Why this matters: Real estate agents and brokers are better prepared to guide their clients when equipped with available local data. Licensees representing themselves as experts must understand that trends in data governing homeownership, leasing and mortgage originations drive their fee-generating services.

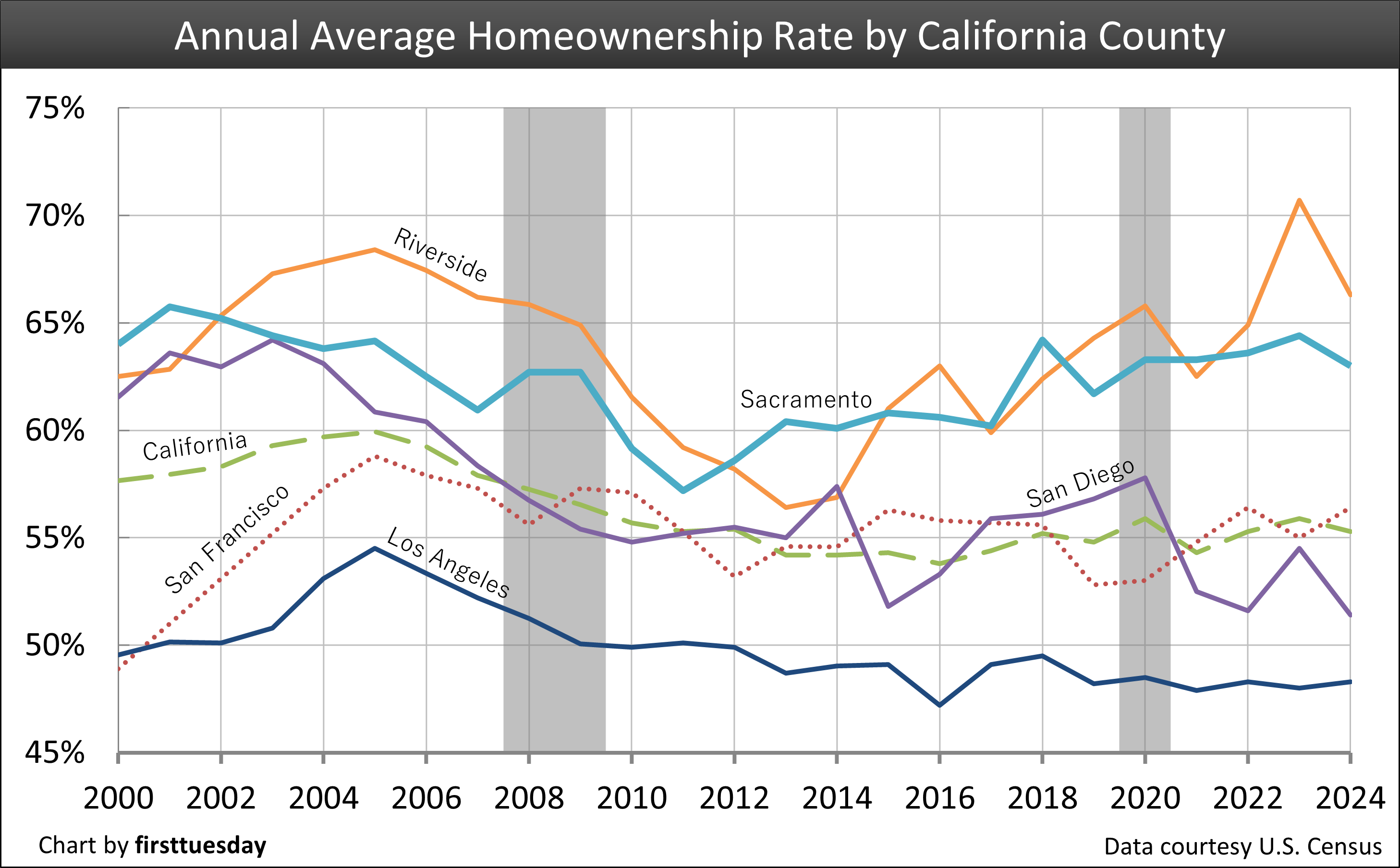

Homeownership rates declined across the state in 2024 and 2025. Riverside beat out Sacramento for the highest rate of homeownership, at over 65% in Q2 of 2025. Los Angeles County remains the current lowest at 46.4%.

