A life preserver for underwater homeowners

Home prices in early 2023 are nosediving in California at a pace of 1 ½% monthly. That monthly rate is likely to continue, except for a modest mid-2023 buyer demand bump and into 2024, hitting a bottom price level in 2025. This pricing activity heralds the start of a new business cycle in our economy.

Homebuyers who purchased in the past few years funded mostly by a mortgage face the risk of insolvency. Month by month and in the reverse order of acquisition, increasing numbers of these mortgaged homeowners will fall underwater — continuing until property prices develop a bottom level.

As these events occur, the pernicious presence of negative equity

A lens on equity

Two breeds of negative equity homeowners exist:

- those who are fully aware of their financial plight but do not know how to correct it; and

- those who aren’t aware or are in willful disregard of their precarious financial footing.

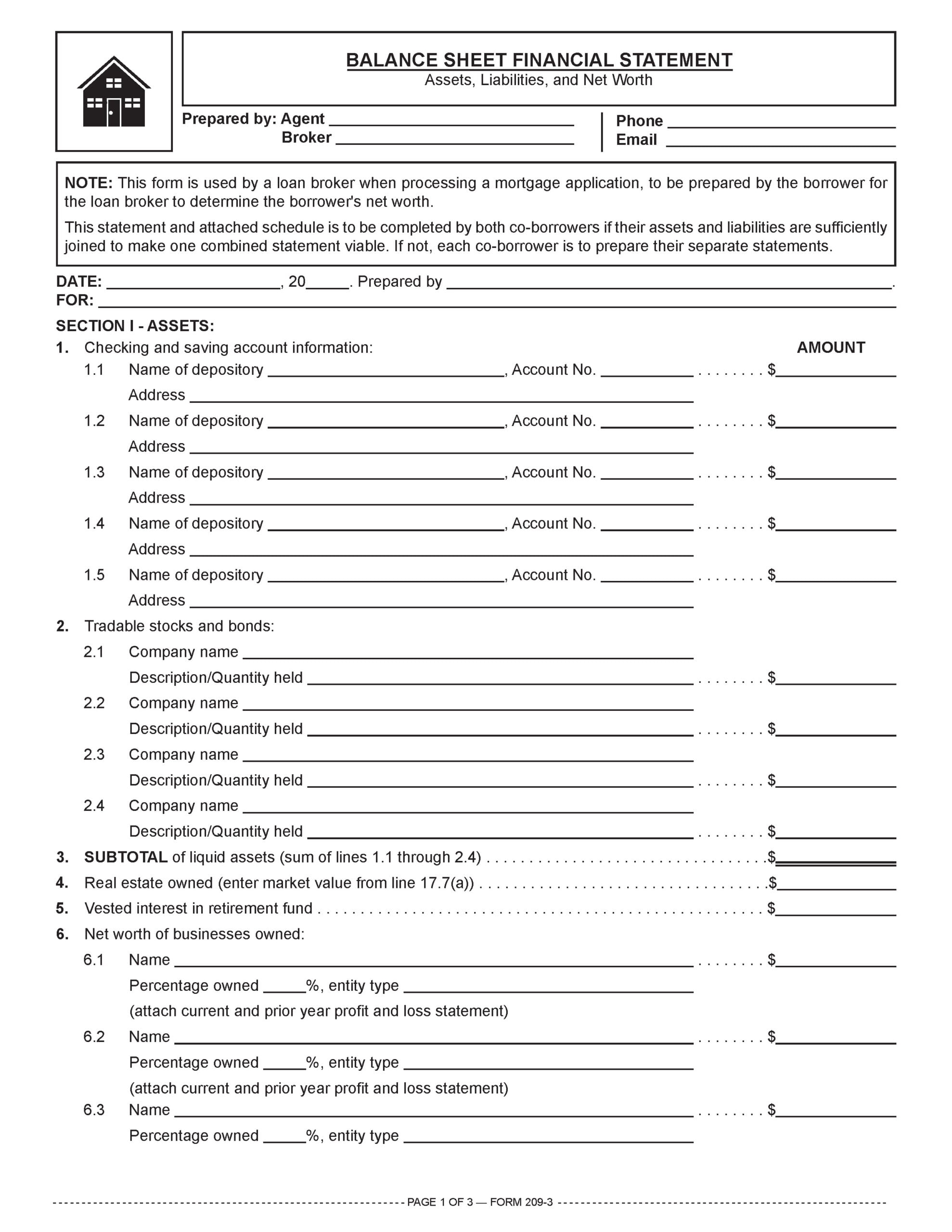

For compelling insight into a family’s household equity position, look no further than a balance sheet. [See RPI Form 209-3]

