Going to escrow

Escrow is a process employing an independent escrow officer, typically a licensed escrow company, to manage and coordinate the closing of a real estate transaction. [See RPI e-book Real Estate Principles Chapter 30]

Escrow activities are typically based on a primary agreement, such as a written purchase agreement, though one need not exist. [Calif. Financial Code §17003(a); See RPI Form 150]

Consider a buyer and seller who enter into a purchase agreement for the sale of the seller’s one-to-four unit residential property. As provided in the purchase agreement, escrow is opened to handle closing. [See RPI Form 150 §13.1]

In modern real estate practice, the expression “opening escrow” simply means establishing a depository for the instruments (deeds, money and other items) with accompanying instructions controlling their use. Escrow instructions are signed by all necessary transaction participants (the buyer and seller), each authorizing escrow to transfer or hand their instruments to the other person or third parties on closing. [Montgomery v. Bank of America National Trust & Savings Association (1948) 85 Ca2d 550]

Related Video: Introduction to Escrow

Click here for more information on this topic.

Before accepting any instruments as an escrow holder for a transaction, an agent of the buyer or seller dictates instructions to the escrow officer. The purpose for this communication is to establish precisely when and under what circumstances the instruments and monies deposited with escrow are to change hands. [See RPI e-book Real Estate Practice Chapter 59]

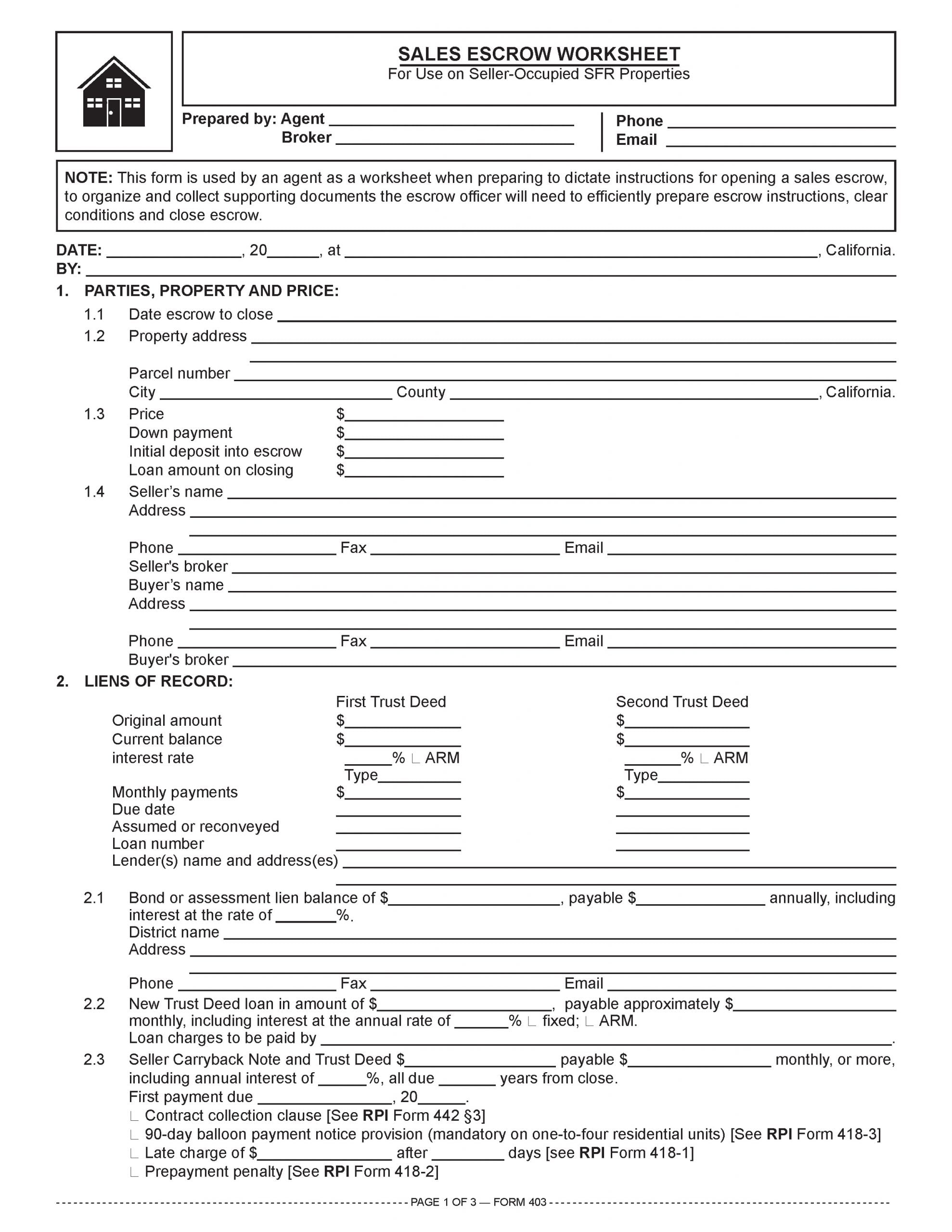

When receiving instructions from an agent, the escrow officer prepares a take sheet. On it, the escrow officer notes all the tasks they are to undertake to process and close escrow. When drafting escrow instructions, the officer relies on the take sheet as a checklist to determine the contents of the instructions. [See RPI Form 403]

Increasingly, agents simply email a copy of the purchase agreement to the named escrow company. The escrow officer then drafts escrow instructions as needed for the buyer and seller to state their obligations to be performed to close the transaction created by the purchase agreement. When prepared, the officer sends the written instructions to the agent to verify they conform to the intent of the persons in the transaction.

