This form is used by a buyer’s agent when the buyer will purchase a negative equity, one-to-four unit residential property, to prepare an offer with a short sale contingency provision paying all cash, or a cash down payment to a new conventional mortgage.

Selecting the right purchase agreement

For a real estate transaction conveying fee ownership of a property, the primary document a buyer’s agent uses to negotiate their buyer’s acquisition of property is a purchase agreement. [See RPI Form 150-159]

The use of different varieties of purchase agreements is required for different types of properties, buyers and financing arrangements. The various purchase agreements contain provisions necessary for the buyer’s agent to readily negotiate the purchase of a particular property with a particular seller.

Three basic categories of purchase agreements exist to formalize real estate transactions. The categories are influenced primarily by legislation and court decisions addressing the handling by the seller’s agent of the disclosures and due diligence investigations required of them to properly market properties.

The three categories of purchase agreements are for the acquisition of:

- one-to-four unit residential property [See RPI Form 150 – 153 and 155 – 157];

- property other than one-to-four residential units, such as for income-producing properties and owner-occupied business/farming properties [See RPI Form 154, 158-1and 159]; and

- land and unimproved parcels. [See RPI Form 158]

Within each category of purchase agreements, several variations exist. The variations cater to:

- the use of a property;

- the diverse arrangements for payment of the price;

- property conditions which affect value; and

- loan discount approvals on a short sale within the one-to-four unit residential property.

Negotiating an SFR sale, with or without an NOD

The distinguishing fact for a buyer’s agent’s selection of the type of purchase agreement used to prepare an offer to acquire a seller-occupied single family residence (SFR) is whether or not the property is in foreclosure and subject to a recorded Notice of Default (NOD).

When title to a seller-occupied SFR is not subject to a recorded NOD, the buyer’s agent simply uses a purchase agreement which provides for the financing arrangements the buyer is going to use — conventional, FHA or VA. This is the case whether or not the buyer intends to occupy the property as their primary residence. [See RPI Form 150, 152and 153]

However, when the buyer is an investor who does not intend to occupy the seller-occupied SFR as their primary residence and the title is subject to a recorded NOD, equity purchase (EP) laws are triggered calling for the buyer’s compliance when preparing their offer. [See RPI Form 156 and 156-1]

To comply with EP law, the agent selects a variation of the equity purchase agreement to prepare an offer since all the following conditions exist:

- the SFR for sale is an owner-occupied, one-to-four unit residential property;

- the SFR is the subject of a recorded NOD; and

- the buyer is an investor. [Segura McBride (1992) 5 CA4th 1028; see RPI Form 156 and 156-1]

Next is the selection of the proper version of these one-to-four unit purchase agreement forms to be used based on whether the principal balance on the mortgage(s) exceeds the price the buyer is willing to offer for the property.

When a negative equity situation exists, the seller’s agent discloses this information in MLS publications and any other release of critical information for marketing the property. [Holmes v. Summer (2010) 188 CA4th 1510]

No NOD, but a negative-equity short sale

When an SFR has negative equity but is not in foreclosure — i.e., no NOD has been recorded — the buyer’s agent uses a conventional purchase agreement which contains short sale provisions to prepare the buyer’s offer to purchase the property. The short sale provisions condition the seller’s closing of escrow on first obtaining a written payoff demand from their mortgage holder for the net proceeds of the sale as full satisfaction of all amounts owed the mortgage holder. [See RPI Form 150-1 § 11.1]

Through a payoff demand, the mortgage holder agrees to accept the seller’s net sales proceeds on the sale at the price paid by a buyer, an amount lower than the mortgage holder’s outstanding mortgage balance.

The purchase agreement offer with the short sale contingency provision becomes a binding written contract between the buyer and seller on acceptance. However, if the seller is unable to obtain a payoff demand from the mortgage holder(s) who hold one or multiple liens on the property, the agreement may be terminated and rendered unenforceable at the discretion of either the buyer or seller. [See RPI Form 150-1 §12.2]

