Transfer disclosure statement: the affirmative duty to disclose property conditions

Mandated on one-to-four residential units

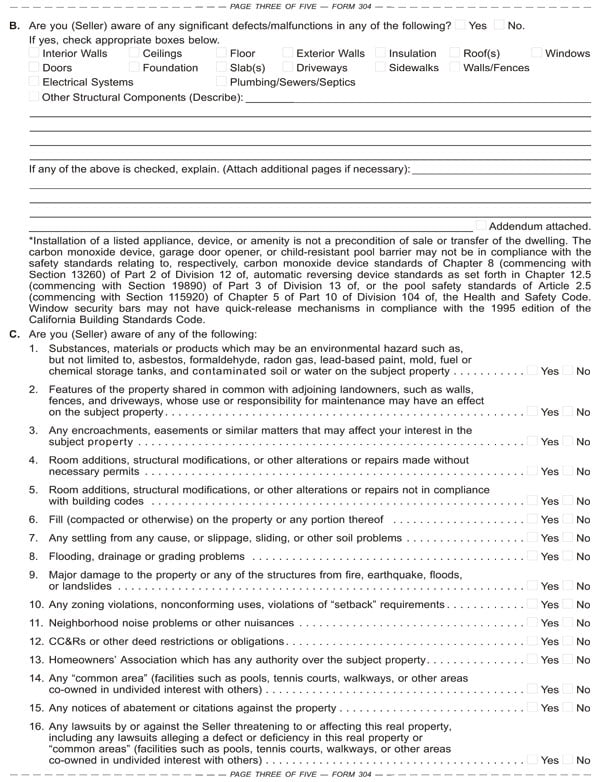

A seller of a one-to-four unit residential property must complete and deliver to a prospective buyer a statutory form called a Transfer Disclosure Statement (TDS), more generically called a Condition of Property Disclosure Statement. [Calif. Civil Code §§1102(a), 1102.3; see first tuesday Form 304 below]

However, some transactions exempt the seller (but not the listing agent) from preparing and delivering the statutory TDS to the buyer, including transfers:

- by court order, such as probate, eminent domain or bankruptcy;

- by judicial foreclosure or trustee’s sale;

- on the resale of real estate owned (REO) property acquired by a lender on a deed-in-lieu of foreclosure or by foreclosure;

- from co-owner to co-owner;

- from parent to child;

- from spouse to spouse, including property settlements resulting from a dissolution of marriage;

- by tax sale;

- by reversion of unclaimed property to the state; and

- from or to any government agency. [CC §1102.2]

The seller must prepare the mandatory TDS with honesty and in good faith, whether or not a broker and listing agent is retained by the seller to assist in its preparation. [CC §1102.7]

When preparing the TDS, the seller sets forth any property defects known or suspected to exist by the seller.

Any conditions known to the seller which negatively affect the value and desirability of the property must be disclosed, even though they may not be preprinted on the TDS. Disclosures to the buyer are not limited to the items preprinted on the form. [CC §1102.8]

Any attempt to have the buyer waive delivery of the statutorily-mandated TDS, such as by use of an “as-is” provision in the purchase agreement, is void as against public policy. The words “as is” should never be used. The words imply a failure to disclose something known to the seller or the listing agent. [CC §1102.1(a)]

Delivery of the disclosure statement

While it is the seller who must prepare the TDS, it is the agent who obtains the purchase agreement offer from the buyer who must hand the buyer the seller’s TDS. If the sales transaction is directly between the seller and buyer, without the participation of an agent in negotiations, the seller has the obligation to deliver the TDS to the buyer. [CC §1102.12]

The failure of the seller or any of the agents involved to deliver the seller’s TDS to the buyer will not invalidate a sale of property which has closed. However, the seller and the listing broker will be liable to the buyer for the amount of actual monetary losses caused by an undisclosed defect known to them, a point of law which has always existed.[CC §1102.13]

For the seller’s disclosure statement to be an effective pronouncement, material defects in the integrity of the property must be disclosed to the buyer before the price of the property is agreed to by acceptance of an offer or counteroffer.

If the seller’s statement is delivered to the buyer of a one-to-four unit residential property after the seller enters into a purchase agreement, the buyer has the right to:

- cancel the purchase agreement on discovery of undisclosed defects known to the seller and unobserved by the buyer or the buyer’s agent (on an inspection) prior to acceptance [CC §1102.3];

- make a demand on the seller to correct the defects or reduce the price accordingly before escrow closes [See first tuesday Form 150 §11.2; or

- close escrow and make a demand on the seller for the costs to cure the defects known to the seller and not disclosed prior to acceptance. [Jue v.Smiser (1994) 23 CA4th 312]

Editor’s note – For more information regarding the use of the TDS, current students can access first tuesday’s Real Estate Practice, Chapter 24: “Conditions of property: the owner’s disclosures,” from within your Student Hompage in the “Library” tab. Log in with your Department of Real Estate (DRE) license number under “Enrolled Student Services.”]

Recent changes to the TDS effective January 1, 2011

Carbon monoxide devices have been added to the list of items mandated to be disclosed, if present on the property, by a seller in Section A of the TDS. [See first tuesday Form 304 below]

The TDS now also discloses:

- the existence of carbon monoxide devices on a property is not presently mandated as a precondition of the property’s sale or transfer (as are smoke detectors and water heater bracing); and

- any carbon monoxide devices present on the property might not be in compliance with the law. [See first tuesday Form 304 §A below]

The smoke detector no longer appears in Section A. Instead, TDS forms now include a statement requiring the seller to certify the property has or will have an operable, compliant smoke detector on the property on or before the close of escrow on the sale of the property. [See first tuesday Form 304 §D, 1 below]

The water heater status of being properly braced, anchored, or strapped also no longer appears in Section A. TDS forms now include a statement requiring the seller to certify the property has or will have any water heater present on the property braced, anchored, or strapped on or before the close of escrow on the sale of the property. [See first tuesday Form 304 §D, 2 below]

Editor’s note – For more information regarding revisions to the TDS form, see the June 2010 first tuesday Legislative Watch. Current first tuesday students can access a fillable and saveable version of this form in the “first tuesday Forms Downloads and Updates” tab within your Student Homepage. Log in with your Department of Real Estate (DRE) license number under “Enrolled Student Services.”

Also, all first tuesday Purchase Agreements (Form 150 through Form 159) have always conformed to these present legislative changes, including the buyer protections afforded by the water heater bracing and smoke detector installation. While other form publishers must update their existing forms to comply, first tuesday, innovative and forward-looking as a matter of policy, preempted this change.