When do you think the next big economic recession will occur?

- In the next five years. (79%, 92 Votes)

- In around a decade. (17%, 20 Votes)

- Not for at least two decades. (3%, 4 Votes)

Total Voters: 116

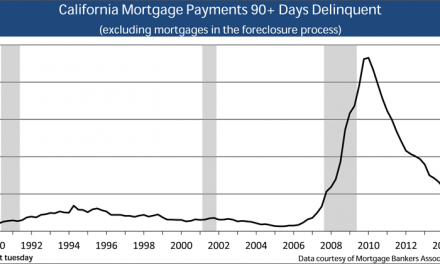

How far have we actually come since the real estate market melted down five years ago?

What lessons have we learned –and have we internalized them enough to prevent another Great Recession?

Let’s take a look at the three critical lessons Big Banks have allegedly learned:

1. Big Banks have become even larger since the 2008 recession. The six largest banks hold 28% more assets today than before the crisis, according to Bloomberg News. So you don’t get the wrong idea, all this monopolizing of wealth doesn’t equal an extra cushion if the economy falters again. It means these banks will make a bigger crash when they inevitably fail again.

Worse, the Fed is in a position to limit the relative amount of assets banks are allowed to hold through a change in monetary policy, but have chosen not to do so. From a regulatory position, the Fed has done very little as far as changes to loan-to-value ratios (LTVs), credit analysis, property value standards, types of mortgages (fixed or adjustable rates), types of buyers (occupant or absentee) and interest rates.

2. The average equity-to-assets ratio is 10-11% for Big Banks. The ratio needs to be around 30% to survive another financial crisis without the need for a government bailout, according to Stanford professor Anat Admati.

3. Lender balance sheets remain poor representations of what is actually on their books.

For example, look no further than the shadow inventory of housing, which is impossible to precisely calculate but has been estimated to be around two million homes, according to CoreLogic. None of these homes show up on lender balance sheets, even though their combined value is over $300 billion.

So why haven’t lenders wised up yet? Lenders are like delinquent school children – and as adolescents, they will continue to push the boundaries until something goes horribly wrong and someone has to lay down the law.

Regulators, like the Securities and Exchange Commission (SEC), fail to hold Big Banks accountable.

Instead, the legal system has worked to keep the banking system alive and well (which strangely runs contrary to arguments against imposing more protective regulations). Despite a number of new laws in response to the 2008 recession, Big Banks have managed to create enough loopholes and exceptions to make these laws too flimsy to really reel in their reckless banking behavior.

For example, look at the Dodd-Frank Wall Street Reform and Consumer Protection Act. Despite the many changes it’s heralded to have made to the financial system, banks are still able to make risky trades with their customers’ government-insured deposits, and with their own capital accounts.

Between July 2010 and October 2011, lobbyists met with Federal regulators on behalf of Big Banks a total of 419 times. During this same period, public advocacy lobbyists met with regulators only 19 times.

Further, virtually not one person has been held personally responsible. A low-level Bank of America employee is on trial for Hustle (HSSL) loan approvals. Top lender executives survived the recession with their personal assets intact. None but a handful of minions were taken to court for their reckless and fraudulent banking practices. So, with virtually no risk of personal consequence, who’s to blame banking executives for rolling the dice on public wellbeing again?

first tuesday insight

It’s 2013 and our banks are still surviving. However, they are no closer to avoiding another financial crisis like we have just gone through. In fact, the largest banks are wildly prospering in terms of cash flow profits, the argument Washington Mutual pushed when taken over by the FDIC five years ago due to insolvency – more debt than assets.

So who is winning as the nation recovers? The top 1% of income earners in the U.S. experienced income gains of 11.2% during the recovery years of 2009-2011. The remaining 99% experienced an income loss of 0.4%. That includes most of our readers in the real estate business of rendering services.

Related article:

So it’s no surprise that California’s housing market remains in a speculator feeding frenzy as we enter Q4 2013. End users simply are unable to support the recovering housing market yet; the purchasing power of their incomes (jobs) have not caught up with pre-recession levels.

On the other hand, cash heavy investors seeking refuge from the perils of Wall Street have driven home prices 26% higher than one year earlier in low-tier homes as of August 2013. This pricing activity has pushed homeownership for an equal or better standard of housing amenities beyond the present reach for most Californians.

Related article:

Today’s home price leaps will not last forever. Prices will likely flatten by the end of 2013 then subside going into 2014 — all due to falling home sales volume and eventual speculator drawback. However, the damage has been done to end user homebuyers and homeownership rates.

The Chinese zodiac calendar informs us that 2013 is the year of the slithering snake. In Western parlance, it’s fitting to note 2013 is also the year of the short-term speculator (which the Chinese corralled last year).

How many more years do speculators have? Until regulators, administrative and legislative, take their job of protecting society more seriously, it’s hard to say.

Re: Big U.S. banks keeping door open to another financial crisis and 5 years after financial crisis, many losers – and some big winners from the Los Angeles Times

Thanks david -I too have heard some Wells horror stories.

I know someone who tried in vain over 8 months to have his 5.75% MT Bank New York loan reset to a fair current rate.

He has a FICO of 805, about 375k in equity, never missed a payment in his life-no bankruptcies etc….and no other debts in 12 years other than this mortgage.

It was a Countrywide loan originally (see class action lawsuit for ID theft risks), then was sold to BofA-then to MT Bank who uses (Bayview Loan DIS-servicing) They have no intention of resetting his interest rate no matter how many thousands of documents he supplies to them in good faith.

LOOK OUT FOR MT BANK/ BAYVIEW LOAN SERVICING!

its sooo sad they took our tax bailout money to use to help us and they instead

helped themselves!

I would say that this article is well done. There is a big piece missing though. As well as all those banks are doing and have been protected by the Fed, they did it on the backs of citizens who were made homeless, displaced and manipulated by the Fed and the financial institutions. That was best articulated in the recent 9th Circuit case of Corvello v. Wells Fargo Bank, Case Nos. 11-16234, 11-16242, Filed August 8, 2013, which stated, “No purpose was served by the document Wells Fargo prepared except the fraudulent purpose of inducing Corvello to make the payments while the bank retained the option of modifying the loan or stiffing him. “Heads I win, tails you lose” is a fraudulent coin toss.”

Banks are not people. I think we have lost sight of children displaced, lost jobs, bankruptcy, foreclosure, divorce and stress. All caused by misplaced policies, which are still misplaced.