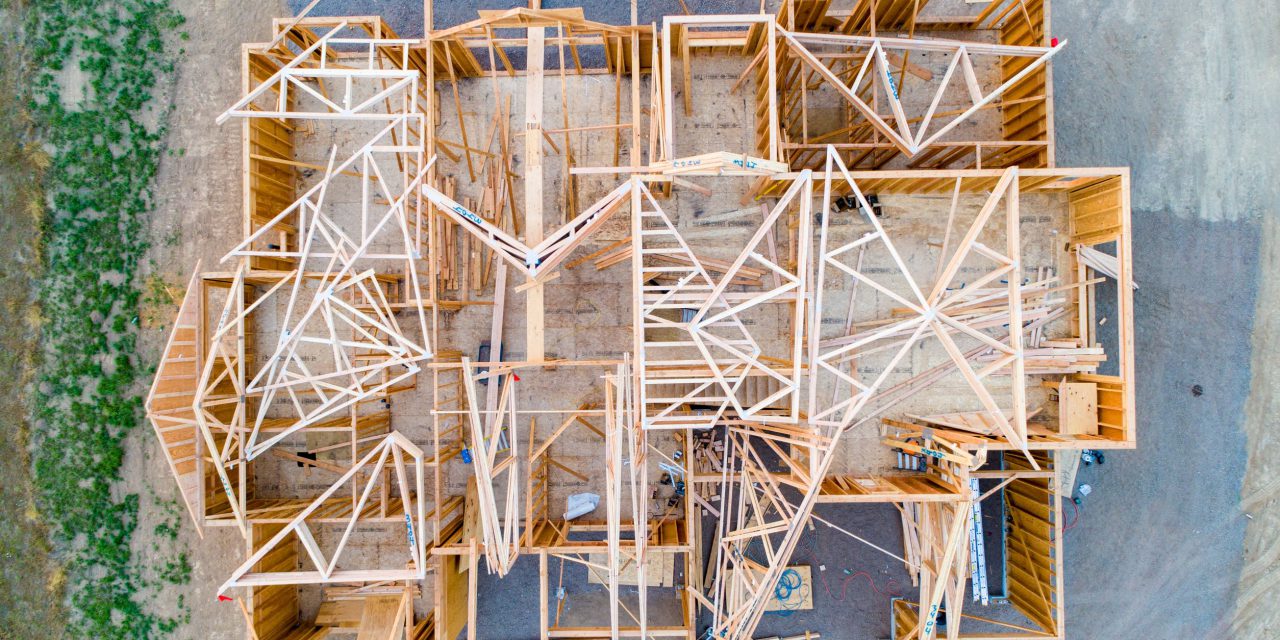

Single family residential (SFR) construction starts are at an all-time high share of the SFR for-sale inventory at the beginning of 2022. Nationally, a record 34.1% of SFRs on the market in December 2021 were new construction, according to Redfin.

Residential construction declined throughout the roughest patches of the pandemic, turning positive in the latter half of 2021. Here in California, SFR construction increased 7% in 2021 from the year prior – totaling 64,500 new starts. During the same time, multi-family construction was up 17% year-over-year.

While new residential construction is up — something much needed in the face of a continuous demand for housing — the incredibly low inventory situation of 2021-2022 begs for more.

Further, three of the biggest California metros had some of the smallest percentages of new construction as a share of total inventory, with new SFR construction consisting of just:

- 4.4% of total inventory in Los Angeles;

- 3.8% of total inventory in Anaheim; and

- 3.1% of total inventory in San Diego.

Construction in California

Why are the Golden State’s most populous metros not seeing as much new construction as a share of total inventory?

Inventory across the nation remains extremely low, so any level of construction is naturally going to take up a significant share of the inventory total. Thus, a rise in new construction share does not necessarily translate to an equal rise in construction.

As of January 2022, the inventory shortage in coastal California metros ranges from 30% below a year earlier in Los Angeles to 28% below a year earlier in San Diego. In inland metros, the inventory shortage is not quite as significant, but still remains high, at 14% below a year earlier in Bakersfield and 7% below a year earlier in Riverside.

California has experienced a severe supply-and-demand imbalance for years. The only way out of the inventory hole we’ve dug here in California is through more residential construction — enough new construction to make a significant change in our inventory.

In 2021, California construction numbers began to pick up as homebuyer enthusiasm exceeded the resale market and spilled over into new homes. However, building material shortages have caused delays and soaring costs, holding back construction from reaching its potential.

Challenges facing construction starts in California include:

- the historic job losses of 2020, over 700,000 of which still need to be recovered in California as of November 2021;

- tightened credit for homebuilders;

- building material shortages in 2021, continuing in 2022;

- rising mortgage interest rates, reducing homebuyer purchasing power; and

- the long-present obstacle of restrictive zoning regulations, which discourage density in desirable living areas.

In recent years, state-initiated legislative efforts have focused on encouraging much-needed construction. Expect to see these efforts begin to pay off with a mini construction boom, expected to arrive around 2024-2025.

Related page: