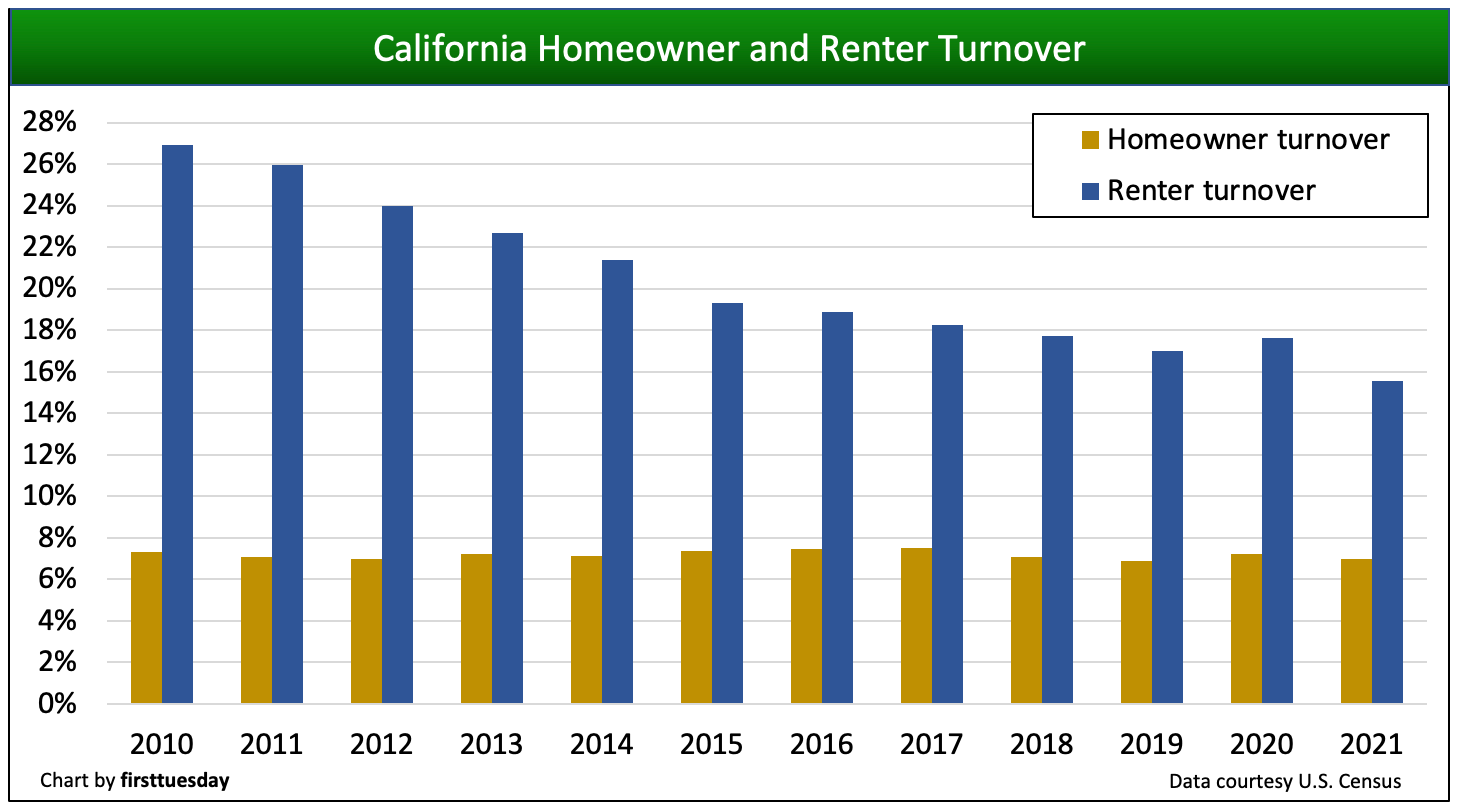

Residential turnover — the share of homeowners or tenants who relocate annually — is the lifeblood of real estate. When turnover falls, so too does agent and broker earning potential.

In 2021, renter turnover tumbled to 15.6%, down from 17.0% in 2019, at a decade’s low. Homeowner turnover declined less significantly to 7.0%, roughly level with 2019.

2021’s low turnover rates occurred due to the eviction and foreclosure moratoriums which incentivized financially insolvent residents — who would otherwise have been forced to move — to remain in place. However, immense investor interest in real estate, along with historically-low mortgage interest rates, managed to crank home sales volume higher and inflate prices to record heights. Thus, while real estate professionals suffered from a lack of interest or ability to compete from occupants, their suffering was tempered by higher transaction fees in 2021’s competitive housing market.

