We look back over a year rife with risky speculation, serious price inflation, discontent with the trade unions and some robust regulation.

2013: a brief history

2013 was the year of the twin menace: the foolhardy speculator and the despotic trade union.

Speculators came on the scene in 2012, but they dominated 2013. Their indelible imprint on the California real estate market this year is apparent in soaring year-over-year price inflation and a homeownership rate with clipped wings.

The National Association of Realtors (NAR) and the California Association of Realtors (CAR) finally bared their true moral bankruptcy for all to see. Hidden fees, anti-trust leanings and misguided profligacy are just a few of the trade union’s sins this year.

Real estate gamblers and impenitent bureaucrats notwithstanding, 2013 was a banner year for real estate regulation. The big banks paid hefty settlements, landmark lawsuits were filed and a banking executive was strung up by her thumbs. There were big changes in the mortgage markets and some promising new leadership was hired to see real estate through the next year.

To paraphrase J.F.K, we’d prefer to live as we once did, but history won’t allow it. Thus, we take a look at our recent past to identify the challenges ahead and devise strategies to conquer them.

Speculators settle in

Of the many real estate headlines of 2013, prices consistently made page one.

We were among the first to notice the spark of asset price inflation at the outset of 2012, but the bang really resounded around the first quarter of this year. The year-over-year California tri-city average showed a red-hot 31% increase in the low-tier. The annual change in the low-tier San Francisco market was 39%. Mid- and high-tier prices were not far behind.

As usual, California led the way in asset price inflation, but home prices spiked nationwide. The national news media consistently hyped the rise in prices as a real estate market rebound, but faithful first tuesday readers knew the real story. At the twilight of the year, Fitch Ratings “broke” the news that real estate was in an asset bubble once more, and it was being inflated by . . . speculators!

With that, the consensus was reached: real estate prices, nationwide and especially in California, were once again artificial and unsustainable. But the 2013 blip was no Millennium Boom. The Millennium Boom was driven by over reaching among aspiring end users — folly facilitated by sub-prime lenders and a deregulated secondary mortgage market.

This mini-boom, on the other hand, was generated by cash from investors big and small. Some institutional investors snatched up large quantities of single-family residences (SFRs) with the intention of building income property portfolios. Due to their scale, they moved the market needle a bit. But most were speculators playing the old game of buying low and selling high.

Or so they thought.

Price inflation and purchasing power

Here and now, as we survey the dawn of 2014, it’s clear the speculators won’t get their great reward. There simply isn’t sufficient end-user demand to create the final profit on resale that speculators require.

Myriad factors affect real estate demand, but the single most influential factor is jobs. The vast majority of SFR end users rely on purchase-assist financing to acquire a property. Their ability to secure financing and the amount they are able to borrow depends on their income.

This is a truism every real estate professional understands. But the issue of employment throughout 2013 was difficult to pin down. Employment in California and the nation improved consistently throughout the year. But the quality of employment is as integral to the health of the real estate market as the number of employed Californians. Many of the year’s gains in employment were in manufacturing and the service sector — professions that put homeownership on a wish list rather than a 5-year plan.

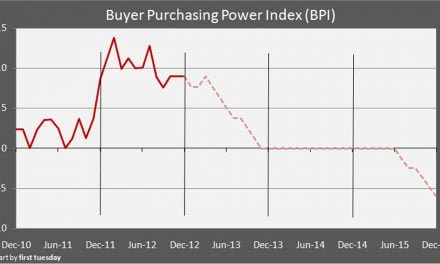

Having been disappointed by other, misleading employment metrics, first tuesday created the Buyer Purchasing Power Index at the outset of 2013. Our index provided the most valuable real estate data of the year, showing agents exactly what buyers were capable of purchasing.

The 30-year fixed rate mortgage (FRM) jumped over a full percentage point in 2013, but wages remained stagnant. Buyer purchasing power (BPP) tumbled to a staggering low. As of November 2013 (the most recent data) the index revealed purchasing power dropped by 10.4%, year-over-year.

This is how we know the insane price inflation that occurred during 2013 was caused by speculator interference and foolish appraisers rather than fueled by organic demand. Organic demand and real home price movement is revealed by the BPP. And BPP was in the proverbial toilet throughout nearly all of 2013.

So where’s it all going in 2014? Read on to find out.

Is this the end for the big “R”?

Revolution may be on the horizon for the real estate industry rank and file. The trade union elites made too many missteps in 2013 and now the barbarians are at the gate.

Revolution brews when an organization’s leadership gets drunk on power, forgets the interests of its constituents and enriches itself at its members’ expense. That is precisely what happened this year with the real estate trade unions.

First was the forms debacle.

CAR has been offering “free” forms to its members since 2001. In one of our most widely read and well-received articles of the year, we broke down exactly how CAR engineered the illusion of “free” forms while charging its members through the nose for their “required” product.

