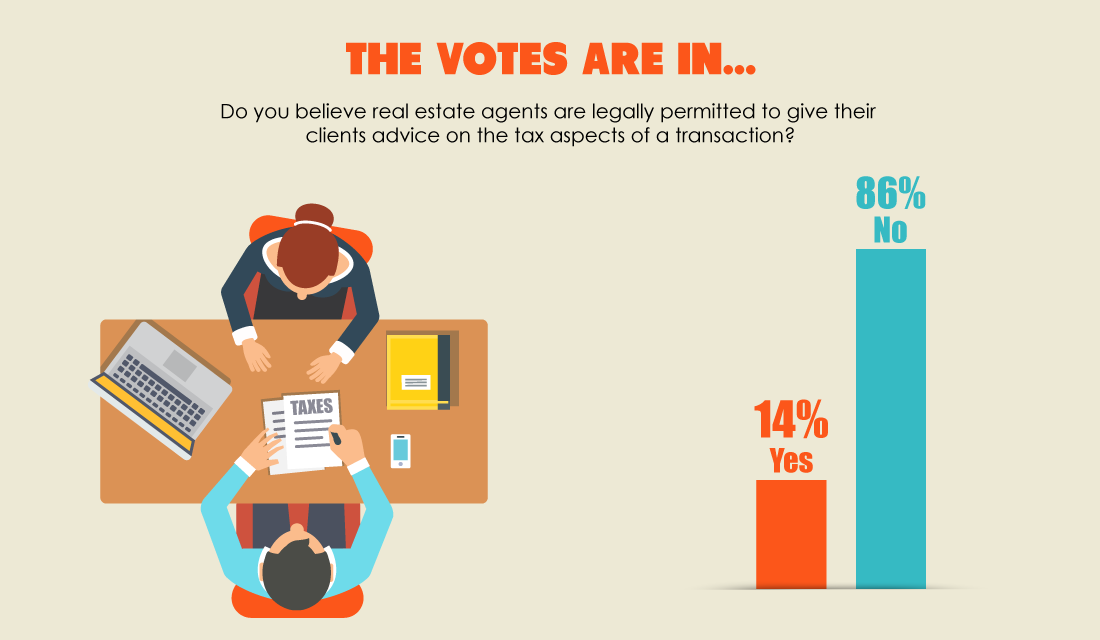

Over the years, first tuesday has asked its readers whether agents are permitted to discuss the tax aspects of a sale with their clients. In light of the results to the most recent iteration of this poll question, it seems prudent to revisit the topic.

As of the last time we sent this question out to readers, 86% of respondents believe agents need to zip their lips when it comes to tax aspects, a result that’s consistent, if slightly down, from 2018.

The idea that real estate agents may not provide their clients tax advice is one of the most persistent misconceptions among California licensees, and it’s worth reminding our readers this is not at all the case.

Why the confusion?

Much of the uncertainty over this issue is rooted in the code of ethics published by the National Association of Realtors® (NAR). This code is enforced for all members of the association, and while tax advice is not covered specifically, the code discourages all licensees from providing “specialized professional services concerning a type of property or service that is outside their field of competence…unless the facts are fully disclosed to the client.”

What “facts” are these? That the licensee is incompetent?

Further, the boilerplate statement in the trade union’s listing and purchase agreements states, “[Brokers] shall not be responsible for providing legal or tax advice regarding and aspect of a transaction entered into by Buyer or Seller.”

While it’s true that it’s in the best interest of the client to consult relevant professionals about any legal or tax-related questions they may have, the language implies real estate brokers and agents are not qualified to give tax advice.

Yet, licensees are not only permitted to share their relevant tax knowledge, but may also be required by their agency relationship to do so depending on:

- the scope of the agent’s knowledge;

- the type of transaction; and

- the client’s intended use of the sales proceeds.

The time to advise

All brokers acting as agents owe a general duty to disclose material facts they know about a property. Brokers further owe their client a specific duty to advise on the consequences of those material facts.

Thus, a broker who determines the tax aspects of a sale may affect their client’s handling of the sale has a fiduciary agency duty to disclose their knowledge of the tax implications. A prudent listing broker extends their guidance to help their client achieve the best tax outcome possible.

For example, tax aspects of a sale are a material fact to a client in a §1031 transaction. Here, as a matter of basic competency, brokers and agents handling the sale need to possess an understanding of the fundamental tax concepts affecting the sale and disclose this to their client.

However, on one-to-four unit residential and commercial properties, a seller’s agent has no duty to disclose their knowledge of possible tax consequences, even when tax implications are known by the agent to affect the client’s decision on how to handle the sale of the property. [Calif. Civil Code §2079.16]

In this case, clients are expected to obtain tax advice from competent professionals other than the real estate broker handling the transaction. [CC §2079.16]

The listing agreement needs to specify the broker and broker’s agents do not undertake the duty to advise on the tax aspects of the transactions. However, on a direct inquiry from their client, the agent is required to respond honestly and to the best of their knowledge. [Carleton v. Tortosa (1993) 14 CA4th 745]

The Agency Law Disclosure addendum attached to listing and purchase agreements further eliminates the duty of a broker and their agents to disclose their knowledge about the tax aspects of a sale when affected property is involved. [See RPI Form 305]

Shifting reliance and avoiding liability

The takeaway here is that providing tax advice is not prohibited — as long as licensees know when providing such advice is appropriate.

Brokers and agents who do provide tax advice are best served by always involving the client’s other advisors, such as their attorney or tax accountant. Input from other professionals eliminates future claims arising from adverse tax consequences due to the client’s reliance on the agent’s opinion.

The most practical method for avoiding liability is to insert a further-approval contingency provision in the purchase offer or counteroffer.

The contingency provision requires the client to initiate an investigation by obtaining additional tax advice and further approval of the transaction’s tax consequences from an attorney or accountant before allowing escrow to close.

Under these circumstances, a broker can offer their earnest tax advice but still ensure their client relies more heavily on the comprehensive information provided by tax professionals.

So, while advising clients on the tax implications of a transaction is typically not a required duty of a real estate licensee, it is certainly not prohibited — and may, in fact, increase an agent’s marketability by widening the range of services and advice offered to clients.

As a tax attorney who has trained many agents on real estate tax issues, I always stress that my goal in the training is to make them better able to spot potential opportunities and pitfalls and alert their clients. The Further Approval Contingency is a good way to distinguish the alerting vs. the actual advising and greatly decreases the risks that the agent will be liable for improper tax advice. In this way the agent also gains good will by showing a broader range of professional knowledge.