Like much of the state, San Diego County never fully recovered from the 2008 recession and financial crisis before the recession, financial crash and pandemic slammed the region in 2020.

The economic response to COVID-19 and the underlying recession caused record job losses in 2020, which finally surpassed pre-recession levels in Q4 2022 — but the next economic recession is expected to take hold in late-2023. Record-low interest rates maximized buyer purchasing power and prices in 2020-2021, with homebuyer fear-of-missing-out (FOMO) on a dwindling MLS inventory also fueling San Diego’s rapid home price increases.

Then, interest rates reversed course in 2022, slashing buyer purchasing power and cooling both buyer and seller attitudes.

The bubble market has now passed, reacting to downward pressure from rising interest rates and slowing sales volume, resulting in plunging home prices. The short-term government efforts to prop up the economy are now fully behind us, and have merely put off the inevitable decline. Yesterday’s interest rate increases are the opening act to the as-yet undeclared economic recession. San Diego’s housing market will likely begin a consistent recovery from the 2023 recession around 2026-2027.

View the charts below for current activity and forecasts for the San Diego housing market.

Updated August 10, 2023. Original copy posted March 2013.

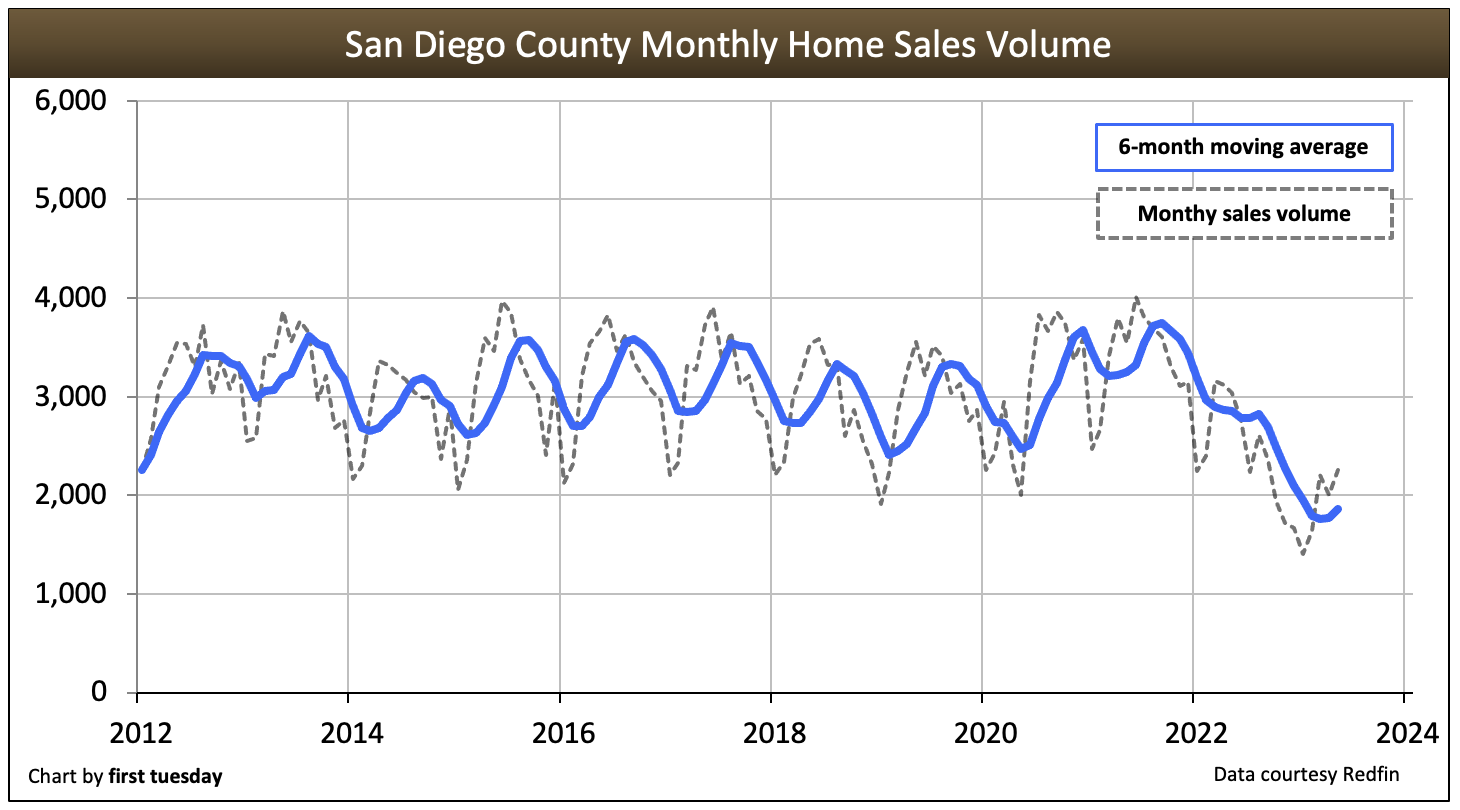

Home sales volume slows

Chart update 08/10/23

| 2022 | 2021 | 2019 | 2003: Peak Year | |

| San Diego County home sales volume | 29,300 | 40,600 | 35,700 | 60,800 |

In 2022, San Diego home sales volume declined 28% from 2021, a decrease of 18% from the last “normal” pre-pandemic year of 2019.