The trade unions continued to strengthen their forms empire with the healthy profits they generate from membership fees. CAR/NAR have their hands in every facet of the forms game. From their ownership stakes in zipLogix, Cartavi cloud-based solutions and DocuSign digital signature services, the trade unions came dangerously close in 2013 to double-, even triple-charging agents for “free” forms and associated services.

In a final coup de grace for 2013, NAR announced plans to develop their new billion dollar headquarters modeled after Rockefeller Center – right after announcing a cut in benefits for its veteran rank and file. Real estate agents and brokers everywhere are fed up with the real estate ruling class. Did somebody say guillotine?

Regulation ramps up

The bidding wars, trade union overreach and investor imprudence was counterbalanced by a couple firm jabs from regulatory contenders.

Some of the most encouraging news came as a federal lawsuit against Bank of America and senior executives of Countrywide for a mortgage fraud scheme known as “the hustle.” A BofA executive was held personally responsible for encouraging the scam, setting a legal precedent in the crusade against mortgage market fraud.

Chase was shown a little rough justice as well, although the outcome was not quite as satisfying. Yes, the $13 billion settlement with the Justice Department was a record penalty. But our consistently hard-hitting coverage of the deal revealed Chase still came out on top. Ultimately, though, a healthy portion of the settlement is going towards cramdowns, and Californians are going to benefit from the deal. Not a home run, but progress.

Not all mortgage market regulation news can be sexy — but looks aren’t everything. Some of 2013’s most important first tuesday coverage detailed crucial developments in ability to repay, qualified mortgage (QM) and qualified residential mortgage (QRM) rules. Although many of the details are still being hashed-out by regulators, our in-depth article provides everything you need to know going into 2014.

We also drilled down into the question of Fannie Mae and Freddie Mac’s future. What happens with “the enterprises” is crucial to the continued health and vitality of the real estate market. With Mel Watt replacing Ed DeMarco at the helm for 2014, we can rest a little easier that the “wind-up” is going to be handled responsibly.

Slouching toward 2014

As the sun rose over 2013, we were fairly confident of what the year held in store. While some events took us by surprise, most of our predictions came to fruition.

We didn’t predict the scale of the trade union’s self-inflicted embarrassment. Don’t get us wrong — we’re not just delighting in their humiliation to be vindictive. The truth of it is that their backwards, self-serving policies have held an entire industry hostage for a long, long time. It’s time the good agents and brokers of California wised up and moved on to better, more cost-effective practices.

We did know, however, that speculator influence was going to artificially inflate prices, tamp down demand and ultimately draw-out the real recovery. When all was said and done, cash speculators, bidding wars and weak demand was the final outcome of 2013. Now that we all agree it was a blip, the wounds can heal and the market can move forward.

But, it’ll do so with a limp in 2014.

All signs point to a year of muted anticipation while organic, end-user demand is repaired. The Fed announced its plans to taper their bond buying just at the end of the year. If mortgage rates rise too quickly in response, it’ll likely cause buyer purchasing power to drop further.

There is going to be a considerable hangover from the artificial price spikes induced by speculators in 2013. Think of the California real estate market as a diabetic recovering from a brief sugar binge. It’ll take some time of healthy market activity before vitals return to homeostasis.

Real estate professionals are (unfortunately) pre-programmed to view falling prices as categorically negative. But in 2014 falling prices will, perhaps ironically, signal market recovery. Wages are not likely to increase too quickly, as wage stagnation is a systemic problem in the U.S. not readily solvable without a serious global marketplace overhaul.

But falling prices and continuing, fairly priced and well-regulated mortgages can get the market back on track by year-end. We’d love to brand 2014 the year of the end-user. But for now, we’ll have to wait and see.

Predictions are hard to make, especially when they are about the future. But here is a glimpse of how we expect 2014 to shape up based on our current vantage point:

- Buyer purchasing power will likely remain negative in a period of rising interest rates and stagnant wages;

- Prices will slump as investors exit the market and buyer demand remains capped by negative purchasing power;

- Jobs will continue along the bumpy plateau, maintaining slow but steady progress into 2016 when a more robust rebound ought to occur;

- SFR construction starts will remain flat under rising interest rates, but multi-family housing starts will continue their upward trend, responding to rental demand; and

- California home sales volume will tick up and down depending on local markets, but will not make a sustainable comeback until jobs rebound in 2016.

So, 2014 looks to be a year of returning to equilibrium. There is great potential for success in the multi-family and property management sectors. To the seller’s agents, beware the sticky pricing phenomenon. To the buyer’s agents, beware the sticky pricing phenomenon.

As always, we are your go-to source for California real estate news and analysis through 2014 and beyond.

Thank you for keeping me so informed on most levels of real estate. It really helps me to have this knowledge, especially when it comes to spending money marketing some properties. Fair price is essential. Sellers still think the market is good. Our job is to give them the facts and if they wish to sell than we must help them understand what is really happening in the real estate market. Jobs Jobs Job yes we need jobs .

Macy