While the moratoriums are now in the past, watch for turnover to continue to fall back in 2022-2023. The 2023 recession is already being felt painfully in the housing market, with sales volume and prices plummeting in the second half of 2022.

Homeowners who need to sell anytime in the next few years best list now before prices fall further. While declining, current price levels will not be seen again until a few years into the recovery, to begin around 2026. For sellers who do not need to sell for the next five years or more, they will simply hold until prices recover to current levels. On the other hand, today’s homebuyers best hunker down until prices have fully bottomed, expected to occur here in California around 2025.

Chart update 11/01/22

| 2021 | 2020 | 2019 | |

| Homeowner turnover | 7.0% | 7.2% | 6.9% |

| Renter turnover | 15.6% | 17.7% | 17.0% |

The importance of turnover

Without turnover, transactions do not occur, homes do not sell and tenants stay put. In other words: no income for real estate professionals.

The number of people moving from their residence each year is indicative of both the willingness and ability of homeowners and renters to relocate. Turnover rates are highest when jobs are abundant, wages are rising, housing starts increase and employee confidence in the economy is high.

But given the economy’s upward trajectory in 2021, along with higher home sales volume and leaping home prices, the reduced turnover of 2021 is somewhat of a puzzle.

But there are two outliers which made an unprecedented impact on turnover in 2021:

- the foreclosure and eviction moratoriums which enabled financially insolvent homeowners and tenants to remain housed during the pandemic; and

- a jump in real estate investment, which propelled sales volume and prices into the stratosphere while dwindling the options of buyer-occupants and tenants.

Investors crowd out buyer-occupants

While the economy remained on shaky ground during the pandemic and global events rocked the global economy, investors shunned many of their go-to investment products in search of a safe haven for their funds. This is why U.S. Treasuries plummeted to historic lows in 2020 — even though the return was low, a return was at least certain, as it was backed by the security of the federal government.

Thus, lacking alternative safe forms of investment — and seeing the potential for lucrative returns — investors poured into real estate in 2020-2021.

Investor purchases made up 18.4% of U.S. home sales in Q4 2021. This was up significantly from 12.6% a year earlier and the highest level since record-keeping on investor purchases began in 2000, according to Redfin, a national real estate brokerage.

Here in California, the investor share in Q4 2021 was:

- 20% in San Diego;

- 19% in Sacramento;

- 19% in Los Angeles;

- 18% in San Francisco;

- 16% in Riverside; and

- 12% in San Jose.

Three-out-of-four investors paid all cash for their home purchase, making it nigh on impossible for homebuyers reliant on mortgage financing to compete. Further, investors end up paying lower purchase amounts on homes than buyer-occupants, according to RealtyTrac, reflecting seller preference for an easy cash sale.

But when the investor presence grows, it creates more problems for end users of real estate — the bread and butter of a real estate professional’s livelihood. Regular homebuyer-occupants find it impossible to compete with cash-heavy investors who can close quickly and with no contingencies.

However, while investors are a rightful concern of homebuyers reliant on mortgage financing, they can be a natural and even useful force when the market turns. For example, when prices drop during a downturn, investors can provide much-needed support in the form of cash and liquidity even in the face of reduced turnover.

Related article:

Investors save the day?

But there is a difference between regular absentee buyers and speculators.

Absentee buyers are any type of homebuyer who purchases without the intent of occupying the home, including long-term buy-to-let investors and short-term investors who make major improvements to the home to sell at a profit. However, speculators — sometimes called flippers — purchase on the belief that prices will rise quickly and significantly enough to turn a profit on sheer market momentum.

Flippers contribute nothing, making little to no improvements to the property while letting it sit vacant long enough for its value to increase.

When speculators increase beyond the point of stability, the market can become artificially inflated, with houses simply changing hands, completely removed from market principles. To an extent, this is what occurred in 2021, with record-low mortgage interest rates providing the extra fuel.

Now that prices are in a free fall, investors are quickly stepping back from the housing market. Once prices bottom, speculators seeking to profit from low prices and pent-up homebuyer demand will become more common, providing a “dead cat” bounce during the coming sales slump.

These speculators will help propel the market to its next pricing boom, set to launch around 2026-2027.

Watch for the next sustainable recovery to begin with the return of end user homebuyers, at which point turnover will rise to healthy levels. The additional and necessary factor of greatly increased residential construction will be experienced and a more stable economic recovery from the 2023 recession will begin.

In the meantime, stay ahead of California’s real estate market updates by subscribing to Quilix, firsttuesday’s weekly newsletter!