Worse, as of May 2023, sales volume year-to-date (YTD) is 32% below a year earlier. Compared to 2019, sales volume YTD is a whopping 40% lower.

Expect San Diego’s slipping home sales volume to continue to fall back heading into 2024. Rising interest rates have swiftly cut out buyers from the market. Further, the job losses stemming from the recession and pandemic pulled many would-be homebuyers and sellers from the market. Those jobless homeowners with mortgages found themselves delinquent, though were able to remained in their homes due to first the now-expired foreclosure moratorium, then forbearance plans. But as these forbearance programs expire, these homeowners are finding themselves heading toward a forced sale, saved from foreclosure due to the high levels of home equity achieved in 2021.

For perspective, home sales volume in San Diego steadily increased in 2020-2021, with 40,600 sales closing escrow in 2021 for a decade’s high. This was a 9% increase over 2020. For perspective, this 9% increase still leaves San Diego well below peak 2003 sales numbers.

The sales volume bump experienced in 2020-2021 follows a decade of stagnant sales in the region, and across the state.

Expect sales volume and prices to bottom following the next recession, anticipated to arrive officially in late-2023. Homebuyers will return in greater numbers to push the housing market to its next stable recovery, expected to begin around 2025-2026.

Related article:

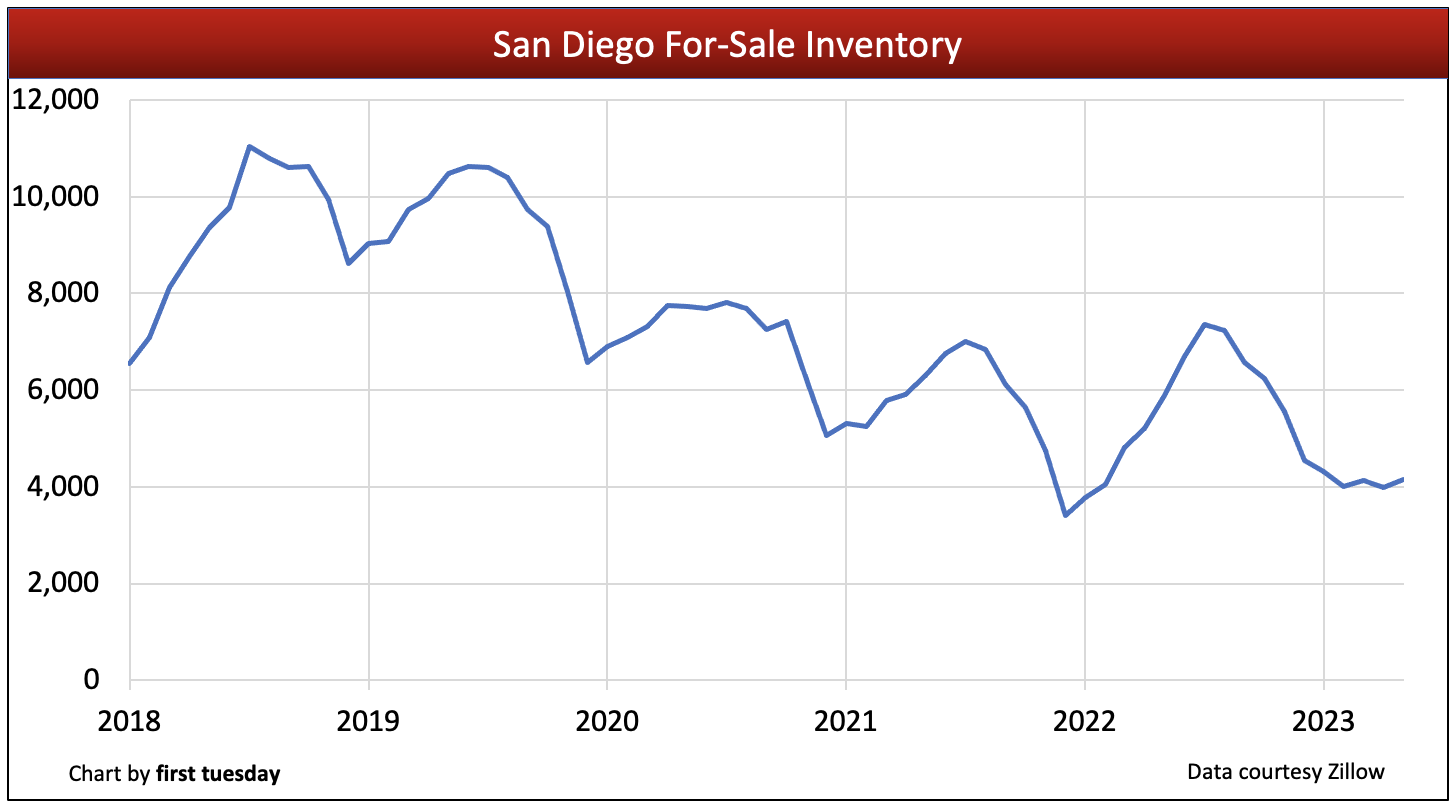

Inventory rises from historic lows

Chart update 08/10/23

| May 2023 | May 2022 | Annual change | |

| San Diego County for-sale inventory | 4,200 | 5,900 | -29% |

Multiple listing service (MLS) inventory is only slightly higher than the historic low reached at the end of 2021. After two years of steep decline (minus a brief bump in 2022 when supply briefly exceeded buyer demand), for-sale inventory in San Diego averaged a significant 29% below a year earlier as of May 2023. Today, inventory remains low due to seller reluctance to list.

