Every real estate professional knows how important residential construction is to a healthy housing market. But construction trends can also shed light on future economic performance.

Cyclical construction decreases tend to signal a decline in gross domestic product (GDP) in the year ahead, according to a recent report by the Federal Reserve Bank of St. Louis.

Housing permits, or construction starts, reflect investors’ expectations of demand in the future housing market. Builders don’t have the luxury to react to current housing trends. Rather, they need to anticipate future market demand since construction takes several months and often longer to complete.

The authors of the report claim the reduced construction starts seen in 2018-2019 portend a softer housing market — and economy — in 2020.

However, the authors don’t want to induce panic. They point out that today’s slowdown in housing starts is more similar to that experienced before the shallow 2001 recession, rather than the falloff heading into the Great Recession beginning in 2008.

Related article:

California construction starts

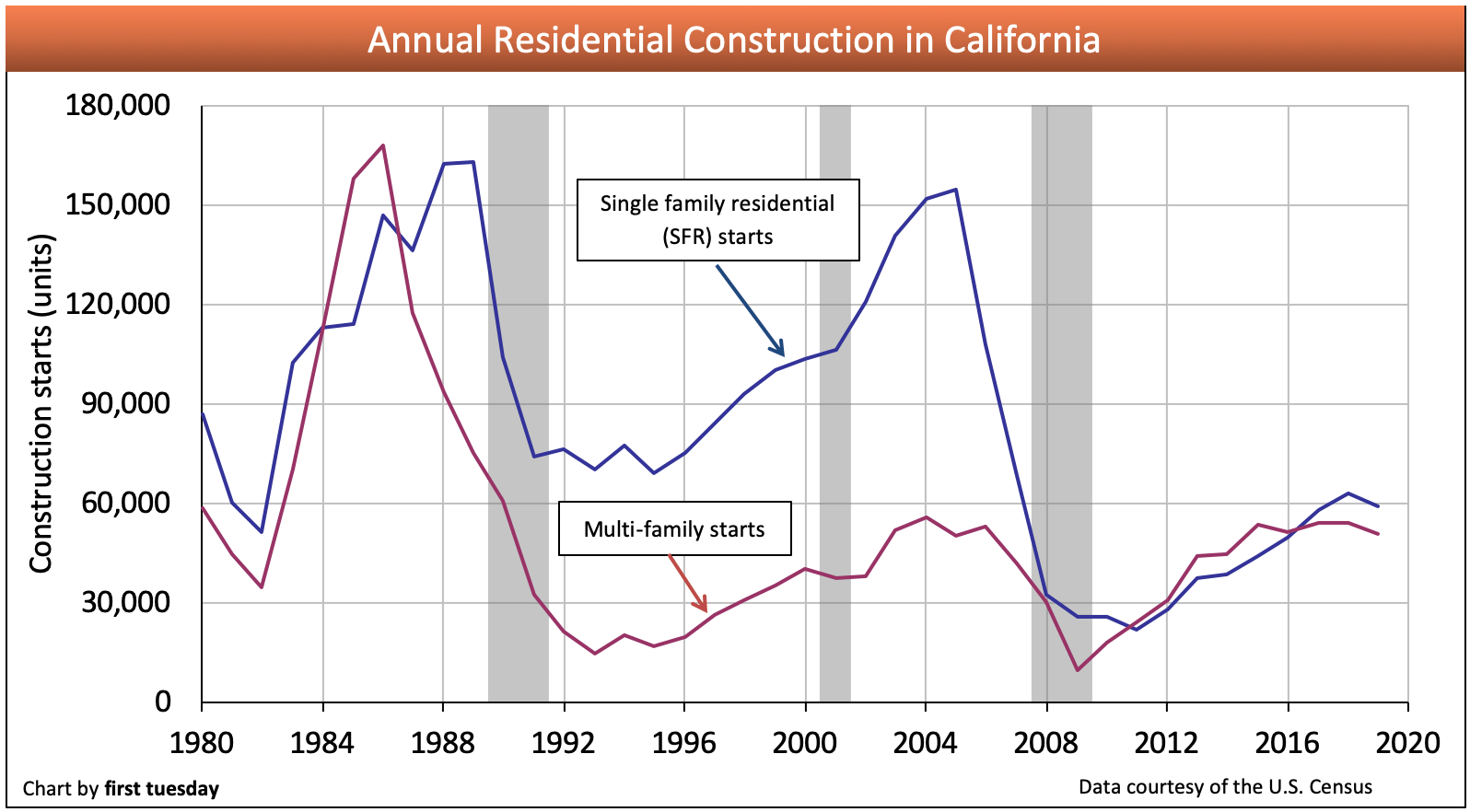

Here in California, residential construction followed the national downward trend in 2019. Annual single family residential (SFR) starts were 5% below a year earlier and multi-family starts were 6% lower. Following the study’s logic, 2020 will see a slight decline in GDP here in California and across the U.S.

While 2019’s slight downturn is a far cry from the plunge experienced before the Great Recession, it will still make an impact, especially considering the state’s dire housing shortage which has seen population growth outpace new construction in all of California’s major metros. In fact, real estate professionals and end users — buyers, sellers, landlords and tenants — need to be more concerned about the impacts of the ongoing construction shortage on the long-term health of the housing market than the economic slowdown expected in 2020-2021.

Real estate professionals can prepare to survive during the coming slowdown by overproducing and saving earnings now, or seeking out recession-proof niches of real estate (such as real estate owned (REO) sales, or property management) in which to weather the coming economic downturn.

But to ensure their career’s long-term success, real estate professionals need to go the extra mile and advocate for more residential construction. This can be achieved by attending local city council meetings and being a positive and well-informed voice for greater, balanced density in desirable areas.

Related article:

Change the law: amend zoning laws to promote multi-family construction