As a worksheet, the homeowner lists on a balance sheet with dollar amounts all the homeowner’s:

- assets; and

- liabilities (debts). [See RPI Form 209-3]

The balance sheet is a tool adopted to break down a homeowner’s financial status into its component parts. The use of the balance sheet, also called a statement of financial position, is a simple, clear-voiced exercise in financial planning. The entries are like those found in the homeowner’s mortgage application.

For the greatest understanding of debt, the balance sheet analysis needs to be conducted by every household (and investor and businessperson) at least once each year.

Preparation of a balance sheet is especially instructive to families who purchased or refinanced during the rapid price escalation from mid-2020 to mid-2022, since they are most likely to be underwater or will soon reach that status.

Related article:

Pandemic-era buying spree plunges homebuyers from minority groups underwater

For the majority of homeowners, their greatest asset (or obverse position of liability) is their home.

By completing a balance sheet, a homeowner can develop a firm mental grasp on the family’s accumulated wealth. In turn, prudent long-term financial decisions are enhanced.

An agent’s use of the balance sheet

The balance sheet approach for establishing a homeowner’s net worth is meaningful for a well-informed real estate broker or agent.

The balance sheet assists individuals in their estate building through the ownership of real estate as either a store of wealth, as with their home or land, or an income producing investment in improved property.

Investors and families accounting for the dollar amount of annual increase in the value of their assets usually do so after the end of each year — often at the same time they prepare their annual income tax return.

The analysis reveals whether the family is on track to meet long-term financial goals, or whether the family is insolvent and in need of a change in behavior or assets. The balance sheet also helps the family rationally determine which assets to best spend their earnings on and which assets they need to discard.

An agent reviewing homeownership with an owner needs to instruct the owner to keep long-term estate building in mind when considering the data provided in the balance sheet. The closer the relationship of the agent is to the client, the tighter the bond endures between them. Financial planning is about as close as you can get, so do not leave it to unlicensed financial consultants to take the opportunity away regarding whether to buy or to sell real estate.

After an owner prepares a balance sheet for review by their real estate agent, it will become clearer which assets need different management decisions. In this context, an upside-down house needs to be considered for disposal to free up monthly cash flow for more prudent family expenditures on shelter.

The financial impact of a homeowner’s current mortgage situation directly affects their annual increase in net worth and their ability to achieve long-term financial goals from their flow of income.

Related article:

Assets and liabilities

A balance sheet is a static statement which distinguishes the critical relationship between two basic financial categories: assets and liabilities.

Assets are tangible and intangible items of value held by the homeowner. Among them are liquid assets which take the form of cash or something easily converted to cash, and include money held in a savings account and tradable stocks and bonds. [See RPI Form 209-3 §§1 and 2]

Generally, the largest dollar-valued asset a homeowner will ever own is their home. It is historically an illiquid asset since its equity cannot quickly be converted to cash. With a positive-equity stake in the home, the owner treats it as a valued asset and thus maintains and improves it.

Over a generation or so in time, property pricing in a stable or growing demographic location experiences an equity buildup — the result of mortgage principal reduction, and asset inflation and appreciation. The buildup in equity is cashed-out by either further financing or a sale of the property.

Other items make up a homeowner’s assets, such as funds held in retirement accounts, ownership interests in businesses and trust deed notes. Vehicles and equipment owned are also assets, as well as furniture, electronic equipment and any other item of recognized value, such as collectibles. [See RPI Form 209-3 §§5 through 9]

Liabilities are the flip side of the financial coin. Together, net worth and liabilities are equal to the value of the assets.

The formula is commonly stated as:

assets minus liabilities equals net worth.