The winter months typically see the lowest inventory of homes for sale, peaking around mid-year.

Looking forward, expect inventory to continue to climb in 2023-2024. The significant interest rate increases of 2022 slashed buyer purchasing power, making it nigh on impossible for mortgaged homebuyers to compete. Along with high inflation, the signs are pointing to a rapidly approaching downturn in the housing market — of which homebuyers and sellers are well aware. Today’s seller’s market has fully tipped, with prices to follow heading into 2024 as inventory grows and homebuyers choose to wait out the declining market.

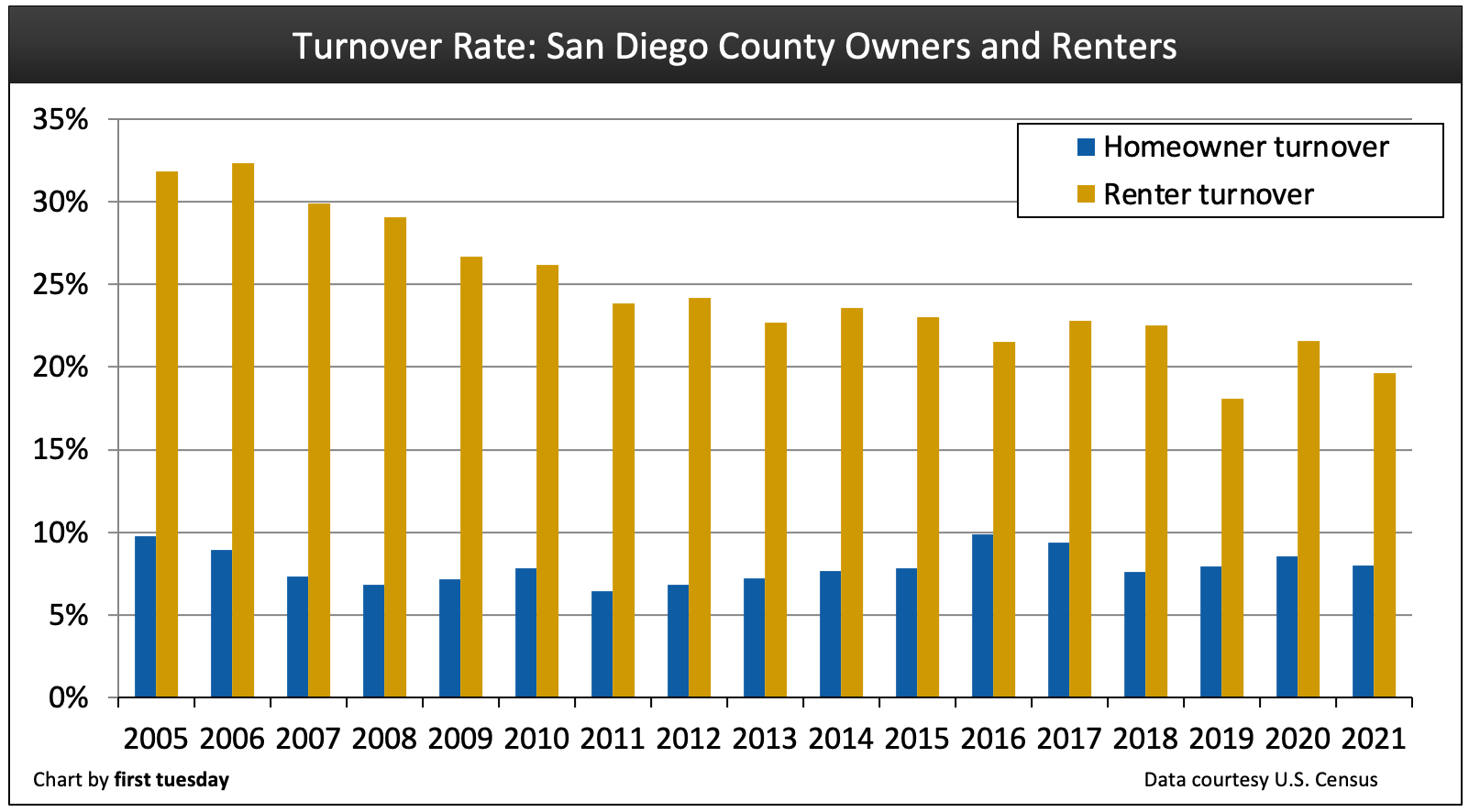

Turnover rates flounder following moratoriums

Chart update 11/08/22

| 2021 | 2020 | 2019 | |

| San Diego County homeowner turnover rate | 8.0% | 8.5% | 7.9% |

San Diego County renter turnover rate | 19.6% | 21.6% | 18.1% |

The percentage of San Diego County homeowners and renters who moved in 2021 fell back from the previous year, but remained higher than pre-pandemic levels. This trend echoes other regions of the state, which saw turnover decline in 2021 following the foreclosure and eviction moratoriums encouraged to keep residents in place during the pandemic.

Further, low turnover rates are indicative of cash-strapped households that simply cannot afford to move, whether they are homeowners or renters. When turnover is low, home sales volume is hindered.