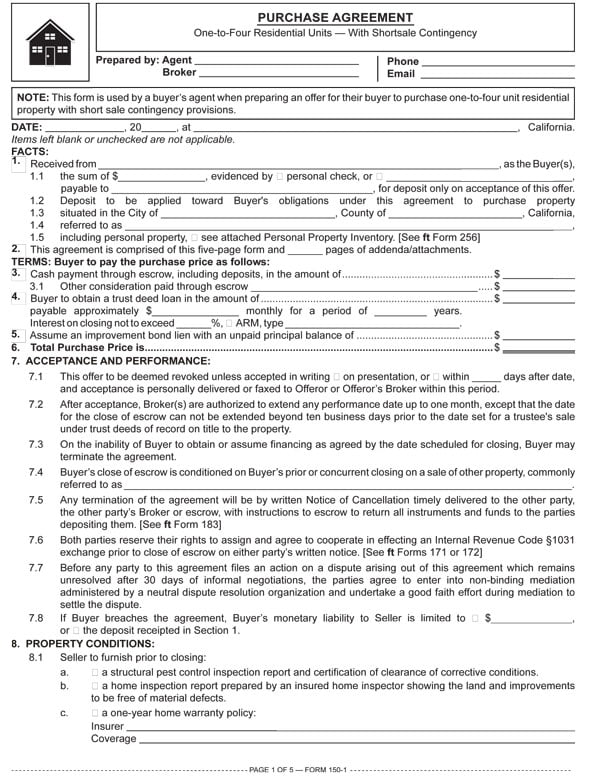

The Purchase Agreement (One-to-Four Residential Units – With Short Sale Contingency) – Form 150-1 published by RPI (Realty Publications, Inc.) is a comprehensive “boilerplate” purchase agreement with additional and modified provisions specific to short sale arrangements. Form 150-1 serves as a checklist presenting the various conventional financing arrangements available to the buyer to fund the purchase price, and includes conditions a prudent buyer and their agent consider when making an offer to purchase. As for the seller, their performance is conditioned on discounted payoff demands made by the holders of the mortgages. [See RPI Form 150-1]

Components of the purchase agreement with short sale contingency

Each Section of Form 150-1 has a separate purpose and need for enforcement. The segments include:

- Identification: The date and place of preparation for referencing the agreement, the name of the buyer, the amount of any good-faith deposit, a description of the real estate, an inventory of any personal property included in the transfer and the number of pages contained in the agreement and its addenda are set out as FACTS in Sections 1 and 2.

- Price and terms: Variations for payment of the purchase price by cash or conventional purchase-assist financing are set out as TERMS in Sections 3 through 6, a checklist of provisions to consider. Terms are selected by checking boxes and filling blanks as desired.

- Acceptance and performance: The period for acceptance to form a binding contract, broker’s authorization to extend escrow, cancellation procedures, financing and the sale of other property closing contingencies, Internal Revenue Code (IRC) §1031 cooperation and liability limitations are established in Section 7.

- Property Conditions: The buyer’s confirmation of the physical condition of the property as disclosed by the seller prior to acceptance is confirmed by the seller’s delivery of reports, warranty policies, certifications, disclosure statements, an environmental, lead-based paint and earthquake safety booklet, any property operating cost and income statements, and any homeowners’ association (HOA) documents not handed to the buyer prior to entry into the purchase agreement, as well as by the buyer’s initial inspection (personally or by a home inspector) and final inspection at closing to confirm the seller has eliminated defects known, but not disclosed, prior to acceptance, are provided in Section 8.

- Closing conditions: The escrow holder, escrow instruction arrangements, date of closing, title conditions for insurance, hazard insurance, prorations and mortgage adjustments are shown in Section 9.

- Notice of supplemental property tax: The buyer is advised they will receive one or two supplemental property tax bills due to a change in ownership in Section 10.

- Notice regarding gas and hazardous liquid pipelines: The buyer is advised that information is available to the public regarding the location of gas and hazardous liquid transmission pipelines in Section 11.

- Loan Discount Condition (Short Sale Contingency): The close of escrow is conditioned on the seller obtaining payoff demands at a discount from the mortgage holder(s) of record in full satisfaction of all amounts owed in Section 12.