Liabilities listed in a balance sheet are financial obligations and debts owed to others, including:

- real estate mortgages;

- auto loans;

- student loans;

- charge accounts;

- credit card balances;

- one year’s amount of alimony/child support/lease payments; and

- mortgages collateralized by stocks, bonds or notes. [See RPI Form 209-3 §§11 through 15]

Related Video: URLA Section 2 & 3: Financial Information

Click here for more information on entering a buyer’s assets and liabilities in mortgage applications.

Figuring net worth

A homeowner’s net worth is revealed when their total liabilities are subtracted from the current fair market value (FMV) of their assets, the price others are presently willing to pay to own them.

Personal net worth is a primary determinant of the financial wealth individuals need to know about themselves. When net worth is positive, the homeowner is worth more than they owe to their creditors — the homeowner is solvent.

However, this balancing act is immediately upended when a high-value asset is mortgaged, such as the owner’s residence, and has negative equity. [See RPI e-book Real Estate Economics, Chapter 4.3]

When the negative equity is large enough, the value of the owner’s other assets on their balance sheet is overwhelmed. Here, their net worth appears as a negative figure. Instead of a positive measure of wealth, the negative net worth is a measure of insolvency.

When insolvent, the homeowner is a candidate for bankruptcy protection, which was severely reduced for mortgaged homeowners in 2005, but not for real estate investors. It is in this context that the agent reviews the pros and cons of the homeowner’s continued ownership and occupancy of the property.

Related article:

MLO recession survival guide Part 2: Buyers’ agents and underwater home sellers

Breaking down the balance sheet

A mortgage broker uses the Balance Sheet Financial Statement — Assets, Liabilities and Net Worth published by Realty Publications, Inc. (RPI) to gather financial information for processing a mortgage application. The borrower prepares the financial statement as a worksheet for the mortgage broker to determine the borrower’s net worth.

It is also used by a proactive agent when assisting a homeowner in recessionary periods, as discussed. [See RPI Form 209-3]

The Balance Sheet Financial Statement — Assets, Liabilities and Net Worth contains the following sections:

- liquid assets such as checking and savings accounts and tradable stocks and bonds [See RPI Form 209-3 §§1 and 2];

- real estate owned [See RPI Form 209-3 §§4 and 17];

- retirement fund vestings [See RPI Form 209-3 §5];

- business ownerships [See RPI Form 209-3 §6];

- trust deed notes owned [See RPI Form 209-3 §7];

- vehicles owned [See RPI Form 209-3 §8];

- other assets of value [See RPI Form 209-3 §9];

- debts owed including auto loans, charge accounts, real estate loans, alimony/child support and mortgages collateralized by stocks/bonds/notes [See RPI Form 209-3 §11];

- job-related expenses [See RPI Form 209-3 §13]; and

- net worth, calculated as total assets minus total liabilities. [See RPI Form 209-3 §16]

Related article:

