an offer. Buyer’s agents can query this information for their clients, or can do their own research on average monthly operating costs. Investors rely on this level of detail about properties; why should homebuyers be less informed?

Related article:

Definitely own? An example

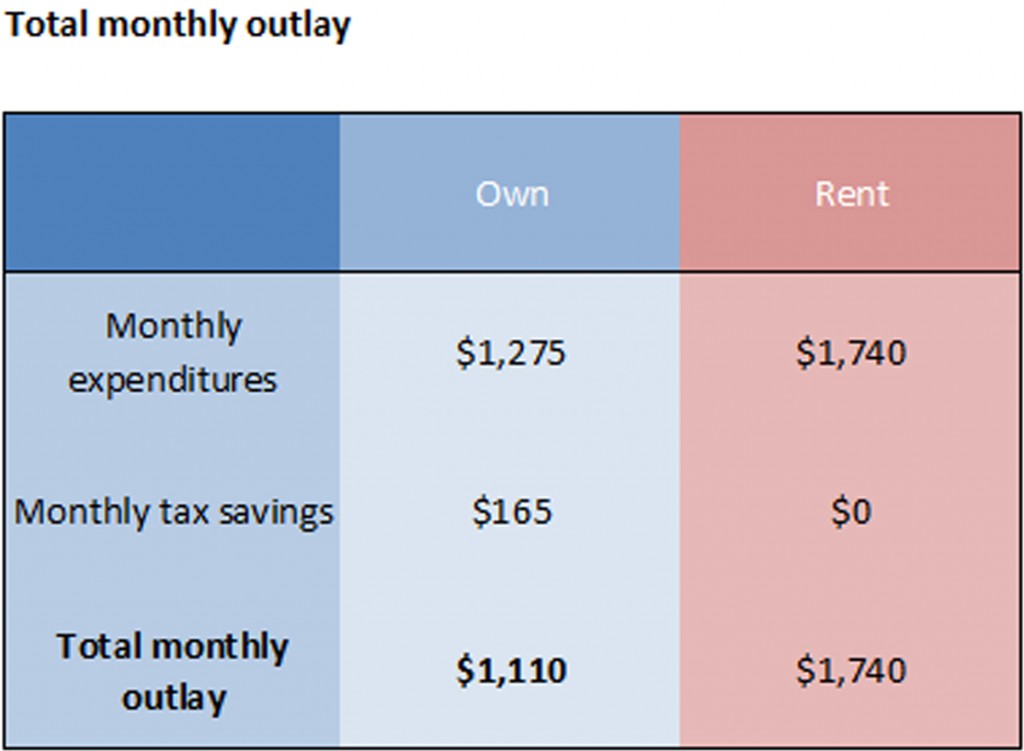

A home listed for $200,000 will likely rent at around $1,600 a month in today’s market. An agent can contact tenants who pay rent of this amount as potential first-time homebuyers. A cost analysis like the one below will show them how they can save money each month by purchasing comparable shelter rather than continuing to rent.

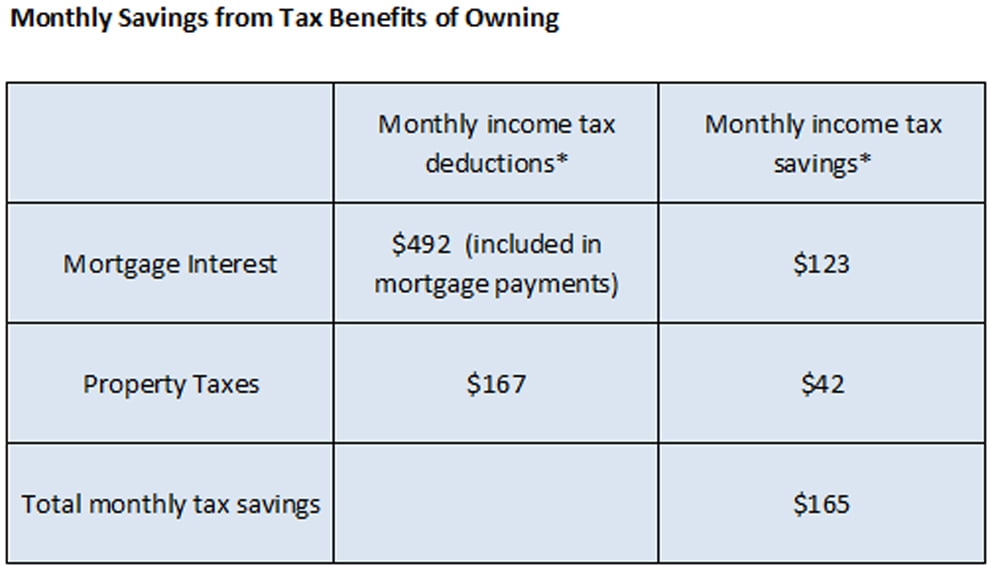

The income tax savings is the annual lump-sum subsidy received by paying reduced amounts of income taxes equal to 25% of the interest and property taxes paid. This rebate-based refund effectively reduces the homeowner’s cost of ownership. While the subsidy does not directly work to reduce the monthly payments of interest or annual property taxes, it effectively does so when filing tax returns and receiving a refund of 25% of the interest and property taxes paid.