- Brokerage and agency: Transaction data is authorized for release to trade sources, the brokerage fee is set and the delivery of the Agency Law Disclosure to both the buyer and seller are set out in Section 13. [See RPI Form 305]

- Signatures: The seller and buyer bind each other to perform as agreed by signing and dating their signatures. This Section also includes the confirmation of the agency undertaken by the brokers and their agents on behalf of one or both principals to the agreement. [See RPI Form 150-1]

Short sale addendum

Alternatively, when a buyer intends to finance their purchase using Federal Housing Administration (FHA) or Department of Veterans Affairs (VA) financing, brokers and agents may structure the short sale transaction using RPI’s FHA or VA variations of the purchase agreement and attach RPI’s Short Sale Addendum – Loan Discount Approval – Form 274 containing the mortgage discount approval language. [See RPI Form 152,153 and 274]

The language contained in the Short Sale Addendum mirrors the short sale contingency provision contained in Form 150-1.

Observations

Providing forms with maximum risk reduction and fee protection for brokers and their agents is RPI’s policy for drafting real estate forms. Thus, RPI’s purchase agreements exclude provisions which tend to increase the risk of litigation. As a matter of policy, provisions that work against the ultimate best interests of the buyer, seller and brokers are excluded as a risk mitigation feature.

Excluded provisions seen in purchase agreements published from other forms providers include:

- an attorney fee provision, since it promotes litigation and inhibits resolution;

- a time-essence clause, since future performance (closing) dates are estimates by the agents of the time needed to close and are improperly used by sellers in rising markets to obstruct or cancel the transaction before the buyer and brokers are able to timely comply with performance provisions in the agreement;

- the liquidated damages provision, since it creates wrongful expectations by sellers of windfall profits and unenforceable penalties; and

- the arbitration provision, since arbitration decisions are final and unappealable without judicial oversight to assure the arbitrator’s award will be fair or correct, a disservice to the real estate industry and the broader public.

RPI’s purchase agreements include a mandatory mediation provision which mitigates the risk of a legal battle. Mediation of any dispute must be undertaken as a precursor to filing an action, be it arbitration or litigation. Mediation is good public policy as it is expeditious and is the most cost effective method of dispute resolution society has developed.

Also, since the buyer and their agent are the transaction participants who make and submit an offer to purchase, RPI’s purchase agreements are designed with the buyer in mind. Thus, the form does not favor the seller in the structuring of provisions as do forms published by other providers.

Editor’s note — RPI publishes a wide selection of purchase agreements which cater to different types of transactions, such as principal-to-principal and commercial property acquisitions. [See RPI Form 150-159]

Each instruction corresponds to the provision in the form bearing the same number.

Editor’s note — Check and enter items throughout the agreement in each provision with boxes and blanks, unless the provision is not intended to be included as part of the final agreement, in which case it is left unchecked or blank.

Document identification:

Enter the date and name of the city where the offer is prepared. This date is used when referring to this purchase agreement.

Facts:

1. Buyer, deposit, and property: Enter the name of each buyer who will sign the offer. Do not enter the word nominee or assignee

1.1. Enter the dollar amount of any good-faith, earnest money deposit. Check the appropriate box to indicate the form of the good-faith deposit. Enter the name of the payee (escrow, title company or broker).

1.2. – 1.3. Enter the name of the city and county in which the property is located.

1.4. Enter the legal description or common address of the property, or the assessor’s parcel number (APN).

1.5. Check the box to indicate personal property will be included in the sale. The seller’s trade fixtures to be purchased by the buyer must be listed as inventory if they are to be acquired by the buyer. [See RPI Form 256]

2. Entire agreement: Enter the number of pages comprising all of the addenda, disclosures, etc., which are attached to the purchase agreement.

Terms for payment of the purchase price:

3. Cash down payment: Enter the dollar amount of the buyer’s cash down payment toward the purchase price.

3.1. Additional down payment: Enter the description of any other consideration to be paid as part of the price, such as trust deed notes, personal property or real estate equities (an exchange). Enter the dollar amount of its net value.

4. New trust deed loan: Enter the amount of the loan, the monthly principal and interest (PI) payment, the term of the loan, and the rate of interest. Check the box to indicate whether the interest will be adjustable (ARM), and if so, enter the index name. Enter any limitations on loan points.

4.1 Buyer’s loan qualification: Check the box to indicate the seller is authorized to cancel the agreement if the buyer is to obtain a new loan and fails to deliver documentation from a lender indicating they have been pre-approved for a loan. Enter the number of days the buyer has after acceptance to deliver written confirmation of their qualification for the loan.

