We’ve been saying it all year. As a matter of fact, it was a central thesis in our 2013 year in review. But since the Wall Street Journal is in full agreement, we thought we ought to say it again: rising mortgage rates in 2014 will perpetuate the bumpy washboard ride of home sales demand.

The buyer purchasing power index (BPPI) is a very straightforward indicator of demand, particularly the ability half of the demand equation. If interest rates rise and income stays constant, home prices fall. In other words (and this is a truism in the real estate market) prices are inversely proportional to interest rates.

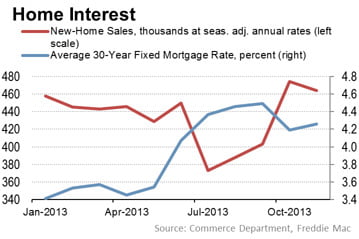

Here’s a nifty chart highlighting just this fact, courtesy of the WSJ:

Interest rates have risen a full percentage point over the course of 2013 and yet prices have continued to rise. We’ve written at length about the reason: speculators and institutional investors drove demand, and they aren’t as dependent on purchase-assist financing. Over 40% of investor sales in 2013 were cash deals. When large investors did leverage their purchases, it was done at prime rates with sizeable down payments. They operate outside the realm of normal buyer financing.

Interest rates have risen a full percentage point over the course of 2013 and yet prices have continued to rise. We’ve written at length about the reason: speculators and institutional investors drove demand, and they aren’t as dependent on purchase-assist financing. Over 40% of investor sales in 2013 were cash deals. When large investors did leverage their purchases, it was done at prime rates with sizeable down payments. They operate outside the realm of normal buyer financing.

Thus (and this is a big “thus”), the reality of rising interest rates has not yet begun to negatively affect real estate prices, especially in California’s booming metro regions. The Fed’s taper of quantitative easing (QE) has yet to cause interest rates to spike. But it is especially clear that in light of the taper and the rebounding 10-year T-note, rates are on a path of persistent upward momentum.

So yes, prices will likely fall. But here’s one point that many are missing: rising interest rates means rising interest in loan assumptions and thus a reinvigorated abhorrence for the due-on sale clause.

Currently, neither the real estate trade associations nor any independent parties we know of are fighting for the legal right to loan assumptions. In the coming era of rising interest rates and rocky end-user demand, agents will wish they still had the loan assumption in their deal-making arsenal. The deal-stifling nature of the due-on sale clause was a defining factor in the rising interest rate environment of the 1970s. It will be again.

…just what are you comparing “bumpy” to? The last five years? I refer to this as the “farmer complaint syndrome”. The weather is either too wet/flood or dry/drought. Never is it “just right”…keeps the federal funds flowing.