The MID decreases over time, as less mortgage interest accrues and more principal is paid off due to amortization.

In contrast, property taxes rise 2% each year. The monthly tax saving estimated above is an average over the first three years of ownership at a 25% tax rate (the tax rate for the average income earner in California). [See first tuesday Tax Benefits of Ownership, 3rd Ed, Chapter 1: Home loan interest deductions]

In this scenario, including the savings from MID and property tax deduction, the owner saves $630 each month by owning rather than renting.

With a smaller downpayment, the dollar difference between ownership and renting shrinks. For instance, with a 5% downpayment the monthly mortgage payment will increase to just over $1,000, at a 4.8% rate due to private mortgage insurance (PMI) premium or FHA’s mortgage insurance premium (MIP) (premiums are deductible as additional interest expenses). Thus, PMI/MIP is included in the homebuyer’s monthly ownership expenses, but the homebuyer still experiences a significant savings over renting.

A larger downpayment translates into smaller monthly payments for the homebuyer and a lesser tax deduction (incentive to borrow more from the lender), but is the downpayment the best investment of funds for the homebuyer?

Related article:

Opportunity cost of lost alternatives

The answer depends on a number of factors, particularly:

- how long the homebuyer plans to own the home; and

- the benefits of alternative uses of the funds applied to the down payment.

Without the pricing effects of a massive real estate boom, it is unlikely a homeowner will experience a return of his downpayment and loan principal reduction – much less a profit –if he does not own the house for at least five to seven years before selling, due to transaction costs and consumer inflation.

As a general rule of thumb, real estate values increase at roughly 2% annually over the long haul as they keep up with the rate of consumer inflation (payroll increases, which control the amount of mortgage funds an employed person can borrow).

Other increases, called appreciation, relate to the property’s location (the area’s demographics of density and income levels), and how well it is maintained. In the years to come, owning property near urban centers will most likely produce greater returns than purchasing in suburban areas, as members of Generation Y (Gen Y) and their Boomer parents are flocking to cities.

Related articles:

The initial investment in the example above was $46,800, so we will use that number to compare investments.

In the first instance, a homeowner invests his downpayment and monthly mortgage payments into a suitable urban home.The home will likely increase in value at an annual rate of around 2%. This probable rate of asset inflation will persist for the foreseeable future, since interest rates (and income levels) control price increases, and rates can no longer drop to drive prices up as has occurred for the past 30 years.

After seven years, his $200,000 house has increased in value to $230,000, since the house has been well maintained and nothing has changed except the purchasing power of the U.S. dollar. (A one percent annual population increase in California, mainly through births, adding incentive for tenants to become homeowners, will create additional appreciation.)

Saving $630 each month by buying instead of renting, the homeowner ends up saving $53,000 over seven years.These amounts are either saved or spent to improve the homebuyer’s standard of living.

This seems like a no brainer —it is much cheaper to own than rent. Not so fast! What about the lost opportunities for other investments due to the homeowner’s initial investment of $46,800 in the home?

If the homeowner had continued to rent and left the $46,800 in the bank, where he received a (generous) 1% annual return on investment (ROI), after seven years of compounding interest he would be looking at $50,200, or interest income of $3,400, an annual ROI of nearly $500 at that rate. An average annual rate of 2% on savings would have an ROI over seven years of $6,900.

The homeowner’s downpayment investment performs much better. After seven years of paying interest and decreasing the principal amount owed, the principal loan amount will be reduced from $160,000 to $137,000. If the homeowner sells the home for fair market value (FMV) at $230,000, he will gross $93,000 on the sale. After subtracting 9% of the selling price for transaction costs (minor repairs, escrow charges and broker fees, etc.), his net equity on closing is $72,300. He can now relocate and use these net proceeds to buy a more valuable property (assuming he will mortgage that property, too).

All this equity buildup of price increase and loan reduction, and the reduced monthly cost of ownership versus continuing to pay rent, present a dramatic return on that $46,800 invested in the home. Presented as the math of a purchase transaction spread over a few years period, it will open any renter’s eyes, and mind.

The good thing about a depression…

… is that it sets apart the go-getters from the mere tagalongs. If agents are to succeed in this tough recovery climate, they need to go the extra mile to satisfy homebuyers. Agents must be willing to aggressively pursue homebuyer-clients instead of being passive participants in the industry.

During the most recent real estate boom, disclosures became lax, and agents grew complacent – very complacent. The fiduciary duty owed a homebuyer by his agent might not yet require an agent to provide a property operating expense analysis as data that will likely affect a homebuyer’s decisions in a real estate transaction. However, the more steps taken to help your homebuyer, the better the agent’s reputation and influence will become for what is actually little additional work. The public’s impression of the housing market will fare better for it.