While the trends are similar to the rest of the state, the magnitude of decline in turnover rate in San Diego County has not suffered as much compared to the rest of Southern California. This is partly due to a better jobs outlook and San Diego’s large military population, which traditionally experiences high turnover. Agents can gain an “in” with this population by familiarizing themselves with the various benefits available to military renters and homeowners such as Veteran’s Administration (VA)-guaranteed and CalVet mortgages, then advertising themselves as experts.

Related articles:

Servicers must assist underwater military members to relocate

Foreclosure of service members’ property prohibited during nine months after service

Homeownership plummets

Chart update 08/09/23

| Q1 2023 | Q4 2022 | Q1 2022 | |

| San Diego County homeownership | 52.5% | 54.1% | 48.4% |

San Diego County’s homeownership rate followed the general statewide and national trend of decline in the years following the Millennium Boom, most recently bottoming in 2016 at 50.7%. In contrast, homeownership peaked at 63% in 2006 in San Diego County.

However, the homeownership rate recently increased from a new low, at a meager 52.5% in Q1 2023. Rising prices and stiff competition have forced out many would-be first-time homebuyers who otherwise add to the homeownership rate, giving cash-heavy investors the upper hand.

In contrast, the homeownership rate in San Diego County has historically been comparable to the rest of the state, at a higher 55.3% in Q1 2023. When home prices resume their downward trend later in 2023, this action will make some room for more new homeowners beginning around 2025, which will see the homeownership rate return to healthy levels. The homeownership rate won’t rise significantly until homebuyers regain full confidence in the housing market, returning in larger numbers in the years following 2026.

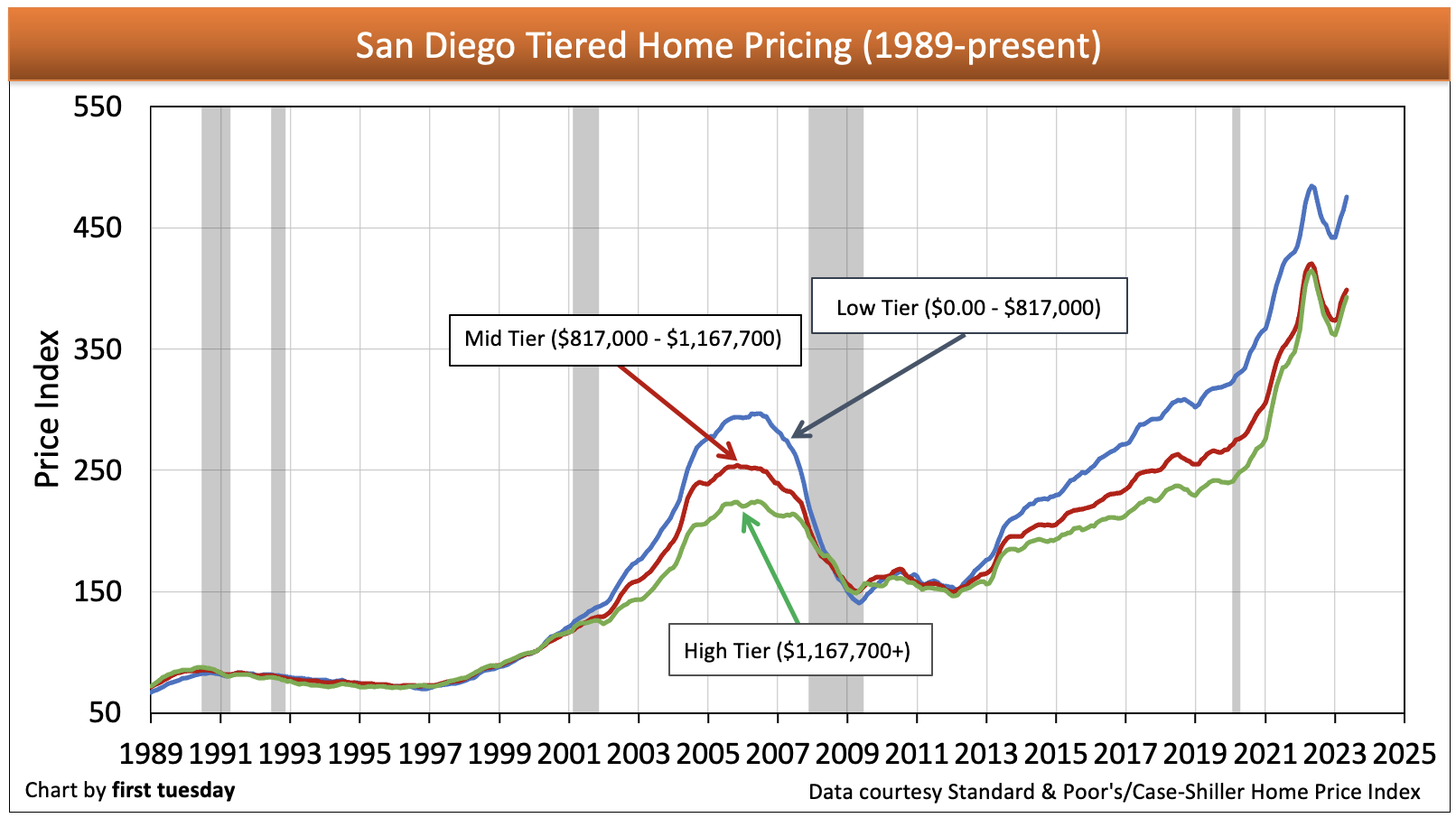

Home price’s seasonal bounce

Chart update 08/10/23

| Low-tier annual change | Mid-tier annual change | High-tier annual change | |

| San Diego County home pricing index: May 2023 | -2% | -2% | -5% |

The price of housing in San Diego County begun to plunge in mid-2022, down 2%-5% from their May 2022 peak as of May 2023. However, this dive was interrupted by a brief seasonal uptick.