A checklist is used by an agent for “going to escrow.” As a worksheet, it guides the buyer’s agent’s collection and organization of facts and supporting papers the escrow officer needs to draw instructions, clear title conditions and close escrow. [See RPI Form 403]

An escrow officer will perform only as instructed. Typically, escrow instructions are prepared by the escrow officer based on information received from the seller’s or buyer’s agent about the transaction. However, agents may include instructions they prepare as an addendum to a purchase agreement. [See RPI Form 401]

In practice, the escrow officer prepares the instructions on forms they have adopted for this purpose. Once completed, the instructions are forwarded to the agents of the participants in the transaction for their signatures and return to escrow. Escrow is considered open for each person who signed and returned the instructions.

Related Video: Escrow Basics

Click here for more information on this topic.

Analyzing the escrow instructions

Most modern real estate transactions depend on both the purchase agreement and the escrow instructions working in tandem to close a transaction.

Both the purchase agreement and the escrow instructions are contracts regarding interests in real estate. Both documents need to be in writing to be enforceable under the Statute of Frauds. [Calif. Civil Code §1624]

Among other things, a purchase agreement sets forth the:

- sales price;

- terms of payment; and

- conditions to be met before closing. [See RPI Form 150]

Escrow instructions constitute an additional agreement entered into by the buyer and seller with an escrow company (or the office of one of the brokers involved negotiating the transaction). Under the instructions, escrow facilitates the completion of the performance required of the buyer and seller to disburse monies and use documents needed to perform their purchase agreement.

Escrow instructions do not replace the purchase agreement. Instead, instructions function separately but in conjunction with purchase agreements, as directives an escrow officer undertakes to coordinate a closing expressed by the terms of the purchase agreement. [Claussen v. First American Title Guaranty Co. (1986) 186 CA3d 429]

Escrow instructions occasionally add exactness and completeness, providing the enforceability sometimes lacking in purchase agreements defectively prepared by brokers or their agents.

An agent or an escrow officer uses the Escrow Instructions form published by RPI (Realty Publications, Inc.) when preparing a purchase agreement (as an attachment) or preparing instructions to open a purchase escrow, to instruct escrow to prepare documents and gather instruments necessary for the buyer and seller to perform under their purchase agreement. [See RPI Form 401]

The Escrow Instructions contain all the provisions expected in a set of instructions prepared by an independent escrow company for a sales transaction. [See RPI Form 401]

Related Video: Escrow Instructions

Click here for more information on this topic.

Analyzing the sales escrow worksheet

In practice, the Sales Escrow Worksheet published by RPI is used by an agent when preparing to dictate instructions for opening a sales escrow. It allows the agent to organize and collect supporting documents the escrow officer will need to efficiently prepare escrow instructions, clear conditions and close escrow. [See RPI Form 403]

As with all checklists, the sales escrow worksheet is designed to address activities which are considered but may or may not be applicable to the transaction at hand. Since it is a checklist, the form is not to be used to create an agreement between the buyer and seller. Also, the worksheet serves as the agent’s personal control sheet (or that of their transaction coordinator) and is to be maintained in the client’s file to act as a reminder of those activities yet to be completed to close the transaction.

The Sales Escrow Worksheet contains:

- the date escrow is scheduled to close, along with the property address, price, seller’s information and buyer’s information [See RPI Form 403 §1];

- any liens of record, including first and second trust deeds and their amounts [See RPI Form 403 §2];

- disclosures to buyers which, when checked, indicates they have yet to be prepared, reviewed or received by a principal or a broker [See RPI Form 403 §3];

- seller compliance information which lists the conditions to be satisfied, approved or waived by the seller prior to closing, with checks indicating each activity to be performed by the seller before escrow may be closed [See RPI Form 403 §4];

- buyer compliance information which lists the conditions to be satisfied, approved or waived by the buyer prior to closing, with checks indicating each activity to be performed or approved by the buyer before escrow can close [See RPI Form 403 §5];

- prorates and adjustments accounting for the debits and credits called for in the purchase agreement to be made by escrow on closing [See RPI Form 403 §6];

- title policy information detailing the vestings and title policy on the transfer of the property [See RPI Form 403 §7]; and

- the broker fee, including the payment amounts, the broker involved, and who is responsible to pay. [See RPI Form 403 §8]

Related Video: Escrow Prorations

Click here for more information on this topic.

Want to learn more about this topic? Click an image below to download the RPI books cited in this article.