5. Bond or assessment assumed: Enter the amount of the principal balance remaining unpaid on bonds and special assessment liens (such as Mello-Roos or 1915 improvement bonds) which will remain unpaid and become the responsibility of the buyer on closing.

Editor’s note — Improvement bonds are obligations of the seller which may be assumed by the buyer in lieu of their payoff by the seller. If assumed, the bonded indebtedness becomes part of the consideration paid for the property. Some purchase agreements erroneously place these bonds under “property tax” as though they were ad valorem taxes, and then fail to prorate and charge the unpaid amount to the seller.

6. Purchase price: Enter the total amount of the purchase price as the sum of lines 3, 3.1, 4, 5, 6, 7 and 8.

7. Acceptance and performance periods:

7.1 Delivery of acceptance: Check the appropriate box to indicate the time period for acceptance of the offer. If applicable, enter the number of days in which the seller may accept this offer and form a binding contract.

Editor’s note — Acceptance occurs on the return delivery to the person making the offer (or counteroffer) or to their broker of a copy of the unaltered purchase agreement offer containing the signed acceptance.

7.2 Extension of performance dates: Authorizes the brokers to extend the performance dates up to one month to meet the objectives of the agreement — time being of a reasonable duration and not the essence of this agreement as a matter of policy. This extension authority does not extend to the acceptance period.

7.3 Loan contingency: Authorizes the buyer to cancel the transaction at the time scheduled for closing if the financing for payment of the price is not obtainable or assumable.

7.4 Sale of other property: If the closing of this transaction is to be contingent on the buyer’s receipt of net proceeds from a sale of other property, enter the address of the property to be sold by the buyer.

7.5 Cancellation procedures: Provides the method of cancellation required to terminate the agreement when the right to cancel is triggered by other provisions in the agreement, such as contingency or performance provisions. [See RPI Form 183]

7.6 Exchange cooperation: Requires the parties to cooperate in an IRS §1031 transaction on further written notice by either party. Provides for the parties to assign their interests in this agreement. [See first tuesday Forms 171 and 172]

7.7 Mediation provision: Provides for the parties to enter into non-binding mediations to resolve a dispute remaining unsolved after 30 days of informal settlement negotiations.

7.8 Liability limitations: Provides for a dollar limit on the buyer’s liability for the buyer’s breach of the agreement. Check the first box and enter the maximum dollar amount of money losses the seller may recover from the buyer or check the second box to indicate the buyer’s monetary liability is limited to the good-faith deposit tendered with the offer to buy.

Editor’s note — Liability limitation provisions avoid the misleading and unenforceable forfeiture called for under liquidated damage clauses included in most purchase agreement forms provided by other publishers of forms.

8. Property Conditions:

8.1 Seller to furnish: Check the appropriate box(es) within the following subsections to indicate the items the seller is to furnish prior to closing.

a. Pest control: Check the box to indicate the seller is to furnish a structural pest control report and clearance.

b. Home inspection report: Check the box to indicate the seller is to employ a home inspection company and furnish the buyer with the company’s home inspection report.

c. Home warranty: Check the box to indicate the seller is to furnish an insurance policy for home repairs. Enter the name of the insurer and the type of coverage, such as for the air conditioning unit, etc.

d. Local ordinance compliance: Check the box to indicate the seller is to furnish a certificate of occupancy or other clearance required by local ordinance.

e. Sewer or septic certificate: Check the box to indicate the seller is to furnish a certificate of the condition of the sewage disposal system stating it is functioning properly.

f. Potable well water: Check the box to indicate the seller is to furnish a certificate stating the well supply meets water standards.

g. Well water capacities: Check the box to indicate the seller is to furnish a certificate stating the amount of water the well supplies. Enter the number of gallons per minute the well is expected to produce.

h. Energy Audit Report: Check the box and enter the rating of the property’s improvements.

i. Other terms: Check the box and enter any other report, certification or clearance the seller is to furnish.

8.2 Property condition(s): Check the appropriate box within the following subsections to indicate the status of the seller’s Condition of Property Disclosure – Transfer Disclosure Statement (TDS).

a. Attached TDS: Check the box to indicate the seller’s TDS has been prepared and handed to the buyer, and if so, attach it to this agreement. Thus, the property’s condition “as disclosed” is accepted by the buyer upon entering into the purchase agreement offer as mandated.