Watch for prices to fall back in the months ahead following spring’s seasonal bounce. Home prices will slump below 2019 pre-recession levels in 2024, not expected to find a bottom until 2025.

The overall home price trend for the next couple of years will continue down, the result of higher interest rates, ongoing job losses and lower sales volume. As during the 2008 recession, the drop in sales volume and prices will first be most volatile on the coast, before rippling outward to inland areas.

Lower mortgage rates — as occurred in 2020-2021 — free up more of a buyer’s monthly mortgage payment to put towards a bigger principal. Thus, San Diego’s high home prices found fuel from the historically low interest rates of 2020-2021, translating to increased buyer purchasing power. However, this boost is fully in the past, as interest rates began their rapid march upward in 2022, turning purchasing power negative and urging homebuyer caution.

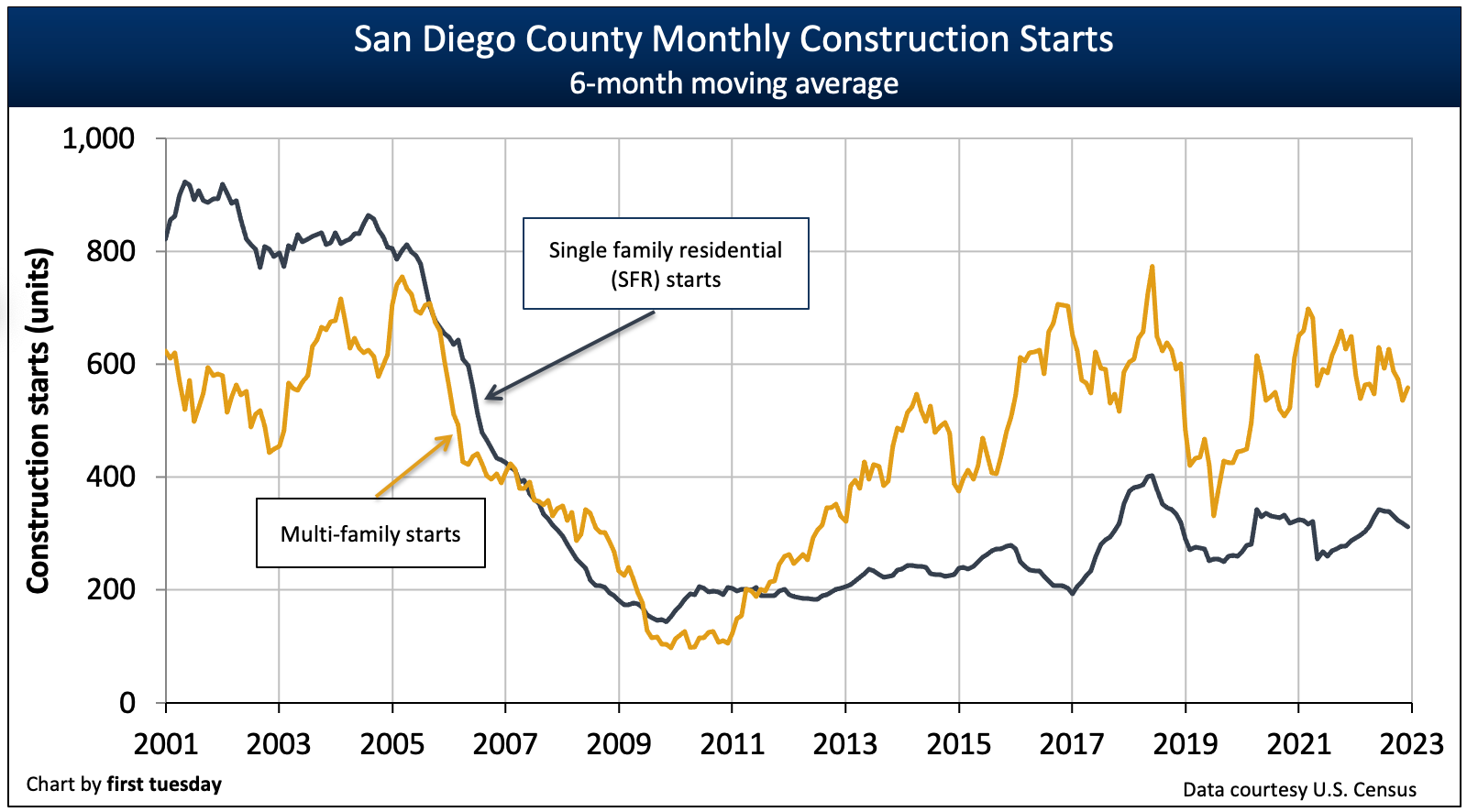

Multi-family construction leads the way

Chart update 02/14/23

| 2022 | 2021 | 2020 | |

| San Diego County single family residential (SFR) starts | 3,500 | 3,200 | 3,700 |

San Diego County multi-family starts | 5,900 | 6,500 | 7,000 |

Residential construction starts were mixed in 2022, rising a slight 10% for single family residential (SFR) starts while falling back 9% for multi-family starts. Until 2018, the recovery had been concentrated in multi-family starts, due to the increased demand for rental housing experienced during this recovery. Fueling this increased rental demand are:

- a demand shift from suburban living to city dwelling by the youngest generation of homebuyers, Generation Y (Gen Y);

- an increased resistance to homeownership following the housing crash; and

- the higher barriers to homeownership due to the return of mortgage lending fundamentals which tightened mortgage lending.