Statewide, the average homeownership rate holds at 55.3%, near where it has been since 2012 after the 2008 recession decimated the housing market.

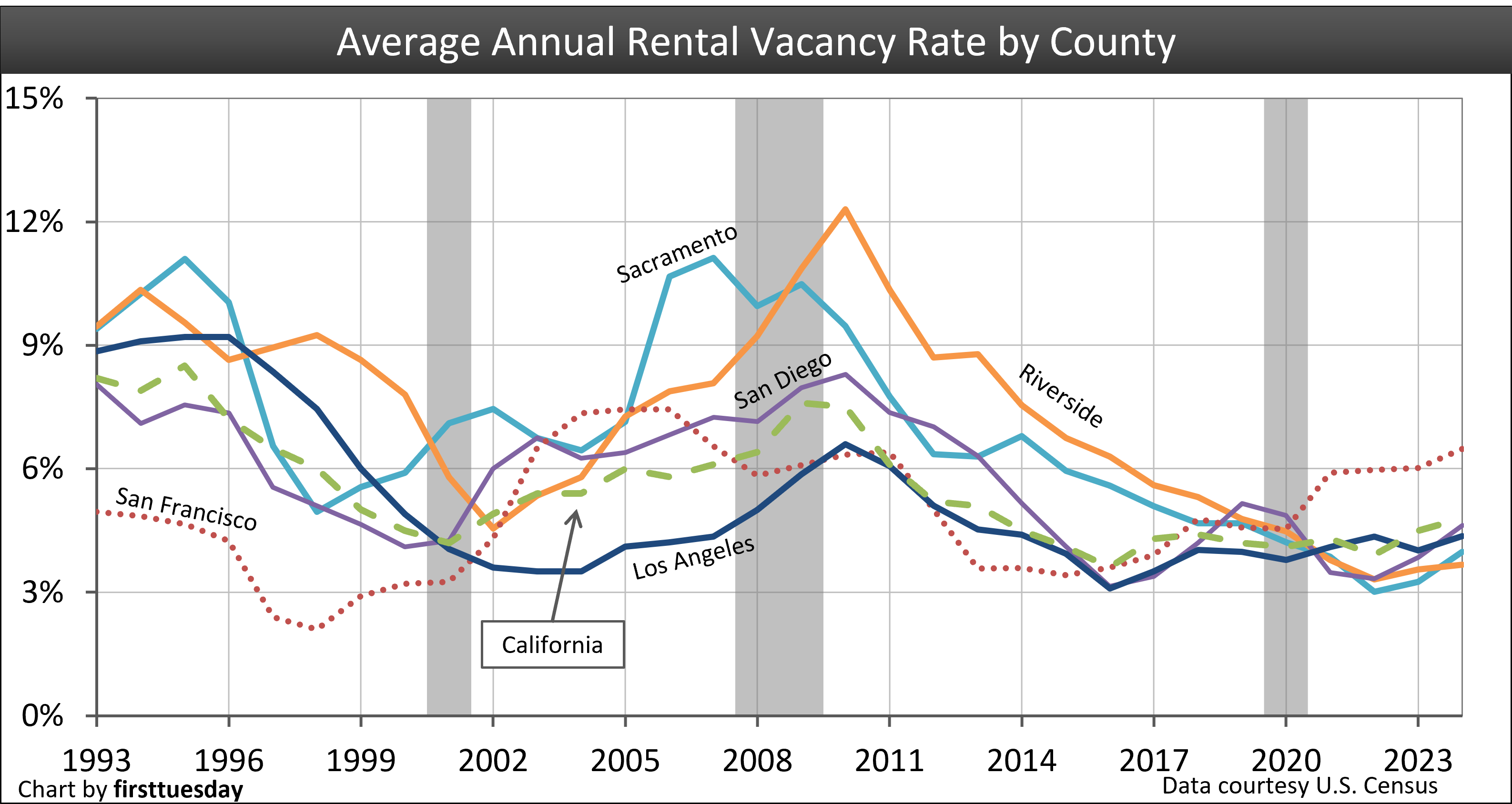

The average rental vacancy rate held at 4.6% in the second quarter of 2025, slightly below historic norms. The highest rental vacancy rate currently in 2025 is 6.8% in San Diego. The lowest at 1.6% is Riverside.