Editor’s note — Use of the TDS form is mandated on one-to-four unit residential property. [See RPI Form 304]

b. Later delivered TDS: Check the box to indicate the TDS is to be delivered later to the buyer to confirm the condition of the property is “as disclosed” prior to entry into the purchase agreement. On receipt of the TDS, the buyer may either cancel the transaction for failure of the seller or the seller’s agent to disclose known property defects prior to acceptance of the purchase agreement (or counteroffer), or give notice to the seller of the defects known and not disclosed prior to acceptance and make a demand on the seller to correct them prior to closing.

c. Repair of defects: Authorizes the buyer to either cancel the transaction or adjust the price should the seller fail to correct the defects noticed under sections 11.2b or 11.4a. [See RPI Form 183]

8.3 Transfer Fee Disclosure Statement: Check the appropriate box within the following subsections to indicate the status of the seller’s Transfer Fee Disclosure Statement (TFDS). [See RPI Form 304-2]

a. Attached TFDS: Check the box to indicate the seller’s Transfer Fee Disclosure Statement has been prepared and handed to the buyer, and if so, attach it to this agreement.

b. Later delivered TFDS: Check the box to indicate the TFDS is to be delivered later to the buyer to confirm the existence of a transfer fee as disclosed prior to entry into the purchase agreement. On receipt of the TFDS, the buyer may terminate this agreement based on a reasonable disapproval of the TFDS.

c. Transfer fee: Requires the seller to pay any transfer fees arising out of this transaction.

8.4 Buyer’s inspection: Authorizes the buyer to inspect the property twice during the escrow period to verify its condition is as disclosed by the seller prior to the time of acceptance.

a. Initial property inspection: Requires the buyer to inspect the property immediately after acceptance to put the seller on notice of material defects to be corrected by the seller prior to closing. [See RPI Form 269]

b. Final walk-through inspection: Requires the buyer to inspect the property again within five days before closing to confirm repairs and maintenance of the property have occurred. [See RPI Form 270]

8.5 Seller’s Natural Hazard Disclosure Statement (NHD): Check the appropriate box to indicate whether the NHD statement disclosing the seller’s knowledge about the hazards listed on the form has been prepared and handed to the buyer. If it has been received by the buyer, attach a copy to the purchase agreement. If the NHD will be handed to the buyer after acceptance, the buyer has ten days after the buyer’s receipt of the NHD statement in which to approve it or cancel.

Editor’s note — Disclosure by the seller is mandated on one-to-four unit residential property.

8.6 Hazard disclosure booklets: Check the appropriate box(es) to indicate which hazard booklets have been received by the buyer, together with the seller’s prepared and signed disclosures accompanying each booklet. [See RPI Form 316-1]

8.7 Other property disclosures: Check the appropriate box(es) to indicate other disclosures made by the seller regarding the location of the property. Enter a reference to any local (option) ordinance disclosure statement attached as an addendum to the purchase agreement and attach it. [See RPI Forms 307 and 308]

8.8 Operating costs and rents: Check the appropriate box(es) to indicate the information the seller is to disclose regarding the operating expenses of ownership and tenancies affecting title.

a. Operating cost sheet: Check the box to indicate the seller will prepare and hand the buyer an Operating Cost Sheet on acceptance of this offer. The buyer may cancel the purchase agreement and escrow if the operating expenses disclosed are unacceptable. [See RPI Form 306]

b. Leasing and Operating Addendum: Check the box to indicate the Leasing and Operating Addendum is attached to confirm the buyer is taking title subject to the tenancies disclosed. [See RPI Form 275]

8.9 Homeowners’ association (HOA): Check the box to indicate the property is located in a Homeowners’ Association (HOA) community.

a. Attached addendum: Check the box to indicate the seller’s Homeowners’ Association (HOA) Addendum has been prepared and handed to the buyer, and if so, attach it to this agreement. [See RPI Form 309]

b. Later delivered addendum: Check the box to indicate the HOA addendum is to be delivered to buyer on acceptance for buyer’s review. [See RPI Form 309]

c. Disapproval of HOA documents: Authorizes the buyer to terminate this purchase agreement within ten days after their receipt of HOA documents when the disclosures are made after entering into the purchase agreement. Disclosure of HOA conditions in escrow triggers a statutory contingency allowing the buyer to cancel the purchase agreement. [See RPI Form 183]

8.10 Criminal Activity and Security Disclosure: Check the appropriate box within the following subsections to indicate the status of the seller’s Criminal Activity and Security Disclosure Statement. [See RPI Form 321]

a. Attached disclosure: Check the box to indicate the seller’s Criminal Activity and Security Disclosure Statement has been prepared and handed to the buyer, and if so, attach it to this agreement.

b. Later delivered disclosure: Check the box to indicate the Criminal Activity and Security Disclosure Statement is to be delivered later to the buyer. On receipt of the disclosure, the buyer may terminate this agreement based on a reasonable disapproval.