Today, the general trend for SFR construction starts in San Diego County is still far below 2002-2004 numbers. The next peak in SFR construction starts will likely begin around 2023. Even then, SFR construction starts are highly unlikely to return to the frenzied mortgage-driven numbers seen during the Millennium Boom.

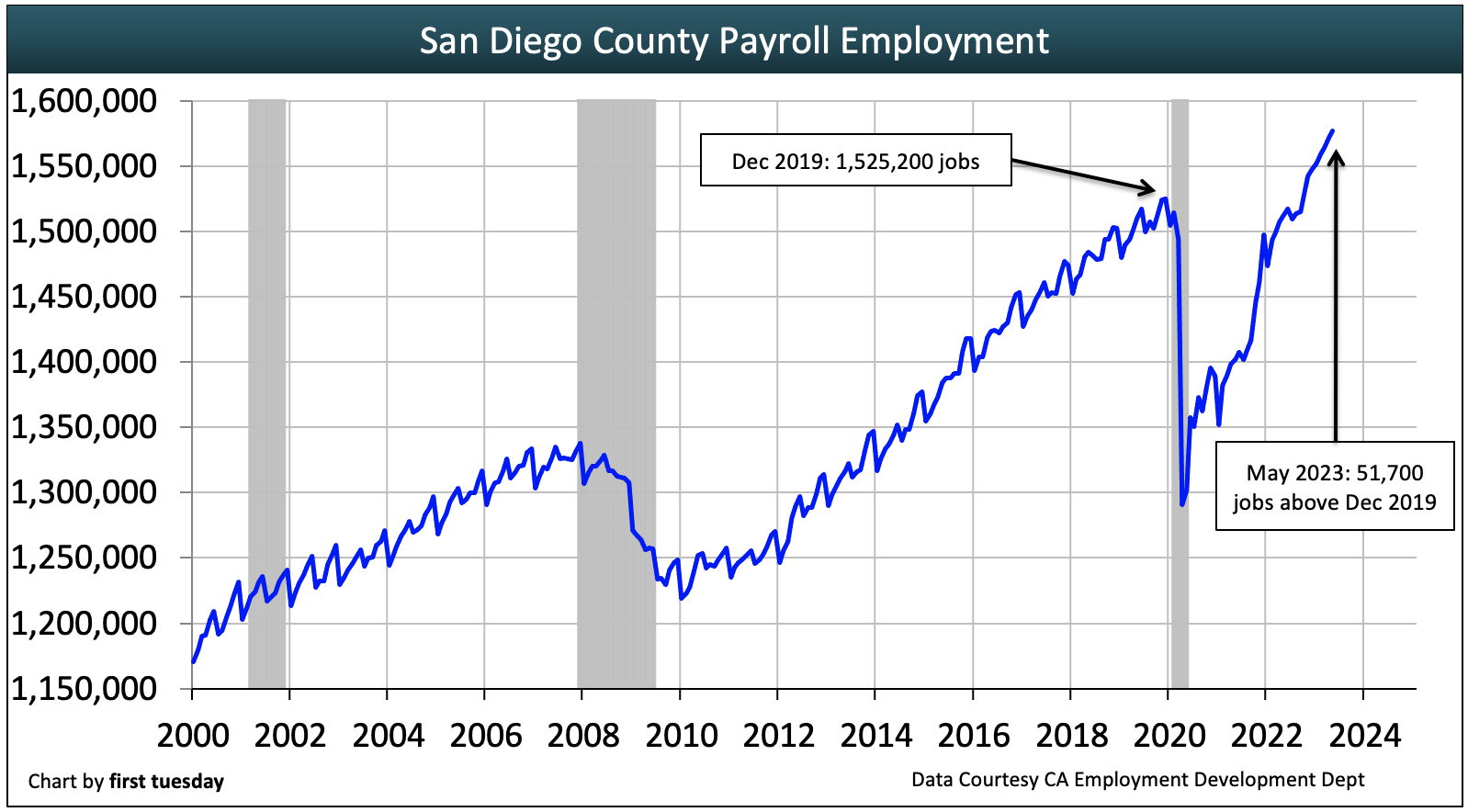

Jobs near recovery point

Chart update 08/10/23

| May 2023 | May 2022 | annual change | |

| San Diego County employment | 1,576,900 | 1,513,200 | +4.2% |

Before end users can provide sufficient support for a housing recovery, they will need to acquire income in the form of jobs and wage increases. San Diego continues to outpace the state’s jobs recovery, which is good news for San Diego’s housing industry.

Unlike other parts of the state with less stable employment markets, San Diego surpassed the level of jobs held prior to the 2008 recession well before the 2020 recession set in. However, due to 2020’s significant job losses and their slow recovery, jobs are now a respectable 51,7,000 above the pre-2020 recession peak as of May 2023. However, an undeclared recession has begun to slow job growth sharply, with San Diego’s jobs market likely to suffer losses later in 2023.