State-initiated legislative efforts to add to the housing stock have focused on encouraging more multi-family construction. However, very little residential construction has been adding to the inventory keeping rental vacancies below historic norms. Recent pressures raising construction costs through trade war taxes and federal attacks on immigration create an uncertain time for builders.

Buyer hesitancy in response to high mortgage rates and pricing is compounding the reduction in turnover. Further buyer caution arises from hiring freezes, federal layoffs and economic instability due to a feeling of job insecurity even for those gainfully employed.

Post updated November 4, 2025.

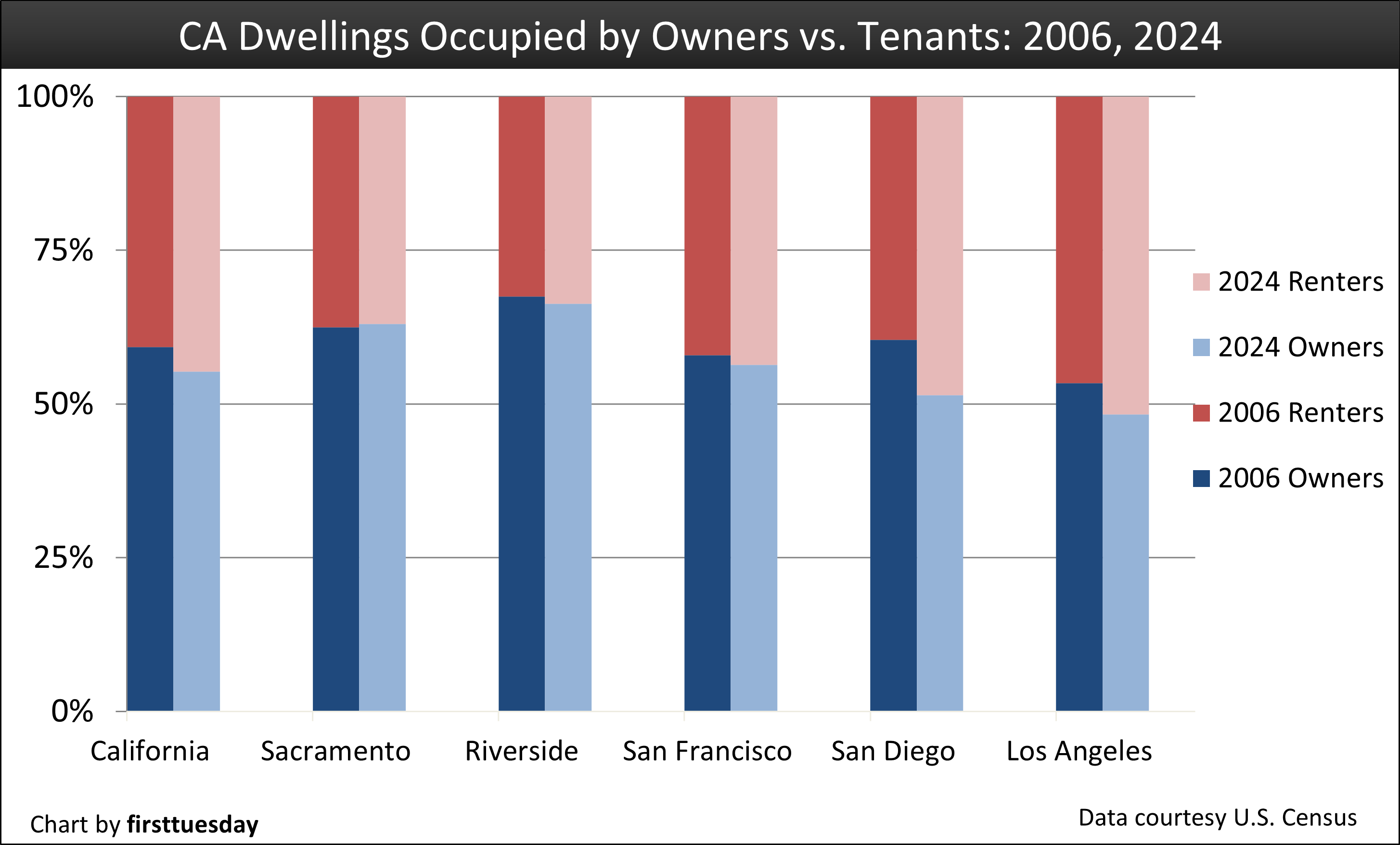

Chart 1

Chart update 11/4/25

| 2024 percentage of owners | 2024 percentage of renters | 2006 percentage of owners | 2006 percentage of renters | |

