This article reviews a recent poll on American attitudes towards owning a home in light of the Great Recession and the housing crisis, and reevaluates the place of homeownership in the American Dream.

Homeownership is at home in the American Dream

Eighty percent of Americans believe it is of total importance they buy a home one day, 90% say they would buy their current homes again and 70% would advise their family and friends to purchase a home as a valuable long-term investment. Clearly the vast majority of Americans still sport a decisive thumbs up to homeownership despite the risk of loss inherent in homeownership made evident by the Great Recession and the housing crisis.

All this is according to the latest Allstate Insurance and National Journal Heartland Monitor Poll which Financial Dynamic conducted to monitor middle-class America’s maneuvers in the economy’s post-recessionary aftermath. (The poll recorded a +/- 3% margin of error for 1000 respondents.) [For more information on the “Homeownership and the American Dream” poll, see National Journal article, A Solid Foundation: Why Americans still long for their own homes.]

The American Dream of wealth and independence sustains American homeownership, a national aspiration which is the result of society’s suspension of disbelief in the myth that home prices continually go up. For example, two-thirds of those Americans polled experienced some type of financial distress such as an underwater mortgage and still believe owning is better than renting. Seventy-five percent believe homeownership will help them achieve the American Dream, compared to the 22% who believe otherwise, and 80% believe owning a home is an integral piece of the American Dream, second only to raising a family.

Californians polled in the survey generally exhibit the same level of national spirit for homeownership ― 68%, compared to the national 75%, believe owning a home will help them live the Dream. In addition, 83% believe owning is a better financial decision than renting, and 71% would advise family and friends to buy a home to build long-term assets. (The poll’s California data recorded a +/- 10% margin of error for 99 respondents.)

Optimism and persistence are American

Homeownership is not solely an economic decision. The American image of the home is deeply imbued with social and cultural sentiments. Though 25% believe owning a home is the best type of investment for their money only behind a retirement plan, 60% in the survey view homeownership chiefly as a means to settle down and raise a family. Thirty-six percent view homeownership as an opportunity to build equity.

The general consensus is present economic troubles and housing market miseries are but minor impediments to the American Dream. Sixty-three percent of Americans and 67% of Californians trust the housing crisis is temporary and the housing market will improve. Nationwide 60% believe their skills coupled with a tough work ethic ― rather than the economy ― has the most impact on their ability to achieve the Dream.

Splintered views in uncertain times

Though many Americans are convinced they control their own Dream, the Great Recession and the housing crisis cast doubt over what part the government plays in subsidizing American homeowners. Americans and Californians are split over the matter. Fifty percent of the nation and 42% of the state want to reduce the role of government agencies like Fannie Mae and Freddie Mac, yet 42% nationwide and 52% statewide want the government to continue its role. On the home mortgage tax deduction question, 50% want the government to keep the subsidy, while 43% want to limit or eliminate it. Californians polled at 56% to keep the subsidy and 37% to trim it down or cut it out. [For more information on getting rid of the home mortgage tax deduction, see the February 2011 first tuesday article, The home mortgage tax deduction: inducing debt and stifling mobility.]

It should be noted the poll shows some Americans appear misinformed about how the government housing policy works. Seventy-five percent report they have not benefited from federal homeownership policy even though 71% report they have taken a home mortgage tax deduction.

The same level of ambivalence exists on the question of whether homeownership stabilizes American society. Forty-two percent agree homeownership has created stable communities because it encourages people to actively invest in a neighborhood and its surrounding area. However, 51% think homeownership encourages people to incur high amounts of debt, which renders them unable to pay their mortgages if they lose their jobs, and results in increased foreclosures and blighted communities.

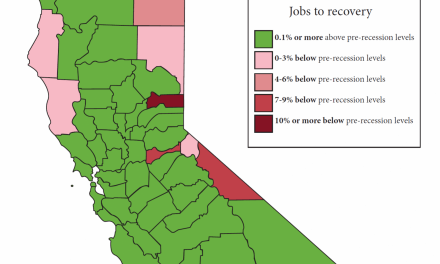

California’s response to the relationship between homeownership and the health of a community differed from national results, which is not surprising since the state has been hit much worse by the housing crisis than the rest of the country. Seventy-seven percent of Californians report their homes have decreased in value (fact: all have decreased), compared to the 41% nationwide, and 40% say their homes are underwater, compared to the 18% nationwide. As a result, 61% of Californians believe homeownership has only made communities less stable.

Younger Americans surveyed seemed the most uncertain about buying a home, but overall, the poll demonstrates the economic down has caused Americans to ask questions about homeownership and the American Dream, but it has not budged their desire for it.

Time to reevaluate the Dream

Americans, and Californians included, are split or confused on what role the government has on the issue of homeownership. They are divided as to whether the government should continue to intervene in the housing market.

Americans crave homeownership, even if they understand they will have to trudge through the backwash of another cyclical recession and accompanying housing crash. But Americans need to distinguish: the Dream is homeownership, not homedebtorship, as promoted by interest deductions. The craving however is not the result of tax policies, which if eliminated would not alter the American compulsion to own and gain wealth.

Homeownership is not for everyone, and those who are forced to finance that acquisition might ask themselves whether owning is the right decision. The job mobility provided by renting is what has always enhanced California’s economy, attracting the most creative and industrious people in the world. Here, homeownership is near 50% of those housed in California, while the rest of the nation ranges around 70%.

The real estate industry calls the mortgage interest deduction the “catalyst of the American Dream,” but an American Dream based on irresponsible indulgence has more costs than benefits. [For more information on the housing subsidy problem, see the December 2010 first tuesday article, The mortgage interest tax deduction imbroglio – the squabble continues.]

At its very core, a home is a form of shelter, a basic life necessity. However since the 1970s, national public policy encouraged and exploited by lenders, builders and brokers marketed homeownership as a symbol of success and autonomy. The glamorous spotlight on the accessibility of homeownership for everyone thus casts a shadow of disapproval on renting, but what is there to be embarrassed about when paying cash to buy a home? If being in debt is a foundation to homeownership in America (and one of the reasons for the housing crisis), then Americans need to change their attitudes towards homeownership. Dreaming about homeownership is laudable, but on a solid foundation. [For more information on the trends of American attitudes towards housing, see the October 2010 first tuesday article, Is homeownership a luxury or necessity?]