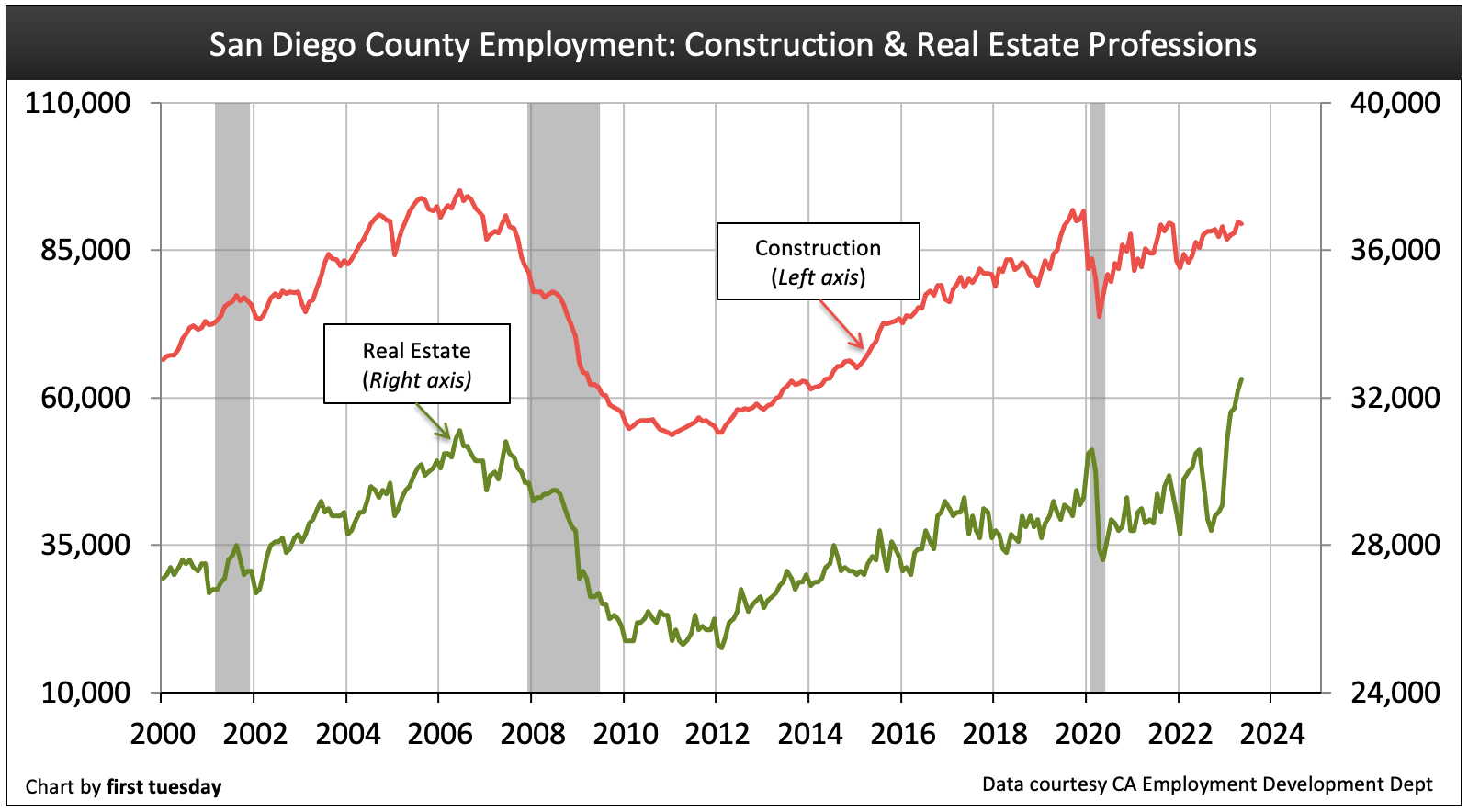

Industry employment rises slowly

Chart update 08/10/23

| May 2023 | May 2022 | annual change | |

| Real estate | 32,500 | 30,500 | +6.6% |

Construction | 89,500 | 86,400 | +3.6% |

In the housing industry, construction jobs have gradually regained numbers over the past decade of recovery from the 2008 recession, nearing a full recovery. Likewise, the number of employed real estate professionals has remained low throughout the past recovery, rising slowly.

In 2020, both industries experienced a hit to job numbers, though both have bounced back fairly quickly compared to other industries — especially for real estate professionals. However, the real estate profession will not likely experience another increase until the next confluence of buyers and renters (members of the Generation Y, Z and Baby Boomer generations) converge on the market in the years following 2024.