| California | 55.3% | 44.7% | 59.3% | 40.8% |

| Los Angeles | 48.3% | 51.7% | 53.4% | 46.7% |

| Riverside / San Bernardino | 66.3% | 33.7% | 67.5% | 32.6% |

| Sacramento | 63.0% | 37.0% | 62.5% | 37.5% |

| San Diego | 51.4% | 48.6% | 60.4% | 39.6% |

| San Francisco | 56.4% | 43.6% | 57.9% | 42.1% |

Chart 2

Chart update 11/4/25

| 2024 homeownership rate | 2006 homeownership rate | |

| California | 55.3% | 59.3% |

| Los Angeles | 48.3% | 53.4% |

| Riverside / San Bernardino | 66.3% | 67.5% |

| Sacramento | 63.0% | 62.5% |

| San Diego | 51.4% | 60.4% |

| San Francisco | 56.4% | 57.9% |

Chart 3

Chart updated 11/4/25

| 2024 rental vacancy rate | 2006 rental vacancy rate | |

| California | 4.8% | 5.8% |

| Los Angeles | 4.8% | 4.0% |

| Riverside | 3.7% | 7.1% |

| Sacramento | 3.8% | 12.8% |

| San Diego | 5.2% | 7.4% |

| San Francisco | 6.4% | 6.9% |

A shift in the housing market has taken place between the Great Recession of 2008 and the 2025 recessionary period. Homeownership rates have declined across the state and the monthly cost of ownership now alarmingly exceeds the rental rate of the same or comparable property.

The preference to own or rent in the future depends, as in the early 2000s, on the pace of residential construction starts, how local zoning ordinances respond to state density initiatives and the sales price of local single-family housing units.

Chart 1 tracks the changing percentage of dwellings occupied by owners versus tenants in California. The sampling is indicative of its more populous counties.

Chart 2 tracks the homeownership rate in California and a sampling of its more populous counties.

Chart 3 tracks the rate of rental vacancies since 1993 in California and in a sampling of its more populous counties. Rental vacancies tend to initially rise alongside increased homeownership and aggressive residential construction. Also, in times of economic uncertainty such as what began in 2020 with the pandemic, vacancies rise as renters consolidate with family, friends or roommates to redistribute the burden of housing. Dark bars indicate periods of recession.

Future vacancy rates are influenced by:

- regional job availability;

- urban-centric residential construction numbers; and

- local foreclosure rates.

Renting into the future

Today’s heavy reliance on residential rental units follows as fallout from the historic spike in homeownership during the Millennium Boom of the early 2000s.

Favorable personal attitudes about homeownership climbed throughout the 60 years before 2006. Then, in quick succession, we experienced a pricing bubble, a Great Recession and multiple once-in-a-lifetime financial crises. The events were fed by significant deregulation of financial institutions over the prior two decades. What followed was insufficient fiscal stimulus to counterbalance and quickly offset the damage to the 2008 economy. But here too we forget.

Today, many households are still recovering, emotionally and financially, from the financial chaos of the 2008 and 2020 recessions. The renter population has tapered down slightly in the last few years as California’s rental population fell from 46.2% in 2016 to 44.7% in 2024. Relocation to specific regions, driven by the rise in working remote, have been key in navigating rents and mortgage rates that rose much more quickly than income.

Jobs’ impact on homeownership

In Q2 2025, California has one of the lowest homeownership rates in the nation at 55.3%. No surprise for a younger, skilled and very mobile population.

Rentals as a percentage of all housing are highest within high-density metropolitan areas, especially in cities like San Diego and Los Angeles.

Future homeownership rates depend on the coming wave of first-time homebuyers. These homebuyers are older than the historical ages 25-35. Often, they will purchase a low-tier, possibly a mid-tier SFR for their first homes and then commute.

