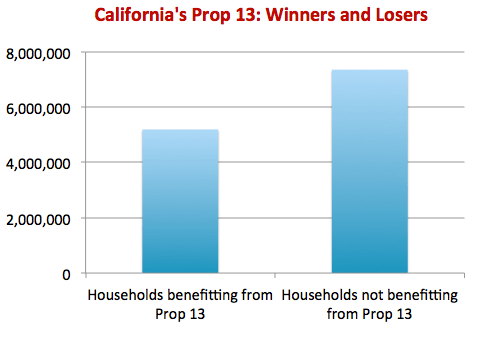

Households benefitting from Prop 13: The estimated number of California households that purchased and retain their homes at a price lower than current fair market value (FMV) and thus pay a smaller amount of property taxes than they would if they purchased today

Households not benefitting from Prop 13: The estimated number of California households that purchased their home at a price higher than its current value (from the years 2003-2008), plus all non-homeowners (renters)

Prop 13 renders homeownership less attainable

Property taxes are crucial to a local government’s ability to provide public services to maintain and give value to the community. In other words, property taxes support a healthy and desirable local housing market.

Most homebuyers, if asked, cringe at the thought of paying annual taxes on their home. The requirement might even make them reconsider becoming a homeowner in the first place. This is where Proposition 13 comes in.

Proponents of Prop 13 claim fixed tax rates are good for the housing industry, as homeowners avoid annual increases in property taxes based on cyclically inflated California home prices. It also purportedly increases neighborhood stability, as homeowners have a financial reason to stay in the home longer. The longer one stays in the home, the more likely they are to experience property tax savings compared to more recent homebuyer arrivals.

Those who purchased their home prior to 2003 are paying a property tax rate sheltered from the outrageous triple asset price inflation of the mid-2000s housing market. Further, those who bought at the bottom of the trough, 2009-2012, are at a much greater property tax advantage than those who bought during the 2013 speculator price wars.

Fewer taxes, fewer services

Keeping taxes low sounds like a great idea. However, Prop 13 presents a major drawback for the local community at large. It is, at its heart, a regressive tax scheme. Prop 13 subsidizes established homeowners with a transfer of wealth from younger, less wealthy families entering the neighborhood. These new homebuyers contribute a disproportionately large share of the revenue collected by the local government to pay for public services. That’s why Prop. 13 is called the “welcome stranger” law.

For instance, consider a homeowner who bought their home in 2009 and is now paying their 2013-2014 tax bill. Due to aggressive price appreciation since the trough of the recession, the home’s current FMV is now 30% higher than when it was purchased. However, under Prop 13, the assessed value of the homeowner’s property has only increased by 2% a year since 2009.

Thus, despite the gain in the homeowner’s household wealth (which, by the way, they can now extract through an equity loan rather than sell and replace that home with a higher assessment and property taxes), they are paying substantially less tax than if they purchased today.

As a regressive tax, Prop 13 places a disproportionate share of the tax burden on those least financially able to bear it: new homebuyers and renters.

This is why the injustice of regressive taxes really hurts others.

Renters are already at a disadvantage; on average they pay landlords more of their household income for housing costs than homeowners, seen in the second graphic. Unlike homeowners, renters don’t have an annual mortgage interest tax deduction to offset their housing costs. Renters pay market rent, while their landlord’s property taxes — and thus, their operating expenses — are held down by Prop 13.

The landlord reaps all the tax benefits, while the renter — future first-time homebuyers — plods on, saving for a down payment without any government support.

Many, many subsidies exist to promote homeownership, nationally and in California. However, renters are left out to dry. Further, they face 25-30 years increasing interest rates which diminish the amount of mortgage money they can borrow to buy a home.

Zoning restrictions drive up prices further as builders cannot meet the demand for additional shelter. Add it all together and you get an extreme issue of inequality in each of California’s communities, particularly in the low-tier areas typically sought by first-time homebuyers.

Get the big picture

Prop 13 benefits the few at the cost of the many. For long-term stability in California’s economy and housing market, a balance of opportunity must be struck between the haves (homeowners and landlords) and have-nots (renters). The 2008 financial crisis and reboot of the mortgage market based on long-term lending fundamentals has focused attention on the deprivation of the less affluent among us.

