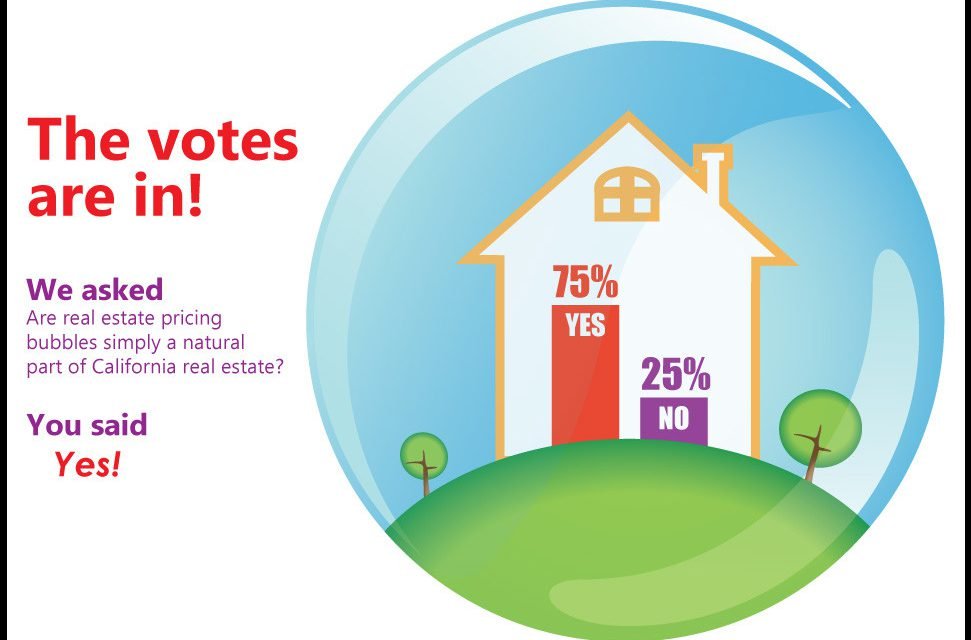

The vast majority of respondents believe real estate pricing bubbles are a natural occurrence in the California real estate market.

There are a few ways we can understand this statement. On one hand, to say bubbles are natural is to argue that a boom/bust, cyclical structure is a necessary component of the real estate market — fundamentally built-in to how we do business.

On the other, it may just be that real estate professionals have no faith this trend will ever change. Thus, they have resigned themselves to considering pricing bubbles par for the career course.

We are of the opinion bubbles are an unfortunate distortion of a healthy real estate market — neither necessary nor inevitable.

It’s true, bubbles are a long part of our history, especially in California. But isn’t the knowledge of historical missteps supposed to play into better management of activities going forward?

Market cycles are difficult to break as expectations tend to produce expected results. But bubbles are by no means natural to doing the business of real estate.

Consider speculators. They buy to flip, adding little or nothing to the value of the property purchased. These individuals profit solely on the up- and down-side of a market bubble, intending to earn nothing from operating the property but carrying costs.

The vast majority of those working in the real estate industry are in it for a sustainable long-term career. They are not here to get-rich-quick during the momentum, then drop out during the crash. This, however, is part of our broker-driven human resources disaster during momentum markets — high agent turnover is encouraged in the churn and burn mentality.

We keep close watch on real estate agent/broker licensee demographics here at first tuesday. We can tell you licensees bubble and burst along with prices, only with a slight lag to account for the Johnny-come-latelys. However, this type always jumps like so many fleas from a drowning dog, leaving the true professionals to wait it out until another bubble bolsters their savings accounts, sustaining them through the drought.

Related article:

There are many links in the bubble formation chain, including:

- the Federal Reserve (the Fed);

- interest rates;

- credit rating agencies;

- lender risk tolerance;

- occupant-buyer housing demand; and

- home pricing structure, among others.

But there comes a time when you have to look at the agent in the mirror. Do you pitch real estate as a “profitable investment”? Are you a buyer’s agent that encourages your buyers to engage in bidding wars? Are you a seller’s agent who encourages cash offers over financing-contingent offers, even those at a higher price?

Related article:

The fact is, about as many agents get rich off of real estate bubbles as individuals who win the lottery. It’s time to take responsibility for creating a sustainable market. Lose your illusions and refuse to sit back and ride the wave that inevitably becomes a tsunami.

Thanks, great info….But remember -Supply & demand….the American way…