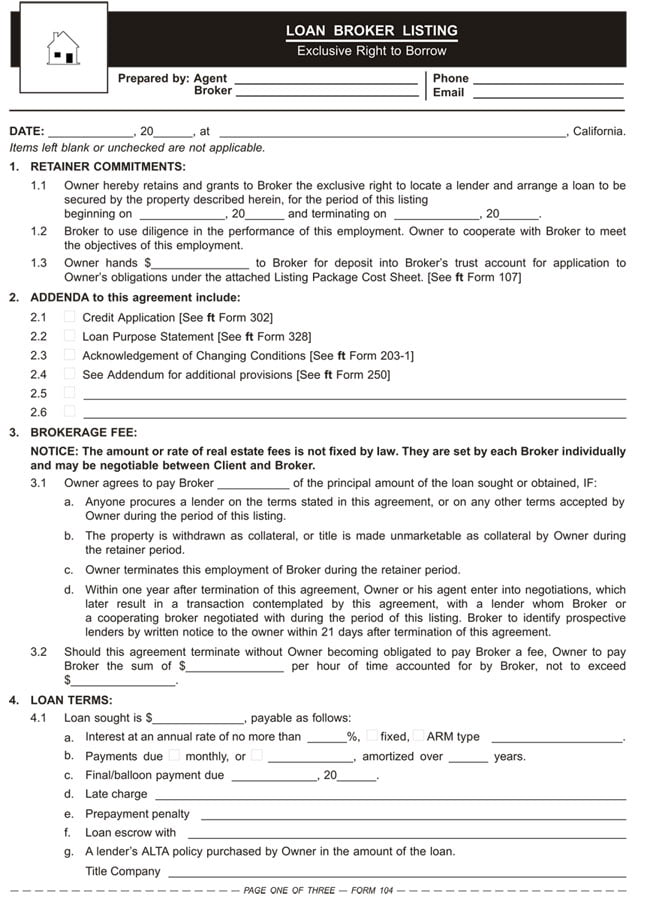

Form-of-the-Week: Loan Broker Listing – Exclusive Right to Borrow – Form 104

Property owners seek out real estate mortgage loan brokers to gain access to their knowledge and expertise in pricing and financing real estate. The broker’s ability to assist an owner by arranging financing is a valued service and part of most real estate transactions.

When asked to arrange financing for a buyer, a listing agreement is entered into to document the extent of the employment and the amount of the loan broker’s fee. The need for a loan broker listing agreement is comparable to any other documented listing agreement agreed to in a real estate-related transaction. A broker’s right to a fee from a client for advice and representation originates with a written listing entered into by the client and the broker. [Crane v. McCormick (1891) 92 C 176]

More specifically, a loan broker listing agreement is used by brokers and their agents when agreeing to provide services for a fee to:

- arrange mortgage financing to fund the purchase of real estate;

- refinance an existing mortgage; or

- further encumber a property to obtain cash.

On entering into an exclusive right-to-borrow listing agreement, the client employs the loan broker to act on their behalf to locate a lender and arrange a mortgage to be secured by:

- a property to be purchased; or

- a property owned by the client.

The right-to-borrow listing agreement grants the broker sole authority to solicit lenders and locate one who will originate a mortgage on terms and conditions sought by the client. It also specifies the fee amount the client agrees the broker is to receive and the conditions to be met for the broker to be entitled to collect their fee. Formal documentation of an obligation to pay a fee — a written agreement signed by the client — is the legislatively enacted and judicially mandated requisite to the right to enforce collection of a brokerage fee from the client.

Analyzing the exclusive employment

first tuesday’s Loan Broker Listing — Exclusive Right to Borrow is used by brokers to solicit and arrange a mortgage on behalf of a prospective buyer or property owner as a client, on terms stated in the agreement. In exchange, the client promises to pay a fee on the origination of a mortgage agreed to by the client. [See first tuesday Form 104]

For the broker, the addenda set out in the exclusive right-to-borrow serves as a checklist for the contents of a mortgage package any prospective lender will need before they will commit to making the mortgage sought. The package contains information about the client’s:

- creditworthiness;

- financial status; and

- purpose for obtaining the mortgage. [See first tuesday Form 104 §2]

The client statement about the purpose served by the mortgage helps the broker determine whether the mortgage will fund a consumer purpose or business/investment/agricultural purpose. If it funds a consumer purpose, the broker needs to know whether the mortgage will be a lien on the client’s principal residence. If the mortgage both funds a consumer purpose and is a lien on the client’s residence, the broker needs to be registered with the NMLS and endorsed by the BRE as an MLO broker.

Related article:

Ability-to-repay, qualified mortgage and qualified residential mortgage — oh my!

Each section in Form 104 has a separate purpose and need for enforcement. The sections include:

- brokerage services: The employment period for rendering brokerage services, the broker’s due diligence obligations and any advance deposits by the client [See first tuesday Form 104 §1];

- brokerage fee: The client’s obligation to pay a brokerage fee, the amount of the fee and when the fee is due [See first tuesday Form 104 §3];

- mortgage terms sought: The client’s desired mortgage terms and conditions [See first tuesday Form 104 §4];

- description of the real estate and personal property securing the mortgage: Identification of the real estate and any personal property, the terms of existing financing and the conditions of the property [See first tuesday Form 104 §5 and 6];

- general provisions of the agreement [See first tuesday Form 104 §7]; and

- Signatures and identification of the parties: On completion of entries on the listing form and any attached addenda, the client and the broker sign the document consenting to the employment.