Form of the Week: The asset, liability and net worth balance sheet

The profit and loss worksheet

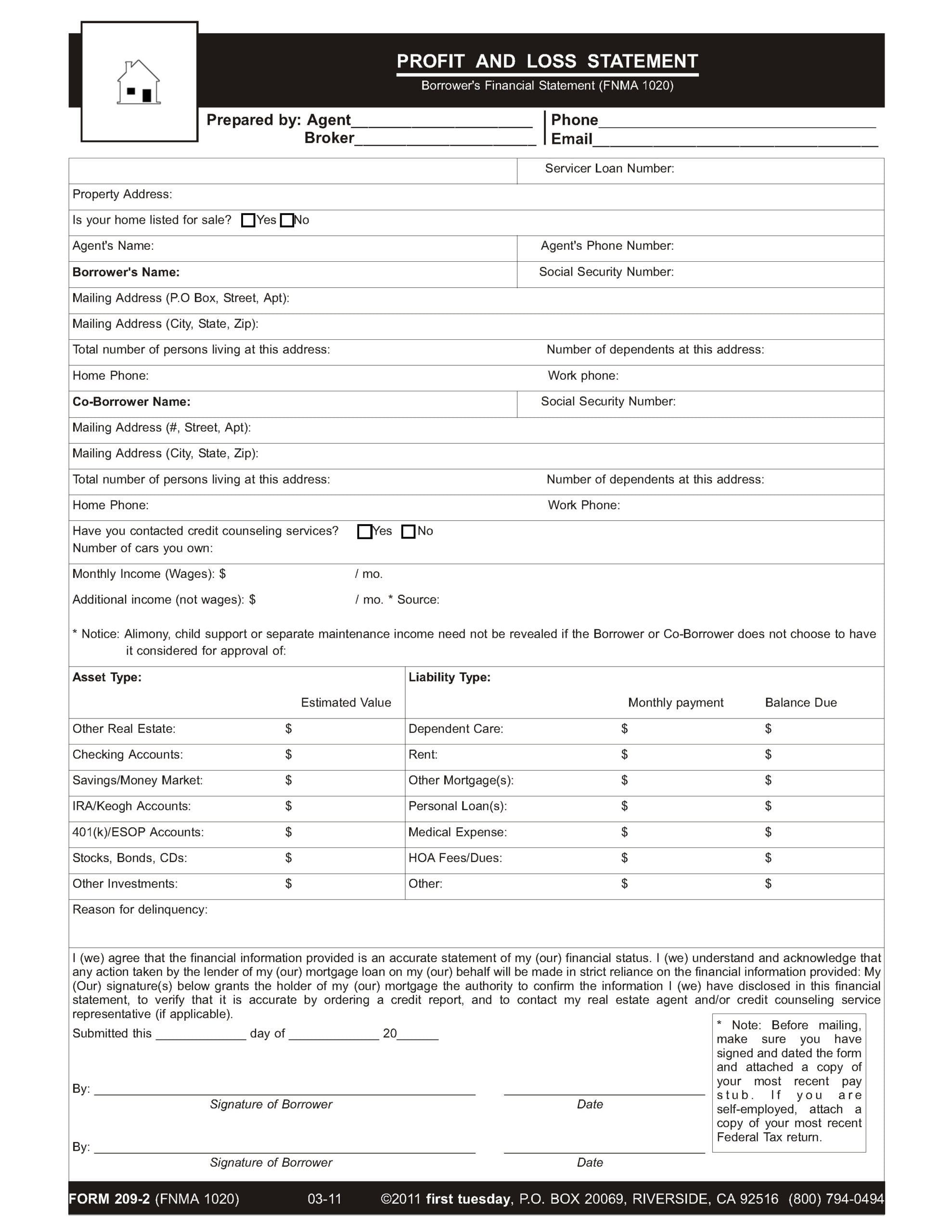

In contrast, a profit and loss (P&L) worksheet is a separate but tandem financial statement serving a different and proactive purpose. It is the basis for a critical budgetary review for adjustments to be made in the homeowner’s ongoing monthly income and expenditures. [See RPI Form 209-2]

A P&L does not deal with the value of the home — an asset — or the mortgage debt — a liability.

Instead, a P&L lists the homeowner’s monthly ebb and flow of cash, consisting of:

- personal income;

- monthly expenses; and

- long-term obligations, including mortgage payments.

A balance sheet is about gold bricks stashed in the basement, not budgeting for expenditures of the household income. For budgeting, a P&L is the preferable tool. [See RPI Form 209-2 and 209-3]

A mortgage broker uses the Profit and Loss Statement — Borrower’s Financial Statement published by RPI when processing a mortgage application. It is prepared by the borrower and delivered to the mortgage broker. The form discloses the borrower’s sources and amounts of income, personal expenses and resulting net income available for savings as an economic cushion. With this information, the mortgage broker calculates the borrower’s debt-to-income (DTI) ratios.

The P&L is also used by an agent assisting a homeowner in their household budgeting. [See RPI Form 209-2]

The Profit and Loss Statement — Borrower’s Financial Statement contains the following information:

- monthly income (wages) and additional income (not wages);

- the estimated value of assets by type, including:

- other real estate;

- checking accounts;

- savings;

- IRA accounts;

- 401(k) accounts;

- stocks, bonds, securities and CDs; and

- other investments; and

- the monthly payment and balance due on liabilities, including:

- dependent care;

- rent;

- other mortgages;

- personal loans;

- medical expenses;

- homeowners’ association (HOA) fees; and

- other debts. [See RPI Form 209-2]

For delivery to a mortgage broker, the borrower signs and dates the form and attaches a copy of their most recent pay stub or, when self-employed, a copy of their most recent federal tax return.

Related article:

Want to learn more about underwater homeowner trends? Click the image below to download the RPI book cited in this article.