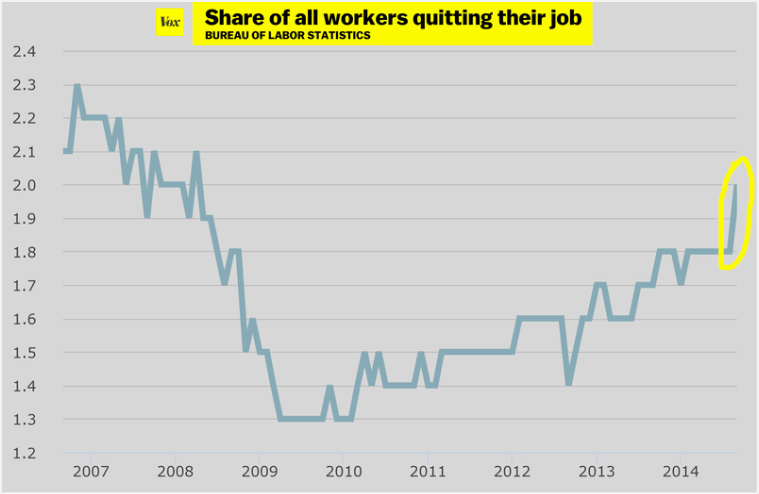

Good news for the employment market: more people are quitting their jobs!

While this concept is counterintuitive for mortgage lenders, when an employee quits their present job, this indicates they are either:

- confident in the ability to find a new job; or

- have already gained employment elsewhere (excluding those who don’t plan on returning to work).

So, September 2014’s spike in job quitters points to more confidence in the job market and our U.S. economy, even if quitting makes lenders wary.

Nationally, the number of people who quit their jobs in September 2014 jumped to 2.8 million, up from 2.5 million one month earlier. In other words, a full 2% of the nation’s working population quit their jobs in September, according to the Bureau of Labor Statistics. For context, the quit rate was frozen at 1.8% over the prior seven months.

Before the 2008 recession and continuing recovery, quit rates hovered around 3.1 million a month, descending to a low of 1.5 million in 2009.

Chart courtesy of Vox

Here in California, the recovery of jobs lost since the onset of the Great Recession is nearly here. As of September 2014, California has to regain 76,400 additional jobs to return to the pre-recession peak in employment seven years ago. We are set to reach that number before the end of 2014.

A complication: when including the working-age population increase of 1.2 million individuals since the recession set in, California won’t regain lost income levels until around 2019, 12 years after the economic crisis began. However, September’s rise in job quitters can only mean one thing: the economy is looking up. Further, this may indicate confident employees are going to start wrangling for wage increases if they choose to stick around.

Is the outlook for housing just as bright?

Jobs are critical to a full housing recovery, which thus far has been unstable to weak at best. Sure, prices jumped through 2013 and most of 2014, but began to slip in most tiers in Los Angeles, San Francisco and San Diego in August 2014. The jump was fueled not by end users of property but by hit-and-run speculators, who have begun to leave the market.

Absentee buyers peaked at one-third of Southern California’s homebuying market (more when including trustee’s sales) in January 2014. Since then, they have swiftly departed to 23% of the market in Q3 2014. Home sales volume has also decreased, year-to-date 8% below the prior year as of October 2014.

Thus, expect prices to fall in 2015, consistent with the latest reports which show prices have already tilted into decline. Sales volume and prices will only experience a stable recovery once end users find the confidence to re-enter the housing market.

First, end users need jobs. Second, they need enough time to store away savings for a down payment to avoid the extra 1.5% in private mortgage insurance (PMI). Then, expect home sales volume to increase significantly beginning in 2016, peaking around 2019.

Editor’s note — If one recalls the recent refinance woes of former Federal Reserve chair Ben Bernanke, mortgage lenders are less inclined to lend to job quitters. Automated lending systems prefer long-standing employment when granting both home refinances and originations, even if you were the former chair of the Fed.