Builders, brokers and all other providers of services to homebuyers benefit from regular turnover of renter and homeowner occupancies. But they are affected by distortions of volatility and long-term cyclical instability brought on by government through unequal taxation. Worse, lenders benefit additionally from government-induced shifts in long-term wealth as income tax subsidies absolutely encourage buyers to mortgage the property they acquire.

Currently, Prop 13 tips the scale in favor of pre-2000 long-term homeowners benefitting from unequal property taxes. These conditions spell trouble for growth in California’s long-term housing market, part of the ill effects you will sense in 2014 home sales volume and pricing.

*Graphics calculated using data and analysis from the U.S. Census Bureau.

According to the TAX FOUNDATION, Californians pay the FOURTEENTH HIGHEST PROPERTY TAX in the nation! Yet, for what is paid, the quality of California’s public education has gone from NUMBER 1 in the nation during the 60’s and 70’s to being ranked 46th in quality of education today. Governor Brown hates Proposition 13 and has fought it ever since it became law during his second term in the late 70’s . The article does not state all of the facts. In fact, the article should compare the costs received for the tax dollar versus what is paid. Had that been done, a completely different picture would have been given. Especially involving real estate. i Prior to Prop.13, Californians were paying over 4.5% on their property taxes and with inflation, property values were being held down, especially since mortgage interest rates in 1979 were climbing to over 18%!

As a comparison, because of Prop. 13, the average property tax in California is ONLY 1.25% of the assessed value!

The problem with California is that the current governor and his party love spending money that the state does not have. Proof of that is the “BULLET TRAIN TO NO WHERE” that the governor wants built that will never be self funding. Like AMTRAK and the Bay Area Rapid Transit they both are government subsidized and Amtrak currently runs a negative budget of over $8 BILLION annually. Governor Browns train is now rumored to cost over $65 BILLION and it hasn’t ever gotten off of the drawing board !

People are leaving California because the current government does not believe in small business and loves BIG LABOR UNIONS !

An Economic Professor from DUKE UNIVERSITY said on TUESDAY, APRIL 2nd, that California will lose over 750,000 JOBS as a result of increasing the minimum wage to $15.00.

The real reason minimum wage was increased was to increase payroll taxes and to reward labor unions since their contracts are tied to minimum wage !

I appreciate Jeffrey Davis’ analysis and comments. The key advantage of Prop 13 is that it promotes predictability. I recall the forced sales in the 70’s due to rapidly rising prop taxes.

Wilma’s comments display fundamental legal and economic misunderstandings. Property is subject to reassessment when there are changes in ownership, regardless of whether the property is owned by individuals, corps, or LLC’s. It is possible for extremely large organizations [all commercial ones, not just apt owners] to have multi-tier ownership that may circumvent change of ownership and reassessment requirements.

As others have noted, if Prop 13 were removed, [apt and SFR] tenants would soon seen rising rents. And remember, tenants get a renters credit on their state taxes. So it is ludicrous to claim that tenants receive no benefit.

So Wilma gets top billing as the comment of the week-Seriously? More proof that First Tuesday has evolved into a liberal leaning entity. Are you really here for the benefit of our industry? It doesn’t appear so.

According to Ms. Wilma, the chief beneficiaries are apartment owners. The truth is the chief beneficiaries are every person or entity that owns property in CA,

regardless of what type. I currently own a home along with commercial and residential properties. I can guarantee that my tenants rent would go up dramatically if Prop 13 was eliminated or greatly modified and caused my taxes to increase at a rate higher than what is now allowed. Because of Prop 13, renters benefit in the form of lower and more stabilized rent.

The author of the original article has exposed herself politically when she labels Landlords and Homeowners as HAVES and renters as HAVE NOTS. It is apparent she has aligned herself with the wealth redistribution zealots. In addition, she has not not provided any concrete evidence or facts to support her opinion.

Note to First Tuesday: you are doing nothing to benefit your business when you allow slanted opinion pieces like this to be published. It is time to go back to publishing professional, factual, and evidenced based articles that enhance Real Estate professionals ongoing education.