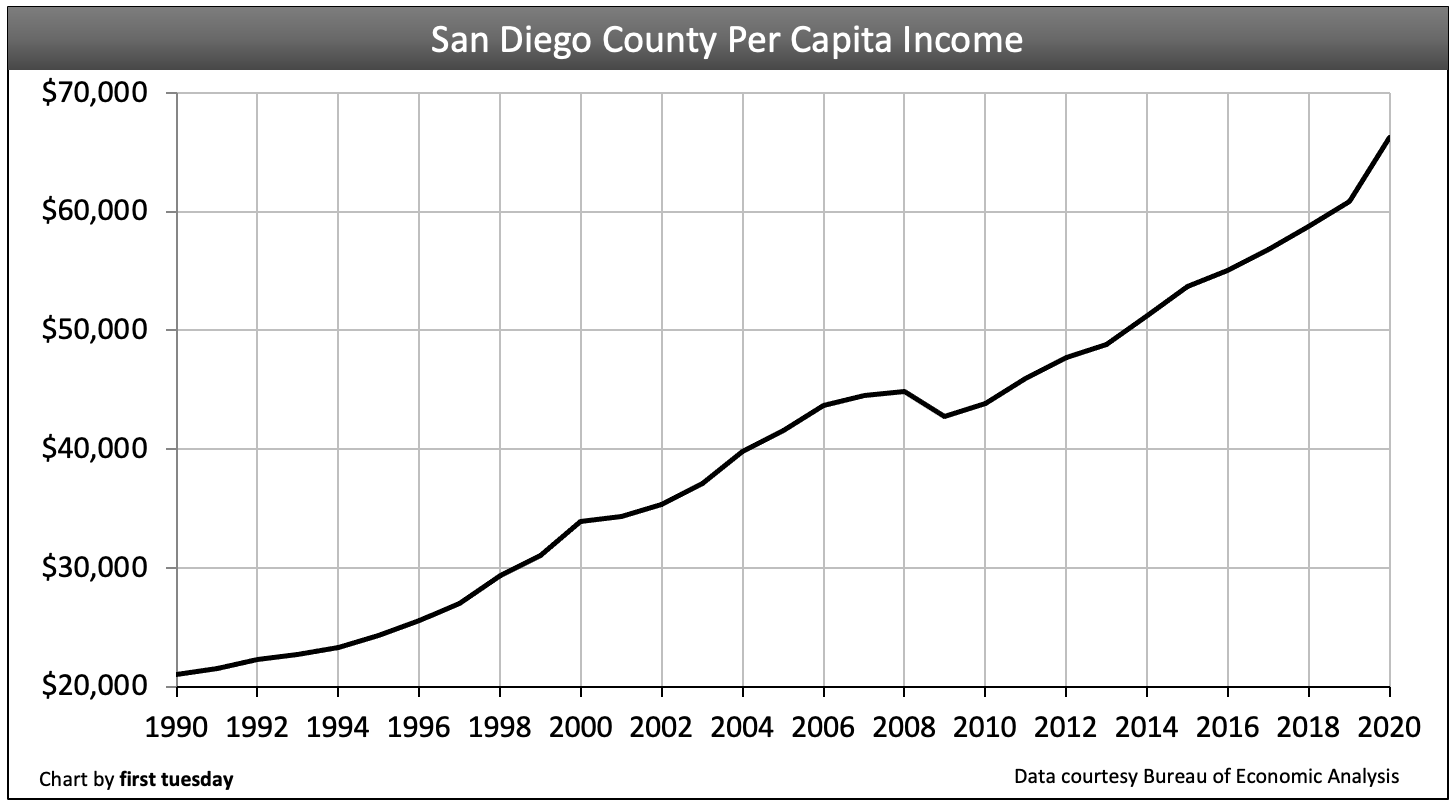

Per capita income has recovered

Chart update 05/10/22

| 2020 | 2019 | Annual change | |

| San Diego County per capita income | $66,300 | $60,500 | +8.9% |

| California per capita income | $70,700 | $65,300 | +8.3% |

The average per capita income in San Diego County is $66,300 as of 2020, the most recently reported Census year. This is a significant increase in income of 8.9% over the previous year. Income took a hit in San Diego during the 2008 recession, and it took three years for income to finally catch up to 2008 levels. In contrast, income has actually accelerated at a faster-than-normal pace following the 2020 recession.

After factoring in an additional 10%-11% increase in income needed just to cover eight years of interim inflation, homebuyers in 2018 had only slightly higher purchasing power to buy a home or rent as they did in 2008 – all else remaining unchanged. Per capita income in San Diego County is slightly lower than the state average, and exceeds levels in the inland valleys by roughly 50%.

As long as the pace of incomes fall behind the cost of housing, home prices and the price of rents are limited. This is due to the reality that buyer occupants ultimately determine selling prices in this economic environment — buyers can only pay as much for a home as their savings and income qualify them to pay — nothing more, unless lenders and landlords want to take on more risky, less qualified individuals. The same fundamental truth is also applicable to tenants’ capacity to pay, which ultimately works to set the ceiling on rental amounts.

This rule has been somewhat altered in 2020-2021 due to the interference of cash-heavy investors in the housing market.

Expect per capita income to rise with increases in job numbers. When considering the jobs needed to cover population growth of one percent per annum in the years since 2007, employment numbers and income won’t drive demand for significant additional new housing until after the recovery from the next recession.

It didn’t affect values in Aviara in North San Diego county, city of Carlsbad.

The increased buyer purchasing power in San Diego is also attributable to more flexible lending guidelines. When you see this become a balanced market or buyers market, consider lenders starting to tighten their underwriting guidelines.

Good stuff. Prices will rise until we see a build up in inventory. Thanks.

I am seeing homes opening up for sale over the past month, more so than the previous year. Do they know something I don’t, or are they just trying to cash in and buy somewhere outright? The stock market fell 2% today and I’m wondering if the Bear Market is having any effect on homeowners wanting to sell? Thanks.