To understand the real estate market, look at state employment.

The quantity of jobs in California directly impacts the percentage of homeownership in California. Without a paycheck, an individual cannot afford to rent an apartment or buy a house, unless they are subsidized by the government or wealthy with cash reserves. The basis for an individual’s creditworthiness to borrow money for housing is a paycheck or self-employed earnings from a trade or business.

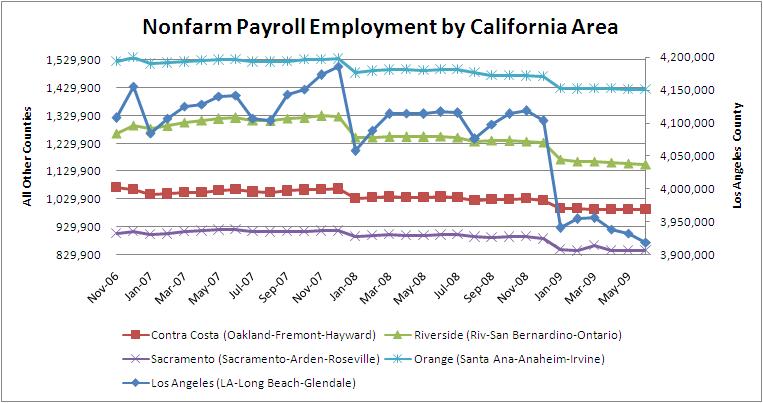

Lack of savings for a down payment, lender resistance to lend to homebuyers (due to dropping prices and a return to credit fundamentals), and government promises of eventual subsidies to lenders and buyers all influence the decisions of jobholders who qualify to buy a home. However, the present loss of jobs throughout California is the single most serious crisis facing real estate sales and rental occupancy.

California has 8.5 million single family residence (SFR) units and 17 million individuals on payrolls. Thus, there are 50% as many homes as people on payroll. Further, 55-60% of households in California own the home they live in (the national average is 68% and dropping).

Thus, as the number of payroll jobs in California drops, it is easy to draw the conclusion that out of every 10 people who lose their jobs, five or six cannot now buy a home or retain the home they live in (unless they have cash reserves).

During 2008, California lost 300,000 jobs that will not be replaced for three or four years, and then only if the unemployed individuals are retrained for a different or upgraded skill set. This loss of jobs means roughly 150,000-175,000 homes will go unsold over the next few years as potential homebuyers no longer qualify to buy a home.

The loss of jobs has a ripple effect on all types of real estate beyond homeownership. As employees are shed, the need for office space, commercial space, and industrial space is reduced. This leads to excess space at the projected annual rate of over 300,000 units in 2009 in California. Subleases, greatly reduced rents, and vacancies are the direct results of job loss.

The good news is that job losses will start to significantly fall off by Fall 2009 after the current bandwagon surge of layoffs has ended. After that, it’s up to the government to stabilize job loss and promote job growth as businesses only respond to demand — and it isn’t there for them and won’t be without government intervention. Governments are good for many macro-economic activities and economic recovery is one of those activities, contrary to the beliefs of the uninformed resistance.

While you observe payroll data as reported by the media or others, be certain you are distinguishing between what’s happening in California and what’s happening with the rest of the nation. The magnitude of California’s real estate bubble exceeded that of almost all other states by any measurement. The recession will be equally severe in correction of the recent past’s excesses.

Also see our article on Jobs as a Real Estate Market Volatility Factor.