Job loss and hiring freezes since 2021, however, have changed the timing of homeownership in almost every region of California. First-time homebuyers have declared themselves financially unable, or just plain unwilling, to purchase a home. Their reasons flow from an assortment of debilitating high mortgage rates, stubborn asking pricing due to low turnover, diminished inventory of low-tier housing for sale, and rentals of equal quality at much lower monthly cost.

Related articles:

Will first-time homebuyers save California’s homeownership rate?

Future rental construction will increase

An increase in rental activity will naturally be followed by an increase in rental construction due solely to turnover influence by competitive landlords. However, consumer caution is fast rising as a response to trade war taxes, rising costs of materials and necessities, and threats against California’s immigrant-worker population.

Collectively, these and other distortions are adversely affecting turnover in residential occupancy. As vacancy rates rise to historic norms (generally near 5% and averaging 4.8% in 2024) and rents rise beyond the rate of consumer inflation, multi-family construction will be necessary to keep rents and home prices down.

Related article:

Homeownership by county

Counties like Riverside were at the center of California’s housing boom in the early 2000s. During the Millennium Boom, homes were built and sold faster than was sustainable in the long term. Riverside’s homeownership rate jumped almost 6% in 2000-2005, pulling the state’s rate of homeownership up with it.

Those homeownership gains which did happen were illusory due to predatory mortgage lending permitted to revive the 2001 economy from recession. From 2005 to 2014, Riverside county’s rate of homeownership dropped significantly, seven percentage points below its level at the peak of the boom – a wash, and thus the illusion. However, it was also one of the quickest to recover from the Great Recession. As of Q2 2025 it is racing against Sacramento for the metro area with the highest level of homeownership in the state.

With every statewide trend, of course, there are exceptions. San Francisco County experienced a less noticeable dent in homeownership during the Great Recession of 2008 but has since gradually declined to near 56.4% in 2024. [See Chart 2]

San Francisco’s upside-down homeownership trend is due to the severe lack of SFR construction and the prevalence of high-tier properties in much of the Bay Area. Further, during the aftershocks of the 2008 recession, their population was less susceptible to foreclosure due to strong local employment in the information technology industry.

Many large southern coastal cities remain examples of past suburban sprawl and inefficient zoning, but effective for keeping the general population out. They have, however, begun to reorganize to a more sustainable, centralized model of higher density urban living – with a push from the OAG and superior court judges.

Vacancies by county

Rental vacancies are driven primarily by local demand. The key factors influencing demand are the local jobs situation and the local political and social attitude toward SFR homeownership and renting, which do change significantly over time.

Trends point to a continued increase in rental demand in upcoming years. Some regions, especially Riverside, will take a longer time to shift from the 1950’s standard of suburban SFR homeownership.

Agents in urban areas may consider adding property manager to their title, as demand for this skill will undoubtedly rise throughout this decade. Also, following the local construction and job trends will help agents prepare to meet the future demand for their services in their communities.

Related article:

When renters “dominate” buy!!!!

When renters are at their “minimum” sell!!!!

Renters are the “left overs” or the “EXTREME FRUGAL”….

Decent article; just seems about 2 years out of date. These “forecasts” are and have been already happening for some time.

And as far as an “absence of willing homebuyers”, not in the Bay Area. I wish it were so… and my buyer clients were NOT continually being frustrated by multiple, over asking, and cash offers at these crazy levels. Folks are bidding up beyond current, intrinsic value in my opinion, but it is reality for now.

Even the trustee sales to investors are going on at near retail; quite a few times over current retail price!

Flippers have been making bank & quick; contrary to the assertion in this article on that point.

You Newletter’s have continued to you “right on” I find, what you state are the “coming Trends” are following that course in my Marketing area, I am in Aguanga/Anza, Marketing in that area, since 1979, This is the worst market, I have seen in this area, even worst than the 1991-99, era, Now, with Rentals down, and still many

foreclosures, that were “held back”l last year. We are seeing them either, being sold in “bundles”at auctions,

or finally coming on the market. Our inventory, currently is low, and a “false” increase in prices, reflect the

demand, However, many properties, are not in “” Lender financing” condition, so they are being offered in the $70,000 price range, where the homes in decent condition, are in the $124,000 and up, however, still in

short sale position” We are definitely not out of the woods yet!

Heather