8.11 Safety compliance: Requires smoke detectors and water heater bracing to exist or be installed by the seller.

8.12 Solar Collector Notice: States the seller will hand a copy of the notice received from any neighbor to the buyer. If the seller sent neighbors a notice, a list of everyone who was sent a notice is to be handed to the buyer. The buyer is authorized to terminate this purchase agreement for cause within ten days after receipt.

8.13 Buyer’s possession: Check the appropriate box to indicate when possession of the property will be delivered to the buyer, whether at closing or under an attached buyer’s interim occupancy or seller’s holdover agreement. [See RPI Forms 271 and 272]

8.14 Property maintenance: Requires the seller to maintain the present condition of the property until the close of escrow.

Editor’s note — See section 11.4b for the buyer’s final inspection to confirm maintenance at closing.

8.15 Fixtures and fittings: Confirms this agreement includes real estate fixtures and fittings as part of the property purchased.

Editor’s note — Trade fixtures are personal property to be listed as items on the Personal Property Inventory at section 3. [See RPI Form 256]

8.16 Sex offender disclosure: Complies with requirements that the seller disclose the existence of a sex offender database on the sale (or lease) of one-to-four residential units.

Editor’s note — By the existence of the disclosure in the form, the seller and brokers are relieved of any duty to voluntarily make further disclosures regarding registered sex offenders.

9. Closing conditions:

9.1 Escrow closing agent: Enter the name of the escrow company handling the closing.

a. Escrow instructions: Check the box to indicate the purchase agreement is to also serve as the mutual instructions to escrow from the parties. The escrow company will typically prepare supplemental instructions they will need to handle and close the transaction. [See RPI Form 401]

b. Escrow instructions: Check the box to indicate escrow instructions have been prepared and are attached to this purchase agreement. Prepare and attach the prepared escrow instructions to the purchase agreement and obtain the signatures of the parties. [See RPI Form 401]

9.2 Closing date: Enter the specific date for closing or the number of days anticipated as necessary for the parties to perform and close escrow. Also, prior to seven days before closing, the parties are to deliver all documents needed by third parties to perform their services by the date scheduled for closing.

a. Escrow charges: Requires each party to pay their customary escrow closing charges, amounts any competent escrow officer can provide on inquiry.

9.3 Title conditions: Enter wording for any further-approval contingency provision the buyer may need to confirm that title conditions set forth in the preliminary title report will not interfere with the buyer’s intended use of the property, such as “closing contingent on buyer’s approval of preliminary title report.”

9.4 Title insurance: Provides for title to be vested in the name of the buyer or their assignee. Enter the name of the title insurance company which is to provide a preliminary title report in anticipation of issuing title insurance. Check the appropriate box to indicate the type of title insurance policy to be issued on closing.

a. Policy endorsements: Enter any endorsements to be issued with the policy.

b. Payment of premium: Check the appropriate box to indicate whether the buyer or seller is to pay the title insurance premium.

9.5 Fire insurance: Requires the buyer to provide a new policy of hazard insurance.

9.6 Prorates and adjustments: Authorizes pro rations and adjustments on the close of escrow for taxes, insurance premiums, rents, interest, loan balances, service contracts and other property operating expenses, prepaid or accrued.

9.7 Personal property: Requires the seller to execute a bill of sale for any personal property being transferred in this transaction as called for in section 1.

9.8 Property destruction: Provides for the seller to bear the risk of loss for any casualty losses suffered by the property prior to the close of escrow. Thus, the buyer may terminate the agreement if the seller is unable to provide a marketable title or should the property improvements suffer major damage. [See RPI Form 183]

10. Supplemental property tax bill: Notifies the buyer they will receive one or two supplemental property tax bills they are to pay when the county assessor revalues the property after a change in ownership.

11. Gas and hazardous liquid pipelines: Notifies the buyer of the public availability of information regarding general location of gas and hazardous liquid transmission pipelines via the National Pipeline Mapping System (NPMS) web site.

12. Loan discount condition:

12.1 Shortsale contingency: Provides that the close of escrow is conditioned on the seller obtaining payoff demands at a discount from the mortgage holder(s) of record in full satisfaction of all amounts owed.

12.2: Acceptance of seller’s proceeds: Enter the date by which the agreement may be terminated by either the buyer or the seller if the seller is unable to obtain written payoff demands from all lienholders.

12.3: Backup offers: Provides the seller may accept backup offers contingent on the cancellation of this agreement.

12.4: Seller consequence: Provides the seller understands they will likely have negative consequences on their creditworthiness and income tax reporting as a result of the shortsale.

12.5: Notice of default (NOD): Provides that, in the event the property is the seller’s principal residence and the property is subject to a recorded notice of default (NOD), the buyer intends to occupy the property on the close of escrow. Enter the date the NOD was recorded.

13. Brokerage fee:

13.1 Fee amount: Enter the total amount of the fee due all brokers to be paid by the seller. The amount of the fee may be stated as a fixed dollar amount or as a percentage of the price.

a. Seller paid: Provides that the seller will pay the brokerage fee on the change of ownership.

b. Wrongful prevention: Provides that the party wrongfully preventing the change of ownership will pay the brokerage fee.

Editor’s note — The defaulting party pays all brokerage fees and the brokerage fee can only be altered or cancelled by mutual instructions from the buyer and seller.

13.2 Fee sharing: Enter the percentage share of the fee each broker is to receive.

Editor’s note — The percentage share may be set based on an oral agreement between the brokers, by acceptance of the seller’s broker’s MLS offer to a selling office to share a fee, or unilaterally by an agent when preparing the buyer’s offer.

13.3 Agency law disclosures: Attach a copy of the Agency Law Disclosure addendum for all parties to sign. [See RPI Form 305]

Editor’s note — The disclosure is mandated to be acknowledged by the buyer with the offer and acknowledged by the seller on acceptance as a prerequisite to the buyer’s broker enforcing collection of their fee when the property involved contains one-to-four residential units. [See RPI Form 305]

13.4 Disclosure of sales data: Authorizes the brokers to report the transaction to trade associations or listing services.

14. Other terms: Enter any special provision to be included in the purchase agreement.

Agency confirmation:

Buyer’s broker identification: Enter the name of the buyer’s broker and their California Bureau of Real Estate (CalBRE) license number. Enter the name of any buyer’s agent and their CALBRE license number. Obtain the signature of the buyer’s broker or the buyer’s agent acting on behalf of the buyer’s broker. Check the appropriate box to indicate the agency which was created by the broker’s (and their agents’) conduct with the parties. Enter the buyer’s broker’s address, telephone and fax numbers, and email address.

Seller’s broker identification: Enter the name of the seller’s broker and their CalBRE license number. Enter the name of any seller’s agent and their CALBRE license. Obtain the signature of the seller’s broker or the seller’s agent acting on behalf of the seller’s broker. Check the appropriate box to indicate the agency which was created by the broker’s (and their agents’) conduct with the parties. Enter the seller’s broker’s address, telephone and fax numbers, and email address.

Signatures:

Buyer’s signature: If additional buyers are involved, check the box, prepare a Signature Page Addendum form referencing this purchase agreement, and enter their names and obtain their signatures until all buyers are individually named and have signed. Enter the date the buyer signs the purchase agreement and the buyer’s name. Obtain the buyer’s signature. [See RPI Form 251]

Seller’s signature: If additional sellers are involved, check the box, prepare a Signature Page Addendum form referencing this purchase agreement, and enter their names and obtain their signatures until all sellers are individually named and have signed. Enter the date the seller signs the purchase agreement and the seller’s name. Obtain the seller’s signature. [See RPI Form 251]

Rejection of offer:

If the offer contained in the purchase agreement is rejected instead of accepted and the rejection won’t result in a counteroffer, enter the date of the rejection and the names of the party rejecting the offer. Obtain the signatures of the party rejecting the offer.

Form navigation page published 12-2015.

Form last revised 04-2024 to include the mandatory appraisal notice.